Value Investing

Price is what you pay, value is what you get

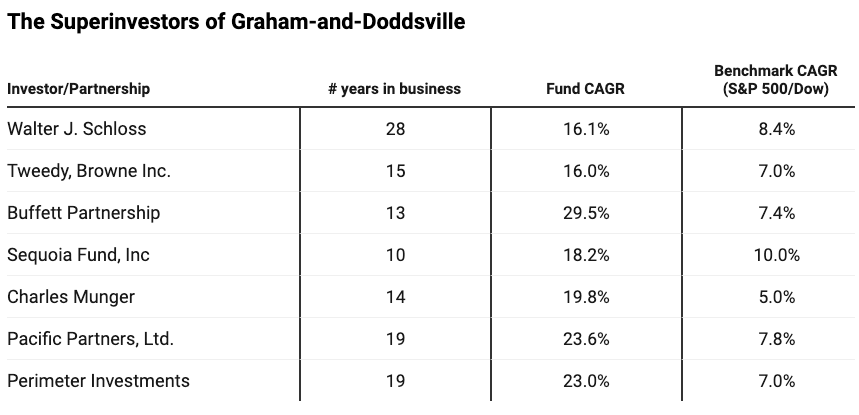

Security Analysis was first published 90 years back in 1934, shortly after the Wall Street crash and start of the Great Depression. It’s considered one of the most important books ever written on investing. In 1984, on the 50th anniversary of its publication, Warren Buffett gave a speech at Columbia Business School arguing that the markets are inefficient and highlighting the effectiveness of value investing approach using the performance of super investors of Graham-and-Doddsville1.

Buffett goes on to showcase a group of investors who followed the simple principle of looking for value with a significant margin of safety and were able to beat the market for decades running.

All of these investors followed Graham’s value investing approach, but, in very different ways. Some of them had gone to the best educational institutions on the planet whereas others never went to college. Some had extreme concentration, whereas others had dozens of stocks focused on diversification. They bought and sold stocks in very different market conditions and industries - the only thing that ties all of them together is that they search for discrepancies between the value of the business and the price you pay to get a part of that.

The principle of value investing is simple. You are trying to find diamonds in the rough - many companies fall out of favor of investors due to their overreaction to bad news, such as an unexpected loss, slowing down growth, or an accounting scandal. Once the investors come back to their senses and realize that they undervalued the firm, the share price shoots back up and reverts back to intrinsic value and the value investor exits with a good profit.

Buffett used to specialize in this a few decades back. Our favorite example is Buffett's investment in American Express following the Salad Oil Scandal in 1963. A massive portion of the loans in the scandal were funded by American Express. When Allied filed for Chapter 11 bankruptcy, AmEx was on the hook for the loans issued. AmEx nearly went under and the stock dropped more than 50% due to the scandal and that’s when Warren Buffett came in. Buffett took a 5% stake in the company for $20M and played an active part in repaying the creditors and building back the trust in the company. His bet paid off with AmEx stock jumping from 94 cents in ‘63 to $5 in ‘68, and Buffett exited his position with a cool 400% gain in 5 years.

A more recent example would be that of Meta. The company dropped ~70% over the last year following just two-quarters of weak earnings. A fun exercise to do is to go to Google and use their custom filter to search for news related to the stock during the last quarterly report. Analysts were writing off the company and below $100 price targets were issued and justified with so much conviction. Just after Meta announced a wave of layoffs, some cost-cutting initiatives, and a decent quarter, the stock is now up 105% in just 3 months. These are the type of investments value investors specialize in.

Academic research has also consistently documented the excess returns following the value strategy - Lakonishok in 1994 reported that investing in 30% of the lowest market-to-book ratio (value stocks) and shorting the top 30% stocks with the highest market-to-book ratio (glamour stocks) yielded a whopping 34.4% rolling three-year return from 1968-89. Arguably the most famous one is the Fama-French High Minus Low (HML) strategy which averaged 5% annually during the 1930-89 period. It argued with substantial evidence that companies with high book-to-market ratios (value stocks) outperform those with lower book-to-market values (growth stocks).

But as Einstein once quoted, “In theory, theory, and practice are the same. In practice, they are not.”, what we are really interested in is:

How to identify undervalued companies?

Does value investing still work or are we holding on to a relic from a time when most data was not easily accessible and high-frequency trading was not the norm?

How did value-based ETFs like $VFVA, $FVAL, $SPYV, etc. perform compared to the market?

It is extraordinary to me that the idea of buying dollar bills for 40 cents takes immediatly with people or it doesn’t take at all. It’s like an inoculation. If it doesn’t grab a person right away, I find that you can talk to him for years and show him records, and it doesn’t make a difference. I have never seen anyone who became a gradual convert over a ten year period to this approach. It’s instant recognition or it is nothing - Warren Buffett

Let’s dig in: