The Definitive Guide to Bonds

How bonds can fit into your portfolio

By now, all of us know how SVB went bankrupt in the blink of an eye. But what most people don’t remember is that something very similar occurred in Orange County, California nearly 30 years back. Robert Citron was responsible for collecting and investing hundreds of millions of dollars on behalf of Orange County. In the wake of a new rule that dramatically reduced property tax revenue, Citron was under pressure to deliver more and more money for the local governments using his investments.

To deliver these returns, Citron started working with Merrill Lynch to invest in high-risk bond market derivatives. To put it simply, Citron had now leveraged $7 billion of public money into a $20 billion investment fund, and for years, it worked. Citron’s investments earned more than twice as much as those made by the state treasurer.

But, leverage is that magical thing that works until it doesn’t. The problem was that all the investment Citron made was focused on the Fed dropping the interest rates1. In Feb ’94 the rate was 3.25%. By May, it was 4.25%. By the end of the year, it would be a whopping 6% making it one of the fastest rate hikes in history.

The sudden rate hike crashed the bond market and Orange County lost $1.6 billion or close to 30% of its entire portfolio. Unable to pay its debts, the county had to file for Bankruptcy making it the largest municipality in U.S. history to do so at the time. The bankruptcy had far-reaching consequences, including layoffs and cuts to public services in the county, and they even had to import trash into their landfill to pay off their debt. It would take 22 years before Orange County was finally paid up.

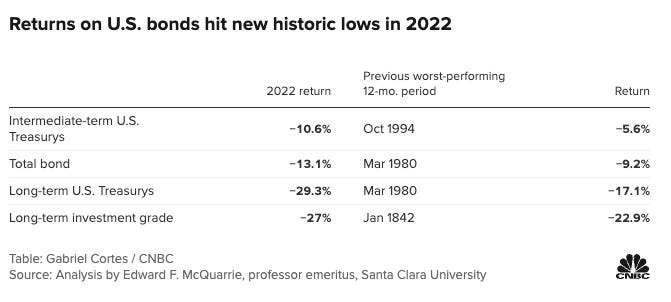

2022 was the year of reckoning for the bond market. Trying to control the raging inflation, the Fed hiked its interest rate at the fastest pace in history and the effects were instantaneous — The Total Bond Index which tracks U.S. investment grade bonds lost more than 13% in 2022 making it the worst year on record going back 250 years.

But the aggressive Fed action has created one of the best buying opportunities for bonds in the past 2 decades. We now have positive real yields (the best we have seen since 20132), and both govt. and corporate bonds offering ~ 5% interest rate (supporting a 4% retirement withdrawal rate), and investment banks now updating bond forecasts higher. The cherry on top is that if the Fed manages to bring inflation back under control and cut rates, bond funds will have a strong comeback.

Given this, it would be the perfect time to get a deep dive into the bond market. This is one of the most in-depth articles that we have ever done and we are adding an index to help you navigate better.

What are bonds, and how do they work?

Open market bond pricing – how do interest rates affect bond prices?

Short-term vs Long-term bonds – Yield Curve 101

Investing in bonds – Individual bonds vs Bond ETFs

Benefits of bonds in your portfolio and historical performance

Best fixed-income opportunities for 2023

Risks of bond investing

Bonds 101

Bonds are a way in which a company or government can borrow the money it needs to fund its projects. When you buy a bond, the issuer agrees to pay you a specific rate of interest over the life of the bond and repay the face value of the bond when it reaches maturity.

Let’s take the example of you buying a $100, 10-year bond with a 10% coupon rate:

On the day of purchase, you have to give $100 to the issuing organization. Over the next 10 years, the bond issuer will give you $10 every year as the coupon payment, and at the end of 10 years, you receive the initial $100 you used to purchase the bond. Bonds are called fixed-income investments due to the fact that you are assured of that $10 payment every year (usually paid semi-annually) unless the issuer goes bankrupt.

