Before we jump in, a lot of subscribers have joined us recently. For those who are new, we have published 250+ reports in the past 4 years. Most of these are timeless insights, and we did not want our new subscribers to miss out on these. So,

(We will go ahead with this only if more than 80% vote for yes)

Here’s the hard truth about investing:

You always hear about the guy who made $100K by betting $100. You never hear about those who put in thousands and are left with nothing.

In his now-infamous 1929 article “Everybody Ought to Be Rich,” John J Raskob argued that anyone could become rich by investing in the stock market.

Ten thousand dollars invested ten years ago in the common stock of General Motors would now be worth more than a million and a half dollars.

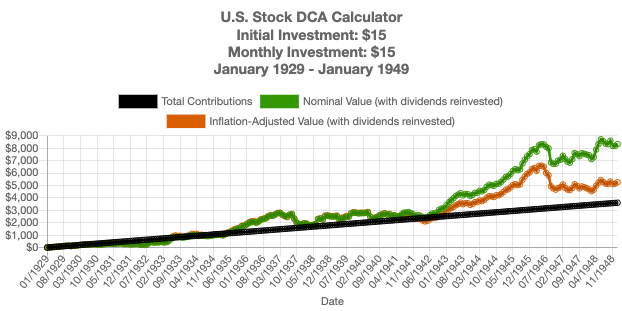

Suppose a man marries at the age of twenty-three and begins a regular saving of fifteen dollars a month—and almost anyone who is employed can do that if he tries. If he invests in good common stocks and allows the dividends and rights to accumulate, he will at the end of twenty years have at least eighty thousand dollars and an income from investments of around four hundred dollars a month.

He will be rich. And because anyone can do that I am firm in my belief that anyone not only can be rich but ought to be rich.

Except that it didn’t happen. Someone who followed Raskob’s advice and invested $15 monthly into the stock market for 20 years would have had a portfolio of $8,326 (IRR of 7.6%) — A far cry from the promised $80,000!

While Raskob’s advice was not bad, his assumptions were terrible. He was expecting a consistent 12% CAGR for stocks and did not anticipate the Great Depression that immediately followed or the U.S. being dragged into the World War. Yet, U.S. investors were lucky — even after accounting for both, the U.S. was nowhere near the drawdowns experienced by investors in other developed markets.

PLEASE TAKE A MOMENT TO LIKE THIS POST

Nothing so undermines your financial judgment as the sight of your neighbor getting rich. — J.P. Morgan

If you owned literally any asset class this year, you would have made money.

Gold — +28%

S&P 500 — +27%

BTC — +122%

Dogecoin — +365%

Nvidia — +191%

These extraordinary returns naturally generate FOMO. Rather than being happy with the 27% return from the S&P 500 (nearly triple its expected annual return!), you would be envious of the guy who went all in Nvidia at the beginning of the year and tripled his money.

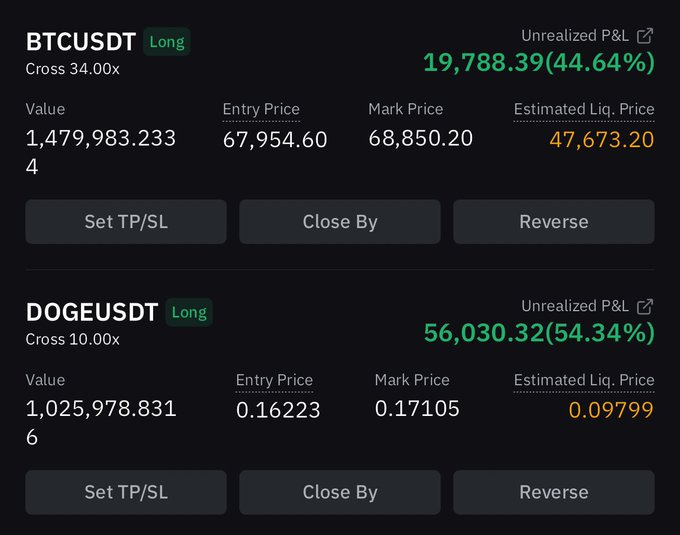

We are guilty of this too. I religiously follow the daily updates of this gentleman on Twitter who went long on Bitcoin & Dogecoin starting November 2024.

Take a moment to see how wild the bet is. He has leveraged 34x on Bitcoin and 10x on Dogecoin and invested $150K across BTC and DOGE. At that leverage, a 3% drop in the price of Bitcoin would wipe out his entire investment, and a 30% drop would wipe out his entire portfolio (He is using cross margin, meaning all the funds in his account act as collateral for that position).

While he has changed his overall positions a bit, let’s look at how the portfolio is doing exactly a month later on Dec 5th, 2024!

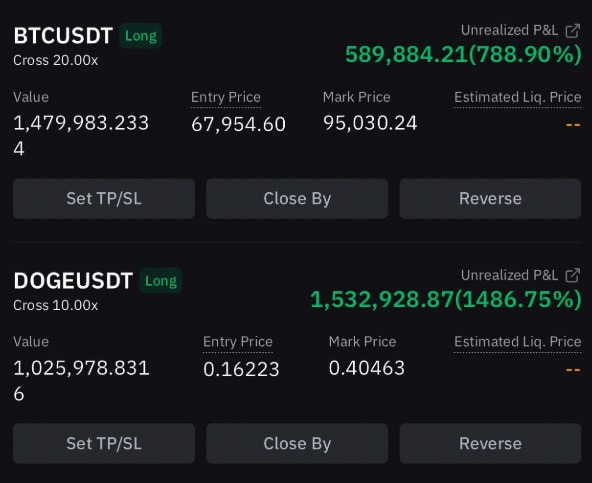

His $150K investment is now worth more than $2.1M. That’s life-changing money made in a matter of days. People have been nudging him to shift some to t-bills but he is still holding on to his investments.

