The Cockroach Portfolio

And a special offer from Market Sentiment

Thank you for reading Market Sentiment and being one of our most engaged readers. As a token of our appreciation, we are sending you one of our paid articles for free.

If you find our work insightful, please consider subscribing and supporting our work. (Lock in a 20% discount on annual subscriptions)

Now, let’s jump right to it:

Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1– Warren Buffett

Let’s start with a thought experiment. You are planning to make a long-term investment (10 years), and you have three options.

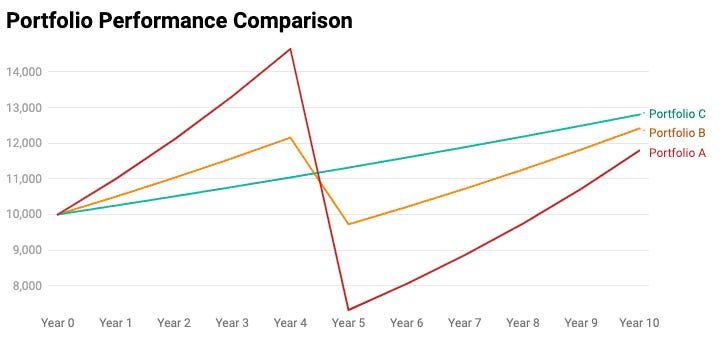

Portfolio A grows 10% every year consistently, but the catch is that once every ten years, it goes through a 50% drawdown. Portfolio B works exactly the same but only returns 5% and has a relatively lower drawdown of 20%. Finally, you have the option of parking your funds in a 10-year term deposit offering 2.5% APY.

The trick here is that most of us tend to allocate more importance to the returns generated by our investments than to their possible downsides. Simple math shows us that a loss of 10 percent necessitates an 11 percent gain to recover. Increase that loss to 25 percent and it takes a 33 percent gain to get back to break even. A 50 percent loss requires a 100 percent gain to get back to where the investment value started. This is why conserving your portfolio is more important than trying for maximum returns.

Returning to our experiment, portfolio A starts off the strongest, generating a yearly 10% return. Portfolio B also outperforms C with a 5% CAGR compared to the pitiful 2.5% return offered by the Term Deposit. But where it gets interesting is once you factor in the drawdown.

After 9 up years and 1 down year, portfolio A would have generated an 18% return (CAGR 1.24%), whereas portfolio B would have generated a 24% return (CAGR 2.18%). But, both of these portfolios would have been beaten by the term deposit offering a CAGR of 2.5% with zero volatility. (In this case, we have assumed the drawdown at year 5. The year the drawdown occurs does not matter for the overall return).

A 50% drop in the stock market is not a once-in-a-century event like the pandemic. The ‘70s bear market, the 2001 tech bubble, and the 2008 Global Financial Crisis all had close to or more than 50% drawdowns for the S&P 500.

While it’s one thing to see these drawdowns on a chart, it is another to have lived through them. Over 15 million people lost their jobs, and close to 6 million American households lost their homes during the 2008 crisis. The stock market lost half its value, and real estate was down 67% from its top. Imagine losing your job, home, and half of your portfolio in two years.

A portfolio for all seasons?

If you break it down, any period of recorded economic history can be categorized into just 4 types.

Most of our portfolios are only designed to work well in periods of growth (stocks perform well) or during periods of deflation (bonds perform well). But what if we experience another stagflation like in the 70s when stocks were down ~50% and bonds were down ~10%, or in the case of Japan where the stock market took more than 30 years to regain the all-time peak it reached back in 1989?

It’s situations like these where the Cockroach Portfolio shines through. It was Dylan Grace who coined the term Cockroach Portfolio in 2012 to highlight its resilience.

“But what I like best about cockroaches isn’t just their physical hardiness, it’s the simple algorithm they use to survive. According to Richard Bookstaber, that algorithm is singularly simple and seemingly suboptimal: it moves in the opposite direction of gusts of wind that might signal an approaching predator.‛ And that’s it. Simple, suboptimal, but spectacularly robust.” — Dylan Grice

While it all sounds good in theory,

How exactly can you build a Cockroach portfolio?

Can the Cockroach portfolio perform irrespective of the macroeconomic conditions?

How can we maximize long-term compounding while having enough assets in the interim for emergencies?

Can it survive outlier events like the Covid crash, The Great Recession, or 70’s stagflation?

Let’s dig in:

The Cockroach Portfolio

The portfolio is simple by design. Almost anyone can create it, and the adjustments required are minimal. It does not try to give market-beating returns – it seeks to survive in all types of economic scenarios:

25% allocation to stocks: When inflation is under control, and the economy is growing, stocks tend to outperform every other instrument.

25% allocation to bonds: The last time the U.S. faced deflation was during The Great Depression in 1929. Investment-grade bonds from treasuries and blue-chip companies perform well during periods of deflation.

