The Definitive Guide to REITs

How REITs can fit into your portfolio

Buy land, they're not making it anymore. - Mark Twain

While a lot has been written about Warren Buffett and how he made his break into the investment world, it’s really interesting how Charlie Munger made his first million. Charlie was practicing law in 1961 when Otis Booth came to him with a problem — Otis wanted Charlie to handle the sale of some real estate assets.

But Charlie saw the location and immediately advised Otis to keep the property and develop it by building his own apartments. Otis countered

Charlie, if this is such a good idea, and you’re so sure it will work, why don’t you put up some of the money and join me. I won’t do it without you.

Munger and Booth joined forces and invested a combined $100,000 (back in 1961!) and they built the property. They had to hold it through a recession, but, eventually, they sold it for an incredible 400% profit. Charlie and Booth would go on to do multiple successful deals before Charlie moved on to Berkshire.

Even though Berkshire does not actively invest in real estate, Buffett has been a proponent. At the annual Berkshire Hathaway shareholders meeting in 2022, Buffett did not mince his words when asked about Bitcoin and highlighted the importance of investing in income-producing assets.

If you said… for a 1% interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon.

[For] $25 billion I now own 1% of the farmland.

[If] you offer me 1% of all the apartment houses in the country and you want another $25 billion, I’ll write you a check, it’s very simple.

Now if you told me you own all of the bitcoin in the world and you offered it to me for $25 I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything.

The apartments are going to produce rent and the farms are going to produce food.

While the benefits of investing in real estate are apparent, it comes with some unique challenges

High capital investment — The average home in the U.S. is now selling for $500K+ which makes it unaffordable for the vast majority of investors

Illiquid — Unlike stocks, real estate investments are highly illiquid requiring months to complete a deal.

Low Diversification — Just buying one investment property is itself out of reach for most investors. Now imagine the capital required to diversify your investments through a variety of real estate holdings like office spaces, retail shops, and industrial buildings.

This is where Real Estate Investment Trusts (REITs) come in. These are companies that individuals can invest in to gain exposure to real properties. You can buy shares in companies that invest in real estate which then pay out their rental income (or proceeds from sales) as dividends to their investors. In the U.S., REITs are legally required to pay out a minimum of 90% of their income as dividends to shareholders.

Consider a company like Realty Income O 0.00%↑ — They invest in real estate properties primarily owned under long-term net lease agreements with commercial clients.

Due to a great underlying portfolio, Realty Income has managed to generate predictable, lease-based revenue. A company can easily put off buying new equipment or R&D investments when the times are tough, but if you have a 20-year lease on a commercial building, you’re contractually obligated to pay your landlord regardless of economic conditions.

This is reflected in Realty Income’s dividend history. The company has been able to sustainably increase its dividends through the dot-com bubble, Global Financial Crisis, and the Covid ’19 pandemic.1

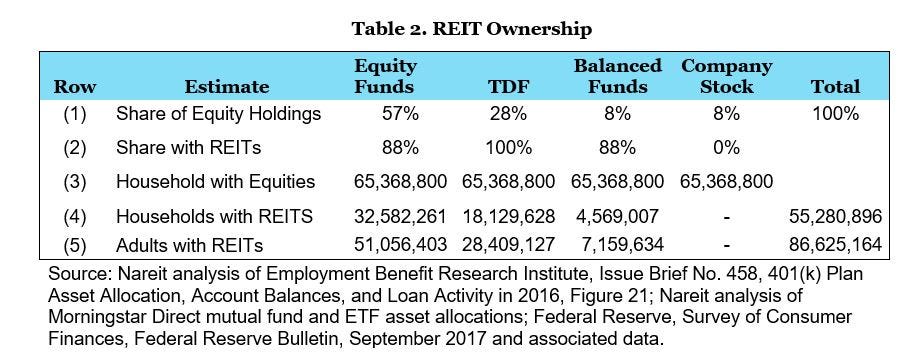

A fun fact is that most of us own REITs without knowing it. Latest reports suggest that 87 million adult Americans, or roughly 44 percent of American households own REIT stocks (mainly through employer-sponsored 401(k) plans).

At first look, REITs take away all the challenges that we highlighted with real estate investing: Capital investment is low, investments are highly liquid, and getting diversification is as simple as buying a low-cost REIT index. But, as with everything in the investment world, REITs come with their drawbacks.

It’s surprising how little coverage REITs get compared to traditional investment products like stocks and bonds. So, we have put together one of the most in-depth reports on REITs to see whether you should consider adding them to your portfolio.

What are REITs, what are the various types of REITs, and how do they work?

REITs in a high-interest/high-inflation era?

Historical performance of REITs

Should you add REITs to your portfolio — REIT Index funds

Risks of REITs investing – Tax inefficiency & management fees

REITs 101

REITs were created in the 1960s as an affordable way for ordinary investors to get exposure to real estate. The companies that are classified as REITs by law should have at least 75% of their income coming from real estate related sources and should also distribute 90% of their income directly to investors (pre-tax! — Remember this as it is the key limitation or advantage of REITs depending on your tax bracket which we will cover later).

The functioning of REITs is simple — Let’s say there are 100 individual investors who each have $100K to invest. The REIT collects a total of $10M from these investors and then buys or builds a commercial property.

Let’s assume that the company then rents out this property for $1M per year. The rent they receive is sent back to the investors (ignoring fees here for simplicity). So in this case, each investor makes $10K per year. In addition to this, the company stock also appreciates if the underlying property goes up in value.

So the investors are rewarded in two ways — The monthly dividend they receive from the company as well as the stock price appreciation. REITs are mainly an income instrument since they pay out 90% of their income as dividends with stock appreciation being a bonus.

REITs come in a wide variety of types and specializations. The most popular ones are the publicly traded equity REITs but each type has its own perks and drawbacks. Fundrise has put together a detailed guide on the type of REITs that we highly recommend if you want to get into the nitty-gritty.

REITs in a high-inflation/ high-interest rate era

Nareit evaluated the performance of equity REITs from 1972 to 2021 and found that REITs tend to outperform the S&P 500 during periods of high inflation. The stock price drop due to the rising inflation was offset by the strong income returns generated by the REITs.

This can be attributed to the rent growth — generally, residential rent has grown faster than the inflation rates (we are seeing this play out in real-time now) over the long term, and this, in turn, will correspond to higher dividend income for REIT holders.

On the other hand, the relationship between REIT returns and interest rates is not clear. Even though the correlation between REIT returns and interest rates is positive, the relationship is negative during periods where unexpected short-term interest rate changes occur (like the one we are going through now).

S&P Global found that in four of the six periods since the 1970s when bond yields rose significantly, U.S. REITs earned positive total returns and in two of them they outperformed the S&P 500.

Even though a high-interest rate tends to decrease the value of properties and make financing new projects harder, the rising rents improve the REITs’ cash flow.

The closest period that we can correlate with the current criteria is the high-inflation high-interest rate period of 1976 to 1981, and REITs outperformed the S&P 500 then by a whopping 91%.

REITs — Long-term performance

Given the consistent income and performance REITs offer, it might look like an attractive option to add to your portfolio. But before doing that let’s take a look at the most popular REIT funds, how adding them to your portfolio will affect their performance, the risks associated with REITs, and how they have performed during previous crises.

(Reminder: 20% discount on our annual subscription today)