All of us have at least once wished we had made a similar play to the one that turned $17 into ~6M. More than 2.1 million people right now are trying to find the next crypto moonshot. Even the CEO of Coinbase is touting how if someone had bought $100 Bitcoin when Coinbase was founded, it would be worth $1.5 million today.

With all that’s going on, what’s the actual probability of getting a 100x return on your investment in the crypto world?

What are the odds that you will lose 100% of your investment?

The #1 rule of investing1 is “never lose money”. Investing in crypto immediately breaks this rule.

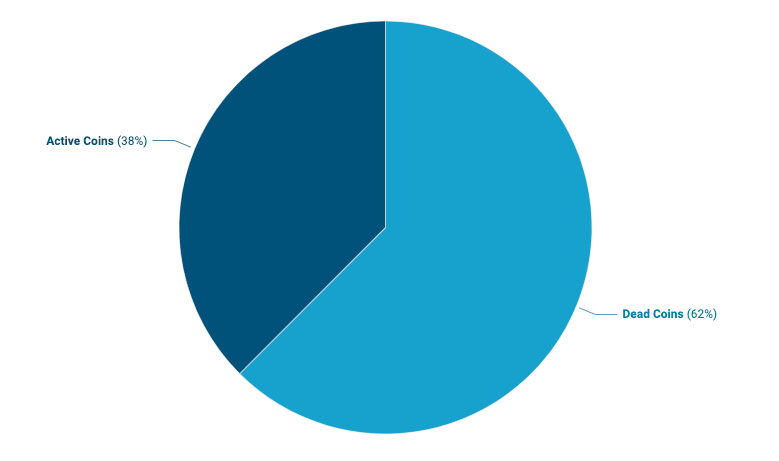

Of the more than 40,000 coins that traded in an exchange at least once in the last 10 years, only 38% are still alive. So forget about making a profit — the probability that the coin you buy will survive over the long run is only ~ 1 in 3.

What about 100’xing your investment?

While there are probably hundreds (even thousands) of coins that might have 100’xed in value during their brief existence (like the Hawk Tuah coin), it’s unrealistic to expect to find them and invest in them before someone rug pulls them out of existence.

To get a more realistic scenario, we kept a minimum market cap limit of $10 Million2 and required the coin to be present in the top 100 coins based on market cap.

The backtest is simple — At the beginning of every month (starting in 2014), we check what the top 100 most popular coins were and the probability that you would have 100’xed your investment if you held on to that coin (data here3).

In the last 10 years, there were a total of 9,502 coins that fit our criteria. Out of these, only 442 (4.6%) grew more than 100x. This assumes that you sold at the very top. If you had held on to these coins to date, the number drops to 160.

So, over the holding period, the chance that you 100’xed your investment on a coin is only 1.7%.

If you remove the duplicates (as the same coin can come up in our filter in different months), of the 460 cryptocurrencies that made it into the list, only 38 (8%) grew more than 100x. If you held on till 2024, only 8 coins (1.7%) provided you with a 100x return.

For those interested, the coins were Bitcoin, Ethereum, Dogecoin, Apollo, BNB, XRP, Monero, and Solana.

If you are calculating the expected value and think that you will come out ahead (given you have a ~2% chance of 100x returns), you must read our research on Kelly Criterion.

Winning a Loser's Game

Dr. Simon Ramo was the first person to find the crucial difference between amateur tennis and professional tennis in his book, Extraordinary Tennis for the Ordinary Tennis Player.

He discovered that in professional tennis, 80% of points are won due to brilliant execution whereas, in amateur tennis, 80% of points are lost due to unforced errors.

Professional tennis players are playing a winner’s game but amateur tennis players play a loser’s game. So, to win in amateur tennis, you only need to avoid mistakes. And the way to avoid mistakes is to be prudent, keep the ball in play, and let the other guy defeat himself while doing so.

Crypto investing, much like amateur tennis, often feels like a game of skill and precision. But most, if not all, gains and losses in the crypto market can be attributed to the market more than the skill of the trader. If SBF didn’t blow up FTX during the 2022 bear market, he would have been worth $100B+ with Bitcoin trading at $100K.

For those who are determined to try to win a loser’s game, here are a few things to consider:

Be aware of the odds — The chance of you hitting a 100x return on your meme coin investment is less than 1 in 50. To put this in perspective, it’s like picking a specific card out of a shuffled deck of cards on your first try!

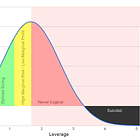

Spread your bets — The best way to improve your odds of winning is to survive. You can reduce your risk and improve your returns by diversifying and making smart bet sizes.

PLEASE TAKE A MOMENT TO LIKE THIS POST

You just finished a 1,500-word deep dive

If you made it this far, chances are you gained at least a few insights that will help you make a smarter investor. If you would like to receive reports like this frequently and get access to our full research, consider becoming a paid subscriber! Thank you :)

Data & Footnotes

Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1 - Warren Buffett

A 100x return at this level means the coin reaches “mainstream adoption” with a market cap of $1 billion.

I wouldn’t have removed the coins that had doubled more than once. Do they not also tell a story?