While much has been written about the dot-com bubble and its aftermath, one key insight most investors miss is how well the international markets performed during the same period. Due to the extreme concentration of tech companies in the U.S., international markets escaped relatively unscathed from the dot-com bubble.

The same occurred once again during the Global Financial Crisis. While it was called “global,” it only significantly affected the U.S. and a few other European markets. Emerging markets that had low exposure to the U.S. financial markets chugged along just fine.

All in all, the 2000s were pretty much a lost decade for the U.S.

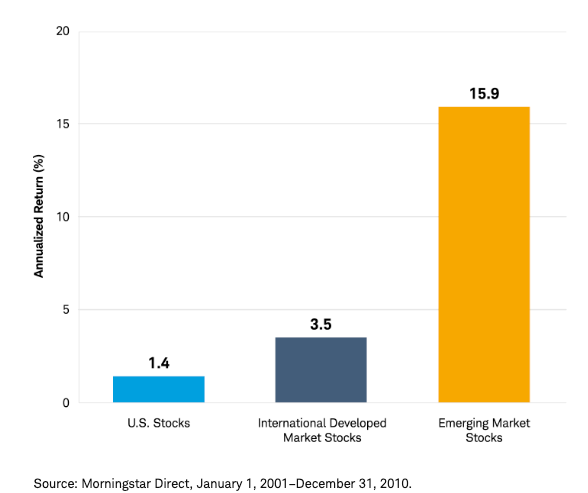

During the ten-year period from 2001 through 2010, the S&P 500 only generated an annualized return of 1.4%. Now, compare this to the 3.5% return by other developed markets and a whopping 15.9% by emerging markets, and you realize the importance of international diversification.

So, why are we again beating the “dead horse” of international markets, especially since we wrote about U.S. exceptionalism a few weeks back?

There are decades where nothing happens; and there are weeks where decades happen. — Vladimir Ilyich Lenin

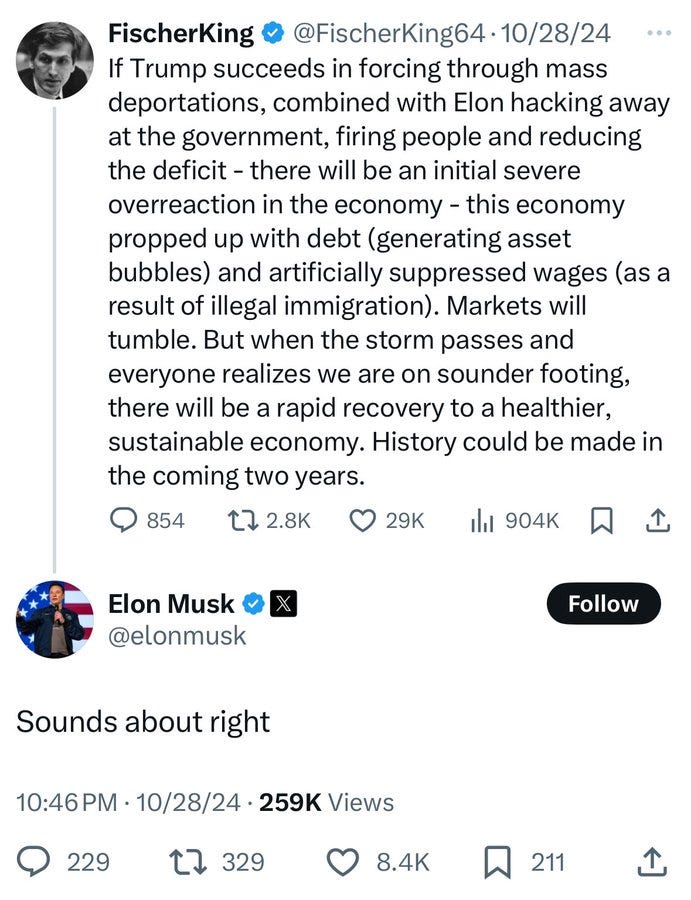

It’s because so much has changed in the past few weeks — every week there are decades’ worth of policy decisions being pushed through, and it looks like the Trump administration might be orchestrating an economic slowdown.

Recessions lower inflation in the same way dying lowers your blood pressure —

While we are among the last people to strategize based on short-term news, here is a rundown of what happened in just the past few weeks that should set the alarm bells ringing if you are an investor:

GDP projections have collapsed: Atlanta Fed was projecting 3.9% GDP growth for Q1 2025 at the start of February. By mid-Feb, they revised it to 1.5% and last week they updated their forecast to -2.8%. While they have again updated it to +0.5% (adjusting for the gold imports), wild swings of this type are unheard of in GDP projections.

Consumer sentiment is not doing great: Consumers are feeling the pinch as inflation expectations rose from 3.2% in January to 3.5% in February — the largest spike since the early pandemic inflation surge.

Massive federal job cuts: Just as the consumer sentiment and GDP projections are dropping, over 250,000 federal employees have been removed from their jobs. This has massive second-order effects that are hard to measure immediately. Based on rough projections, the total layoffs, adding the removed contractors, would be close to 1 million employees.

Tariffs: It’s a pretty good bet to say that only one person inside the White House knows what the exact tariff is going to be tomorrow. Trump is looking to add a 25% tax on Mexican and Canadian imports and 20% on Chinese imports. To put this in context, more than 40% of all U.S. imports come from these countries. If implemented, this will worsen the already dropping consumer sentiment.

Alienated allies: Finally, of all the things we've just discussed, this will have the biggest impact. Trump has already pulled back on Ukraine support and is now suggesting that the U.S. might abandon the NATO alliance. The U.S. dollar remains the world's reserve currency due to the strength of U.S. financial markets and the goodwill of other developed nations. Right now, it feels like we are on a speedrun toward burning all the goodwill we gained after World War II. Losing reserve currency status would be a devastating blow to the economy, with consequences lasting for decades, as the U.S. would immediately lose the ability to print money at will.

Markets have already started pricing in these changes: