By the end of the 1980s, Japan was the place to be for investors. Japan’s stock market was the largest in the world in terms of market capitalization; its manufacturing was the envy of the world, and Japanese tech giants were doing the robot dance way before it was cool. The companies were doing so well that they bought out Manhattan’s Rockefeller Center and Pebble Beach golf resorts in multi-million dollar deals.

At its peak, it was rumored that Tokyo’s Imperial Palace was worth more than all the real estate in California — Yup, a patch of land in Tokyo, in theory, could buy you Hollywood, Silicon Valley, and all the beaches along the Pacific Coast. Makes perfect sense, right?

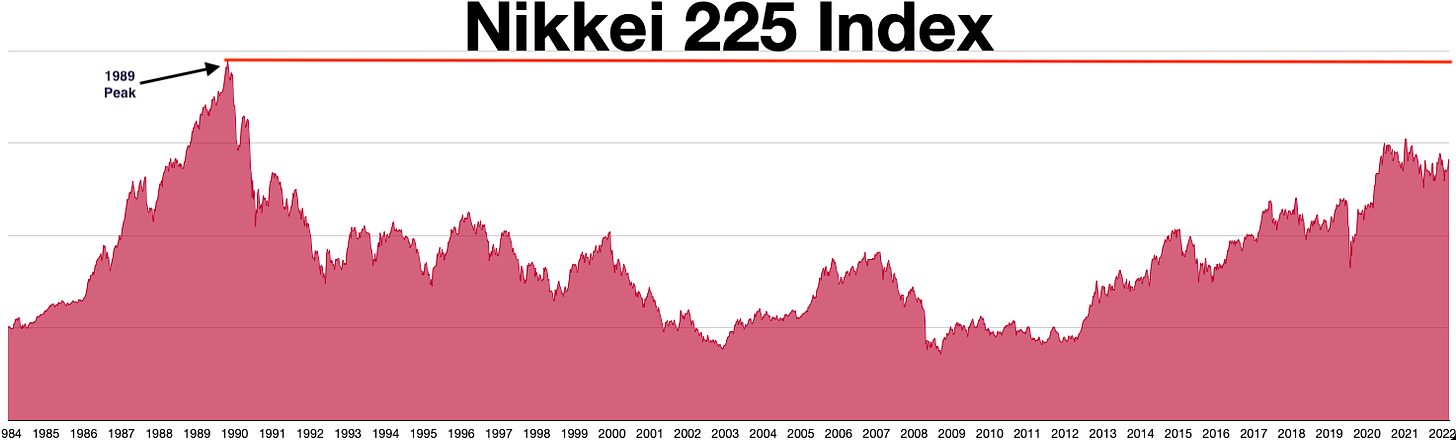

No one loves a never-ending party, especially central banks. By 1989, property prices were skyrocketing, and the equity market was in an explosive upswing. The Bank of Japan started feeling the heat and decided it was time to bring out the proverbial wet blanket with interest rate hikes. The Nikkei 225, which had reached a dizzying high of nearly 39,000 at the end of 1989, began to tumble.

What investors thought was a minor blip turned out to be a decade-long crash. The Japanese stock market dropped 60% between 1989 and 1992, and the real estate market also suffered a significant downturn — with prices falling by an incredible 70%! Japanese market still hasn’t recovered the heights it achieved during the 1989 rally, and the prolonged economic stagnation is referred to as Japan’s lost decades.

While the chart by itself looks horrifying, the real-life implications are even worse. Consider a Japanese worker who started working in 1980 and investing in the stock market. Assuming the worker invested $1,000 yearly over a 30-year career, by the time he/she retired in 2010, the $30,000 capital would have turned into $20,710 — a -31% return on invested capital over 30 years. In fact, from 2000 to 2010 (the last ten years of their career), there were only two years in which their total portfolio would have been green. Add to this the aging demographics; many older Japanese plan to work forever.

If you found this interesting, check out survivorship bias