Momentum is the premier anomaly - Eugene Fama

In the Shakespearean tragedy Hamlet, Polonius counsels his departing son Laertes: "Clothes maketh the man". Fashion, unsurprisingly, has a history that dates back several centuries littered with illustrious name brands: Brooks Brothers has been tailoring suits for almost two centuries, and Burberry’s iconic trench coats have been a staple on London’s streets since 1856.

Despite all this, a recent trend seems to have caught the industry off-guard: fast fashion. Unlike legacy brands, fast fashion thrives on its ability to adapt quickly. It uses advanced algorithms to spot trends and streamlined manufacturing processes to deliver new designs in record time.

Shein, a fast-fashion behemoth, is said to have a turnaround time of just 25 days, whereas legacy brands can take several months to create a new design. At the height of its popularity in 2022, Shein had a valuation similar to that of SpaceX, which launched every six days that year.

Now, Shein and the rest of fast fashion have a serious set of problems (wage asymmetry, environmental, etc.), but it presents a fundamentally different approach to the business - ride the trends as much as possible, cut losses on what's not in demand, and move on to the next trend. Legacy brands stick to their values: Levi’s sells you their jeans, Patagonia has a vest, but Shein is value agnostic.

To quote a Chinese analyst in Tech Buzz - “Shein’s actual strength is acknowledging that they have no idea what you want to wear.”: They sell what is in demand and have been massively successful riding the momentum. The strategy here is to optimize for the outcome (revenue) by doubling down on the winners and ruthlessly cutting out the losers. Fast fashion can even keep up with micro trends (that last less than a season).

Momentum, or going with the flow, is the key: it is almost Socratean in its approach - “I know that I don’t know” - no effort is made to predict the future, the key is to follow what works now.

A similar approach exists in investing: momentum investing.

The strategy here is to invest based on recent performance: go long on the most successful stocks and short the losers. We last wrote about momentum in June 2023, when it was starting to show signs of outperformance. Since then, the performance has been spectacular.

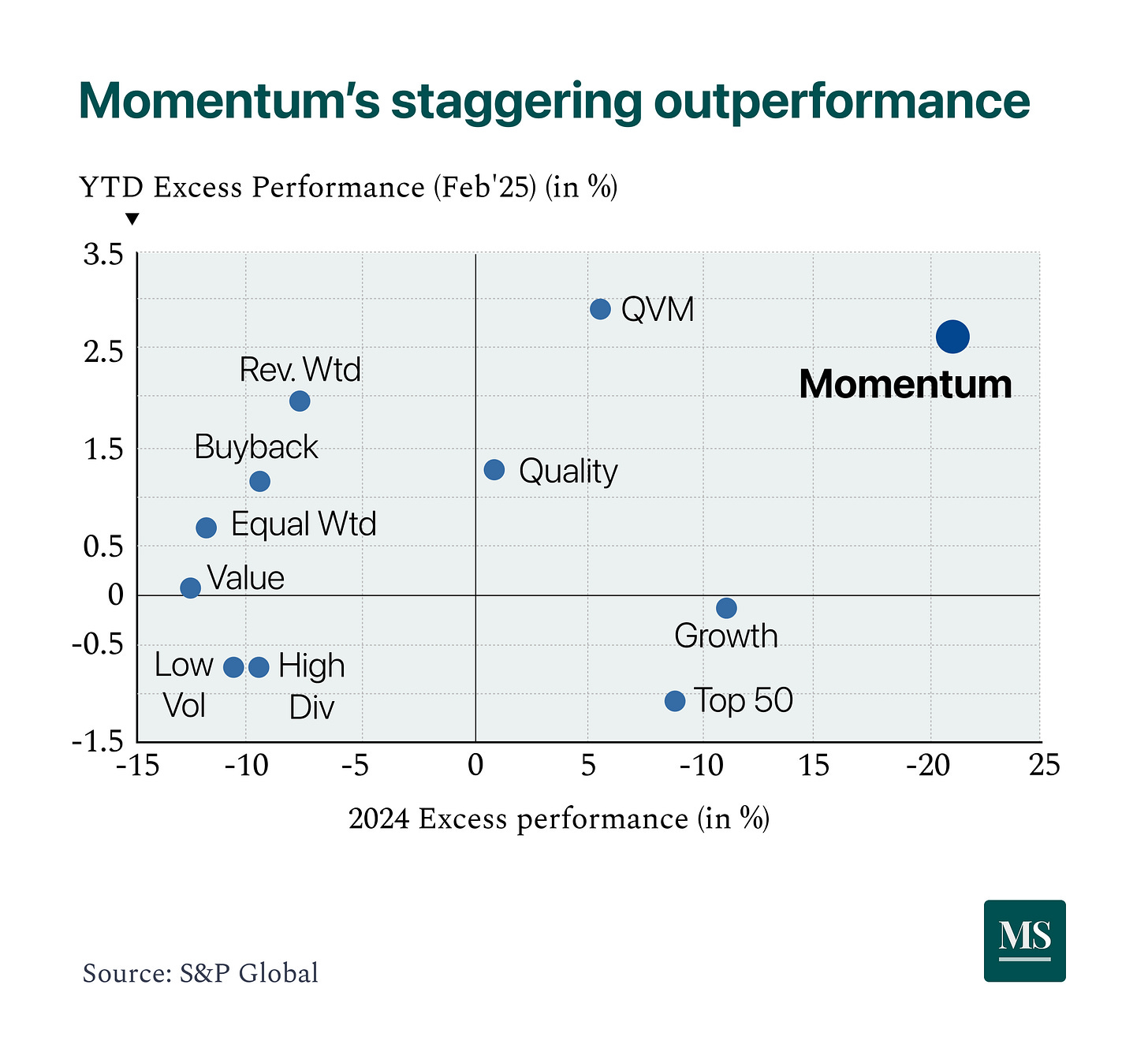

Take a quick look at the figure below. At first glance, momentum might not impress you: ~23% return in a year when the S&P 500 had similar returns. Take a closer look: the x-axis is excess return, over and above market returns.

Momentum investing had a staggering 46% return in 2024, a year where Buffet returned 25% (Berkshire’s best year since the turn of the millennium [2013] stands at 32%).

To put this in perspective, if you had invested in momentum after our June 2023 newsletter, you would be up ~64% now (double the S&P 500 return of 31%).

Momentum’s stellar outperformance over other factors deserves a closer look. So this week, let’s dig deep into how momentum works, how you can best add momentum to your portfolio, and finally, how momentum’s approach of buying the winners and selling the losers fares as we move into an uncertain future of tariffs, rate cuts, and isolationism!