Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 45,000 other investors to make sure you don’t miss our next briefing.

We are publishing this without a paywall.

In the early 1970s, the U.S. was still riding on post-war prosperity. Inflation was low and growth was steady. The stock market had grown a respectable 73% in the previous decade.

Then came the oil shock.

In retaliation for the U.S. supporting Israel, OPEC nations cut oil production and banned exports to the U.S. The consequences were immediate — the price of oil quadrupled within the next few months from $3 per barrel to $12. The rising prices and embargo led to widespread fuel shortages and rationing. Gas lines stretched for blocks, with states like California, Texas, and New York going as far as implementing an odd-even rationing of gasoline.

Unsurprisingly, the 300% spike in fuel costs caused transportation costs to soar. Prices of goods such as food, plastics, and airline tickets all sharply increased, and inflation went from 3% in 1973 to 12% in 1974.

Energy is a foundational input. So when the oil price quadrupled, businesses were hit with soaring input costs. But they couldn’t pass on these prices to consumers, who were already being squeezed by higher gasoline and food bills. The result was predictable: demand fell, and the economy ground to a halt.

The unique scenario of slowing growth and rising inflation is known as Stagflation. There are no good playbooks for solving this. If the Fed tightened its policy by increasing rates, it would slow down the already worsening economy. If it did nothing or lowered rates to boost production, the inflation would spiral out of control.

No matter what you did, something else broke — It was a vicious cycle. Finally, what it took to solve this last time around was raising the Fed rates to astronomical levels. Then Federal Reserve Chair Paul Volcker engineered two massive but brief recessions by raising the interest rate to 20%! By the time Volcker left office in August 1987, inflation was down to 3.4 percent from its peak of 9.8 percent in 1981.

But this came at a cost: As Buffett highlighted in his ‘99 interview to Forbes, from 1964 to 1981, the stock market went nowhere.

Dow Jones Industrial Average

Dec 31, 1961: 874

Dec 31, 1981: 875

Tariffs: The new oil shock?

While a lot has been written about the macroeconomic impact of tariffs, a better way to understand it would be from the perspective of a small business owner.

Casey Ames runs Harkla, a 10-person, 10-year-old company that specializes in products for special needs children. They sell weighted blankets, compression sheets, and some specialized children’s toys.

He had ordered 4,750 units of items from China, which had a tariff of 4% in 2024. But the shipment, due to arrive in June, is now caught in a sudden policy shift — a steep 54% tariff added just last week.

The impact? An unexpected $80,000 in additional tariffs, due immediately upon arrival at the U.S. port — well before he’s had a chance to sell a single unit.

With Trump now threatening an additional 50% tariff on China in an ever-escalating trade war, Casey’s total tariff bill could rise to $191,000. Which means that just the tariffs will be higher than the per-unit sale price of their product.

If the tariffs stay as is, Casey will be left with only two options:

