Hi everyone, this will be our last deep dive for the year. Thank you so much for reading and supporting our work. Looking forward to a great 2024 :)

A pin lies in wait for every bubble.

And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest. — Warren Buffett

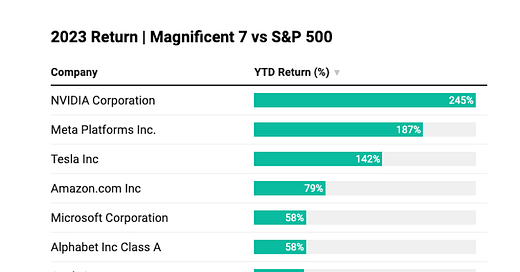

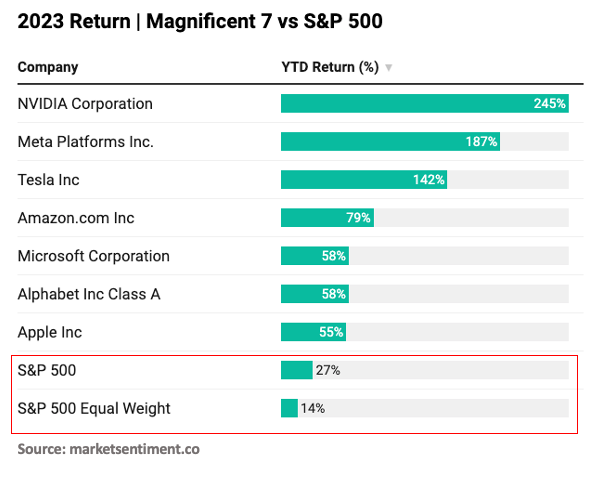

The big story this year has been the remarkable performance of the “magnificent 7”, or the seven largest technology stocks in the S&P 500 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla). As of today, all companies in the magnificent 7 list have outperformed the market by at least 2x and the S&P 500 equal weight index by 4x.

While a lot of analysis has been done on these companies' valuation and prospects by analysts smarter than us, we believe a better way to look at this is through the lens of history.

It’s the same exercise Buffett introduced to Bill Gates on the first day they met. But before we start:

Great, now back to it: Buffett’s exercise is simple - You choose a random year, say 2000, and then examine the top 10 companies with the largest market capitalization. Then you go forward 10 or 20 years and see how those companies fared over time. The idea is that it will help us avoid recency bias, spot emerging trends, and identify companies that can create enduring success.

Let’s start with

The 1980s

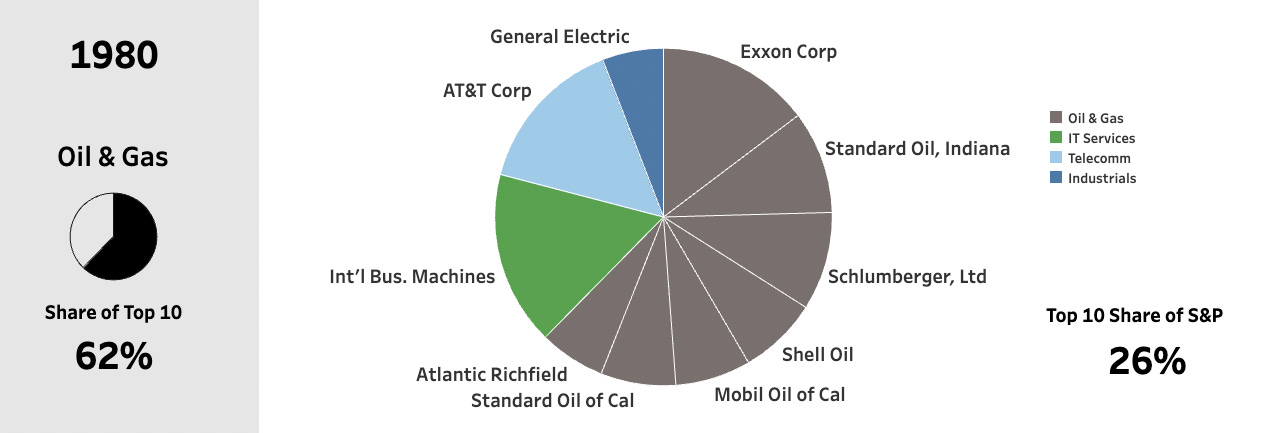

In the 1980s, Oil and Gas companies dominated the top 10 list. IBM was the biggest company back then, closely followed by AT&T. What’s incredible is that the next 7 companies1 were all Oil & Gas (Contributing to ~ 16% of the S&P500). The key factor driving the valuation was the high Oil price - over US$35 per barrel (equivalent to $130 per barrel in 2023 dollars, adjusted for inflation).