25% allocation to cash: For that recession that inevitably occurs, the best thing you can do is hold some cash in your portfolio. Cash also helps to dampen the drawdowns from the rest of the portfolio.

25% allocation to gold: In the unlikely stagflation scenario (where economic growth is low but inflation is very high), gold is the perfect hedge.

When we reviewed the Permanent Portfolio, which had a similar asset allocation, one question that popped up was why the 25% (ie, equal allocation) across the four types of assets. This strategy is what we would call the Jon Snow approach to investing – it’s where you believe you know nothing about what can happen in the future.

When you deviate from equal weighting, you implicitly say you know something about the future market. Say you put 40% into stocks – this shows that you expect stocks to outperform bonds/gold/cash at some point in the future. Avoiding these sorts of predictions is the idea behind the Cockroach Portfolio.

Cockroach Portfolio Performance - Case of Japan

The U.S. stock market has predominantly only gone up, and it creates a considerable bias on how people view stocks as an investment vehicle. Let’s take the extreme example of Japan to show what can happen when it doesn’t. Japan’s Nikkei stock market index hit an all-time high in 1989. What followed was a spectacular market crash that changed the entire psyche of the Japanese market. It took them ten years to bail out the banks from the crash and another 10 to fix the social security reforms. It will take more than 30 years for the stock market to gain back its all-time high once more. This is what deflation can do to the economy. Till a few years back, Japan’s economy was also barely growing at 0.5% and was desperately trying to achieve even a 2% inflation rate.

So let’s take a look into how the Cockroach portfolio performed in the Japanese market:

Over the past 130 years, the Cockroach portfolio has significantly outperformed the traditional 60|40 portfolio (60% stocks, 40% bonds). Clearly, the outperformance was driven by the wartime economic collapse and the nuclear attack (where the stock and bond market evaporated overnight, but the precious metals shot up in value).

If we zoom in on the above chart for the periods after the war, we can observe that the Cockroach portfolio underperformed during the productivity boom from 1950 to 1970 but then recovered and almost beat the 60|40 after the stock market crash and the demographic decline.

The U.S. Story

Coming back home, the Cockroach Portfolio has performed as expected in the U.S., coming in just behind the 60|40 portfolio and the S&P 500 in terms of overall returns.

But raw returns tell us only half the story. The cockroach portfolio had considerably lower drawdowns and market correlation when compared to the other two. Where it really shines through is when we are going through market stress periods.

During the dotcom crash, the S&P 500 was down 45% and 60|40 was down ~20%, but the Cockroach portfolio was only down 5%! Similar trends can be observed through the Covid Crisis and Black Monday. This is the portfolio you need if you cannot stomach market churns and want to sleep well through all the ups and downs in the market.

Stability through volatility

The cockroach portfolio does not aim to create market-beating returns - it just seeks to survive. We believe that this survival aspect is key to three different types of investors.

Absolute beginners - We highlighted the importance of getting the right start in investing a few months back. Depending on when you started in the market (say 2006 vs 2012), your experience would have been the polar opposite after the first few years. Starting off with a Cockroach portfolio will enable you to avoid massive drawdowns and once you have a hang of the market, you can tweak the proportions to your liking. As Morgan Housel would say,

Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.

Nearing retirement – Once you are near your retirement, it becomes more important to conserve your capital rather than going for that extra 1 to 2% edge in the market. As we showcased with the stress testing, the Cockroach portfolio is able to survive almost everything the market can throw at it.

Set it & forget it – If you are someone who does not want to be bothered by what’s happening on the market, and you want to create one portfolio and then forget about it for the considerable future, this is probably your best option. We have created a sample portfolio based on the U.S. Large caps and Treasury bills that you can play around with to find something that fits your risk profile.

The beauty of the Cockroach portfolio is that it expects no insights from the investor. Consider what we discussed in the case of Japan. Just in the last century, Japan had:

Regime changes from liberal to imperial to militaristic

Lost World War 2 and was bombed with nuclear weapons

Experienced rapid industrialization and a productivity boom

Historic asset bubble burst of 1990

Finally, they are now going through a demographic decline

Nobody could have predicted more than 1 or 2 of these let alone time it perfectly. But, during all this, the “dumb” portfolio made by equal allocation between stocks, bonds, cash, and gold managed to beat out almost every other strategy.

The race is not given to the swift or to the strong but to the one who endures to the end.

Market Sentiment is now fully reader-supported. A lot of work goes into these articles, and if you enjoyed this piece, please consider upgrading your subscription. This will give you access to

4 reports like these every month

Curated ideas with actionable takeaways every week

Quick reports on subscriber-only chat

The comments section with active participation from our side

It’s only $180 per year or $19 per month. Thank you!

It’s often said that you get the customers you deserve. If that’s true, we consider the quality of our readers to be the best compliment we could hope for!

Thanks for all the support and see you on the other side :)