Bonds are less risky than stocks due to their place in the order of priority in the corporate capital structure. In the event of a company filing for bankruptcy, bondholders (senior debt) are the first in line to get repaid. A typical example was Lehman Brothers’ bankruptcy, where the bondholders received up to 40% of their investment back whereas equity holders went to zero.

Bond pricing and interest rates

It’s difficult for a retail investor to buy bonds directly from a company. Mostly bonds are bought and sold on the secondary market after they are issued. A bond’s price reflects the value of the income that it provides through coupon payments.

Practically, bond prices are quoted as a percent of the bond’s face value and you can easily make out if a bond is trading for a discount or premium to the par.

When interest rates fall, older bonds that were issued at higher interest rates become more valuable since they have higher coupons compared to the new bonds. Investors holding the older bond can charge a premium while selling the bond in the secondary market. On the other hand, if the interest rates rise, as we saw in 2022, the old bonds become less valuable as now new bonds are being issued at higher coupon rates and older bonds would trade at a discount.

One key mistake that you should avoid is just looking at the current value of bonds in the portfolio. Rising interest rates can actually improve the overall return for the bond portfolio as you can reinvest the coupons and matured bonds in bonds with higher yields improving your long-term returns.

Short-term vs long-term bonds

In general, there are 3 types of bonds:

Short-term — Mature in less than 2 years

Intermediate-term — Mature in 2 to 10 years

Long-term — Mature in over 10 years

As a rule of thumb, the longer your maturity period, the higher the annual yield. The simple logic here is that it’s riskier for you to buy a longer-term bond (the future is uncertain because of all the unknowns, good and bad, that could happen over years of time) and you are rewarded proportionally for taking the larger risk.

For eg., you would get a significantly lower interest rate if you are investing for 1 year vs 20 years as it’s generally riskier to stash away your money for a longer time period. As Nick showed in his excellent analysis, as maturity goes up, inflation-adjusted return also goes up.

But the above chart only holds during normal times – We are currently living through one of those periods where the Yield Curve is inverted. Right now, more and more investors are worried about the short-term economy and are seeking long-term bonds causing the yield to go down. In addition to this, markets are anticipating the Fed to cut the interest rates going forward – so even though the long-term yields seem low now, they are locking in these rates because they might drop in the future.

Individual bonds vs bond ETFs

Certain investors like buying individual bonds from a broker and holding it to maturity whereas others get bond exposure through bond mutual funds or ETFs. There are pros and cons to each approach and it comes down to your personal investment goals, time horizon, and risk tolerance.

Individual bonds are great if you have considerable assets that can offset the slightly higher trading fee, want the comfort of getting a fixed amount semi-annually, and have a predictable market value at maturity barring a default from the company. The downside of individual bonds is that you will usually incur a higher trading fee, initial capital outlay is higher, and they make it much harder to diversify your portfolio.

If you are not a sophisticated investor, sticking to a bond fund is your best bet. Though you have to pay a management fee (aka expense ratio), the minimums are lower to invest, easier to diversify, and mathematically give the same return as holding an individual bond. Considering the fact that the expense ratio is only 0.04% for Vanguard's corporate bond ETFs, it’s not a big price to pay for the convenience and diversification.

One of the best bond ETFs is the Vanguard Total Bond Market ETF. It has an expense ratio of only 0.03% and is currently having a yield of 4.17%. The fund is a good mix of U.S. Govt. treasuries, investment-grade corporate bonds, and mortgage-backed securities.

Impact of bonds on your portfolio

Given the attractive valuation, consistent income and low volatility bonds offer, it might look like an attractive option to add to your portfolio. But before doing that let’s take a look at the common bond portfolios, how adding them to your portfolio will affect its performance, and how they have performed during previous crises. After all, bonds are considered to be one of the best defensive asset classes.

(Reminder: we are offering a 20% discount on our annual subscription)