But this did not last long. The 1980s Oil glut caused oil prices to drop to below $10 by the end of 1986. By the beginning of 1990, only one oil company (Shell) was in the top 10 list.

The 2000s

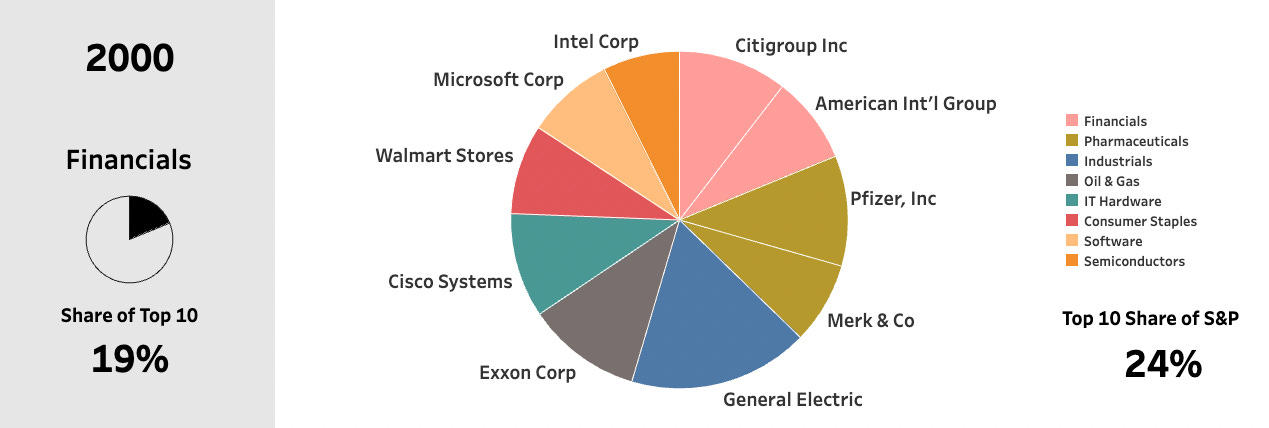

The few years leading up to the millennium were incredible for tech companies, and 2000 was the peak of the dot-com bubble. Companies with non-existent revenue were valued at billions of dollars, and just being associated with the ‘internet’ was enough to have investors lining up2.

Yet, tech alone did not dominate the top 10 list. It was a good mix of tech, pharma, consumer staples, and industrials. The biggest one was Financial services3 — but it only took ~20% of the top 10.

What’s amazing is that only two companies (Exxon & GE) from the 1980s list made it to 2000. Even IBM had dropped out of the top 10 list even though we were in the middle of the dot-com boom.

The 2020s

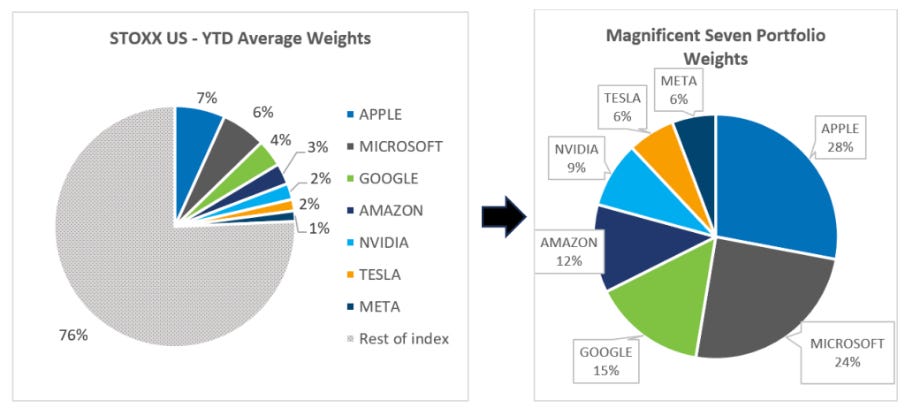

Incredibly, as of 2023, the only companies not associated with tech in the top 10 list of the S&P 500 are JP Morgan Chase and Berkshire4. Just 7 companies contribute 28% of the total market cap of the S&P 500.

Apple, Amazon, Google, and Microsoft continue to dominate the respective industries they are in and are virtual monopolies. Once again, only one company (Microsoft) from the 2000s and not even a single one from the 80s made it to the 2023 list.

The inability to forecast the past has no impact on our desire to forecast the future. — Morgan Housel

We have barely scratched the surface of this exercise. The last few decades have brought spectacular changes to how we live that it will look like a fool’s errand to predict the future. But an important question is, now that you have played the game, would you go back and change your answer on the poll?

As long-term investors, the final piece of the puzzle is how a portfolio of these biggest stocks performs compared to the market — If history is any guide, investing in the largest stocks is a surefire way to increase portfolio risk and underperform the market.

Let’s dig in: