We are publishing this piece without a paywall. Please share widely.

“Riches get their value from the mind of their possessor; they're a blessing to those who know how to use them, a curse to those who don’t.”

– Publius Terentius Afer, Roman Playwright

Janite Lee epitomized the quintessential American dream. Arriving in the United States from South Korea in 1972, she established a thriving business and raised her children single-handedly.

Nearly two decades down the line, something extraordinary happened: she won the lottery

To be precise, she secured a staggering $18 million jackpot from the Illinois lottery in 1993, a fortuity made all the more remarkable considering she had only purchased two tickets. Factoring in inflation, this windfall would equate to nearly $47 million in today's currency.

However, that’s where her lucky streak ended.

Even though she chose the commonly advised option of annual installments over the lump sum, she made substantial charitable investments (she even has a reading room in her honor at the University of Washington) and several poor investment decisions.

Lee further leased numerous luxury cars, borrowed millions from banks, and even dined with the South Korean president. Due to her extravagant spending, her financial situation took a sharp downturn, forcing her to sell her annuity. When she was forced to declare bankruptcy just eight years later, she had a mere $700 in her account and was $2.5 Million in debt.

Lee’s story is an embarrassingly common one. Despite two out of three Americans saying that money is a significant problem in their life, nearly 70% percent of lottery winners in the United States go bankrupt in a few years.

Now, the chances of winning a lottery are astronomically low (1 in 292 million for the Powerball), but windfalls are more common than you think. They can come from tax refunds, bonuses at work, moving your retirement savings, or other sources. For instance, the average American is expected to inherit about $177,000 in their lifetime.

There is a reason why a lot of folks struggle with handling a windfall effectively. It’s like driving a muscle car after driving a beater all your life: there is an entirely different skill set required to be able to handle the sudden resource abundance.

So this week, let’s dive into the proper approach for handling a sudden windfall, how to invest it prudently, and the pitfalls to steer clear of.

Growth vs. Capital Protection

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

The first step towards creating a successful investment plan is to understand the trade-off between risk and returns. To state the obvious, in the long term, riskier assets are expected to give better returns in comparison to safer assets.

This is crucial as a 25-year-old just starting their career and a 55-year-old closing in on retirement have completely different levels of risk appetite. For example, during the great recession, several retirement funds with target dates in the 2010s took a severe beating and forced their investors to delay retirement. Imagine if you were set to retire in 2011 and your 401k just dropped by 10%.

Thankfully, the risk-return question is not an either-or scenario: it can be tailored according to risk appetite.

For this, it is necessary to have an appropriate mix of stocks and bonds in your portfolio to account for growth as well as capital protection. For example, here is how your $10,000 investment at the start of the millennium would have fared in (1) 100% stocks, (2) 50-50 stocks, and (3) 100% bonds portfolio.

Unsurprisingly, portfolio 1 (100% stocks) has given better returns at the cost of a higher risk level. However, it took nearly 15 years for the equity portfolios to provide better performance than the 100% bonds portfolio.

During the 2008 crisis, Portfolio 2 (50% stocks and 50% bonds) drawdown was nearly half of that of Portfolio 1, More importantly, the 100% stocks portfolio was in the red nearly nine years down the line. Along these lines, we have previously covered several investment strategies that fit various risk profiles

60/40 - A 60% stocks and 40% bonds portfolio that gives a good mix of asset protection and growth

Buffer funds - An ETF with an emphasis on capital protection and some exposure to stocks

Three-fund portfolio - A combination of US equities, bonds, and international equities.

After figuring out your risk tolerance, the next factor to consider is how to invest in the windfall. You can either invest it all together in one go (lump sum) or invest a bit at a time (dollar-cost averaging).

The choice here depends on when you plan to use the money. Research generally suggests that lumpsum is better in the long run. But if access to the capital is important in the short term, DCA is a worthwhile option.

Short Term vs Long Term

“For the newly rich, the world often becomes a darker, narrower, less generous place; a paradox that elicits scant sympathy, but is nonetheless true.”

– Felix Dennis

It is easy to lose sight of your targets when you come across a sudden windfall. Here are some short and long-term factors to keep in mind.

In the short term,

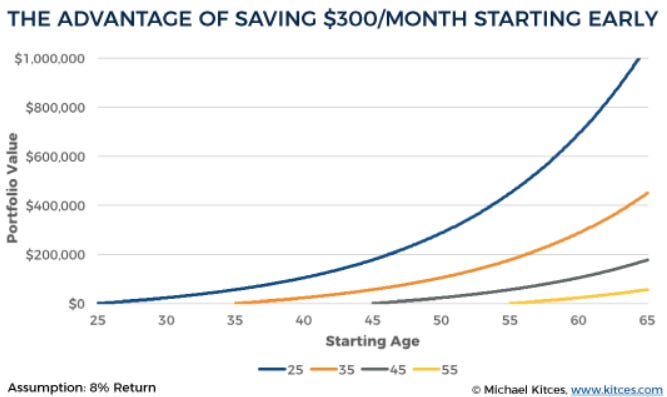

Overspending – One of the biggest pitfalls after a windfall is overspending. While prudent investors avoid flashy car/home purchases, most of us are susceptible to lifestyle creep. To understand this better, if you save an extra $300 every month starting when you’re 25, by the time you retire, your savings could grow to a million dollars (assuming you earn around 8% interest each year). But if you wait until you're 35 to start, your savings might reach less than half a million dollars!

Quitting your job – While experiencing a windfall can be exhilarating, making substantial life changes like quitting your job (or burning bridges) without a well-thought-out plan is almost always a recipe for disaster.

In the long term, this is how a windfall can change your life for the better:

Financial independence – The biggest opportunity of a windfall lies in its capacity to significantly bolster financial independence (FI). From paying off credit card debt to early retirement, a windfall is the best opportunity to achieve financial independence if managed correctly.

Giving back – Once financial independence is achieved, you have an opportunity to give back to the community and support causes you're passionate about. In Janite Lee’s case, her attempts to donate substantial amounts before securing her own future contributed to her bankruptcy. So, make sure you're in a good place financially before you start helping others.

In the book “The Intelligent Investor”, Warren Buffett’s mentor Ben Graham suggested a strategy for beginner investors: Make a written contract specifying how you’re going to invest your money and sign it. Though it seems like a needless ritual, having a pact with yourself reduces the chances that you would get carried away by the emotions of a high or low in the stock market.

A similar strategy could serve well for windfall scenarios. Thinking through in advance how you would handle absurd amounts of money and writing out a plan could put you in the best position to enjoy your good luck. Despite the statistics associated with poor outcomes, we believe that a windfall is an overwhelmingly positive scenario, provided one exhibits good financial acumen.

Just a reminder that Market Sentiment is now fully reader-supported. A lot of work goes into these articles and if you enjoyed this piece, please hit the like button and consider upgrading your subscription to get access to all issues.

(We are offering a 20% discount on our annual subscription)

Disclaimer: We are not financial advisors. Please do your own research before investing