Shut down the business, which he is considering

Raise the prices by more than 100%, causing the demand to collapse

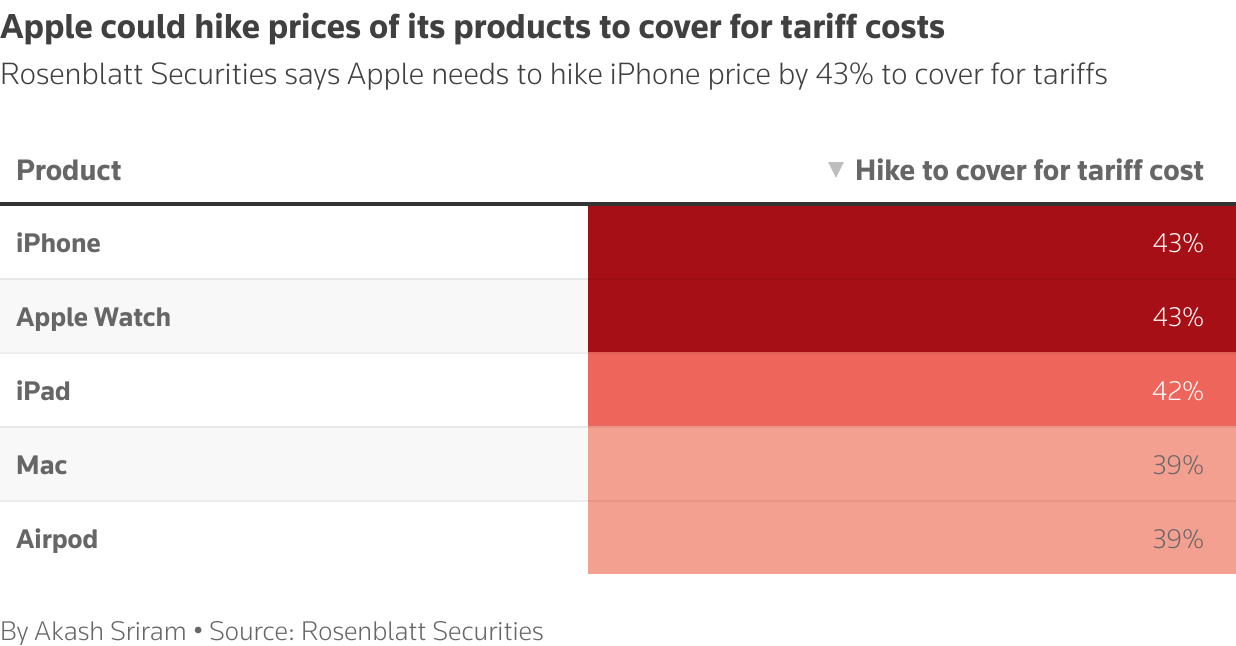

It’s not just small businesses that are affected by this. Even the biggest company in the world, Apple, will have to raise its prices. Based on initial estimates, the price of an iPhone is expected to jump by as much as 43%!

The manufacturing supply chain is now more global than ever, and the compounding effects of tariffs will be devastating.

In the 1970s, companies faced a single input cost shock (energy) and could respond by reducing energy intensity. Today's global supply chains mean tariffs compound at each production stage. A 10% tariff on steel becomes a 12% cost increase in auto parts, which becomes a 15% increase in vehicle costs, and so on. — Citrini Research

Now, extend this impact across industries and companies. Each one will face a tough choice: raise prices to cover higher costs or absorb the hit and reduce profit margins. Businesses will ultimately end up choosing a mix of both — one will drive inflation, and the other will drop GDP growth, both leading to Stagflation.

Finally, if you are curious as to why we can’t manufacture everything in the U.S., take a minute to watch how complex it is to make a simple pencil.

Tariffs are stickier than you think

Using tariffs as a bargaining tool is nothing new — the first version goes back to 1828. But what most people overlook is how long it takes to reduce the tariff once it’s in place.

After World War 2, the U.S. exported close to $50 million worth of Chicken to West Germany in 1962. To protect European Farmers, the EU put a 40% tariff on Chicken imports from the U.S. The U.S. retaliated by putting a 25% tariff on Trucks like Germany’s Volkswagen.

Both of these strategies worked—chicken exports from the U.S. dropped 60% in one year, and truck imports to the U.S. also dropped 50%.

Ultimately, none of the countries backed down, so the Europeans had to pay more for their chicken, and the Americans had fewer truck options.

The kicker: The 25% tariff on trucks is still in place after 60 years, even though U.S. farmers no longer care about selling chickens in Europe.

So why is this important?

Remember the oil embargo that caused the stagflation in the 1970s? It only lasted 5 months. And its effects lasted for 20 years.

If Trump follows through on these tariff threats, the impact may extend far beyond the next quarter or election cycle. As history shows, even temporary shocks can leave lasting marks on the economy. Much like the oil embargo of the ’70s, the immediate damage will be visible in months, but the aftershocks could last decades.

If you made it this far, chances are you gained at least a few insights that will help you make a smarter investor. If you would like to receive reports like this frequently and get access to our full research, consider becoming a paid subscriber! Thank you :)