Jim Simons, the founder of the Medallion Fund has done what most people consider to be impossible. His fund has consistently beaten the market over the last 30 years. The fund has had an average return of 66% before fees during the period of 1988-2018!

To put these returns in perspective, $100 invested into the Medallion Fund in 1988 would have converted into $398 Million by 2018. Even net of fees [1], the fund has outperformed S&P 500 returns by ~1000 times and Warren Buffet’s returns by ~200 times!

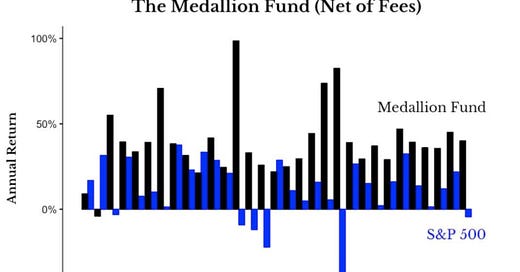

If you are still not convinced about the absurdity of the returns, take a look at the following chart which showcases the annual returns for the Medallion fund in comparison with S&P 500.

Notice anything strange? Since its creation, the fund has only lost money in a single year [2] (1989). For the next 30 continuous years, there was not even a single year where their returns dropped below 20%. Even at the peak of the 2008 financial crisis, the fund had made an 82% gain net of fees!

We all know that Hedge Funds gets a lot of hate, most of the time justifiably so. But returns like this sustained for such a long time period call for further scrutiny. So in this week’s analysis, we are deep-diving into how the Medallion Fund created such outsized returns for its investors.

The Beginnings

Jim Simons has a Ph.D. in Mathematics, taught math at MIT, and has worked for NSA as their codebreaker before turning his attention to the stock market. He was one of the first people who realized that pattern recognition could be applied to beat the stock market.

He created a trading system that uses quantitative models and formed Renaissance Technologies in 1982. The peculiar thing about this hedge fund is that it does not hire anyone from financial or business backgrounds.

They solely focus on physicists, statisticians, mathematicians, and signal processing experts and believe that the herd-like mentality of business school graduates leads to poor returns! Renaissance’s headquarters is famously known as the world’s best physics and mathematics department.

This view is extended to their investment philosophy as highlighted by Robert Mercer (Co-CEO), Medallion Fund only focuses on the quantitative model recommendations and not the underlying business performance/strategy [3].

Fund Performance

I know we discussed the extraordinary returns of the fund in the beginning, but the following chart will put the sheer numbers into perspective.

By now we know that the fund has outperformed the S&P 500 index by a wide margin. But in this research paper by Bradford Cornell (Finance Prof at UCLA), he argued that even if the investor had the ability to predict the stock market returns perfectly on a monthly basis (shift the money to treasury during downturns and back to stocks during the upswings), the investor would only have been able to turn the $100 into $331K (an insane 331,100% return) but even this would be nothing in comparison to the ~$400 MM return generated by The Medallion Fund.

It’s not often you see Warren Buffet so low down a list for long-term investment returns. The Medallion Fund has beaten all the well-known investment managers by a wide margin over its 30 year period.

Fund Strategy

While the exact inner workings of the fund are only known to a few key insiders who are tightly bound by confidentiality clauses, what we know comes mainly from the book ‘The Man Who Solved The Market’ by Gregory Zuckerman [4].

As per the book, Medallion strategy involves holding thousands of short-term long, and short positions (aka like your avg r/wallstreetbets user) at any given time. Allegedly, they win 50.75% of the trades they make (not like your avg r/wallstreetbets user) which is enough to make them billions as they are conducting millions of trades every year.

Adding to the excellent quantitative models they have created, Medallion Fund also did two things right

Leverage: It’s estimated that Medallion trades with 12.5x leverage on average with it going up to 20x when the system is confident. If you remove the leverage from the picture, the fund’s returns are similar to S&P 500. It’s their effective usage of leverage and deep understanding of risks involved that makes their returns legendary

Fund size cap: The fund has made sure that their Asset Under Management (AUM) never goes beyond $10Billion. They understand that adding more money might not work with the same strategies and have paid out their returns to their investors to keep the AUM same.

What does this mean for an average investor?

The Medallion Fund has been closed to outside investors since 1993. As of now, only the existing and previous employees of the company can invest in the fund. The funds of Renaissance that are open to the public have performed so poorly that the two funds made it the HSBC’s top 20 losers list for 2020.

While it certainly is a bummer that the average investor cannot invest in the fund, this analysis gave us some key insights into the market. The first and most important being that the stock market is not perfectly efficient and that there are inefficiencies that someone can leverage for more than 3 decades. The second being that not all funds that charge an exorbitant fee structure [1] are taking money away from the investor. In Medallion’s case, they are justifying their eye-watering fee structure with phenomenal returns.

Finally, this should not be considered as a call to action to find similar funds as not every team with stellar people end up producing market-beating returns [5]

Conclusion

It’s like Jim Simon’s had created a license to print money with the Medallion Fund. How long the fund’s algorithms can remain a secret and continue generating market-beating returns is anyone’s guess. My incredulity and skepticism during this analysis was perfectly captured by Bradford Cornell in his research paper

During the entire 31-year period, Medallion never had a negative return despite the dot.com crash and the financial crisis. Despite this remarkable performance, the fund’s market beta and factor loadings were all negative, so that Medallion’s performance cannot be interpreted as a premium for risk bearing.

To date, there is no adequate rational market explanation for this performance.

Until next week…

Footnotes

[1] The fund charges an exorbitant amount of fees. From 2002 onwards, it has a 5% management fee and 44% performance fee. To signify the impact of this fee, let’s take the following e.g. if you invest $100K into the fund and at the end of the year, your fund grows to $130K (a 30% return), they would charge you $5K (5% management fee) + $13.2K (44% of the profit) for a total of $18.2K in fees. So your net returns would only be 11.8%. Even if they lose money, they will still charge you $5K for managing your money. Vanguard SP500 ETF would charge you $30 for the same!

[2] Even in the year, their returns were negative, the fund returns before the fee were + 1%. The 5% management fee pushed them to the -4% net returns.

[3] His exact quote was “sometimes it [the model] tells us to buy Chrysler, sometimes it tells us to sell”

[4] The man who solved the market — It’s an excellent book and a highly recommended read.

[5] Long Term Capital Management - A fund that was managed by a bunch of PhDs and Nobel laureates. It had posted great returns since starting in 1995 (in the 40% range) only to be bailed out in 1998, and was dissolved in 2000)

If you found this insightful, please share it with your friends :)

WhatsApp | Facebook | Twitter | Reddit

How would you rate this week’s newsletter?

PS: Some of you have reached out to me stating that this newsletter is going to the promotions tab instead of the primary inbox in Gmail after I have shifted to Substack. This is mainly due to the usage of $ symbols for Stock tickers and using the terms Buy and Sell for analyst recommendations. Google AI mainly classifies emails containing these words as promotional e-mails.

It would be awesome if you could mark this e-mail as important or move it to primary or just reply to this email with a “hi” or any questions you have so that it always comes to your primary inbox and you won’t miss out on the weekly posts. Thank you :)

> signal processing experts

The philosophy inside of me can't help but be slightly witty with *cybernetics*, and the question is this: has the "legendary investment vehicles" absorbed the large majority of alpha from the market (assuming ETFs are smart beta)?

https://www.youtube.com/watch?v=Hu4Cq_-bLlY https://www.youtube.com/watch?v=nZxlwxFL-yA