The Best of Market Sentiment 2024

Our most popular articles and personal favorites of 2024

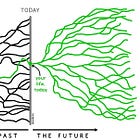

As we wrap up 2024, we wanted to say a heartfelt thanks to all of you for reading, sharing, and supporting our work. Your comments, shares, and emails have not only kept us going but have made this whole thing fun. We truly believe the best is yet to come.

We published 60+ articles this year, which were read more than 2 million times 🤯, and we wanted to pick a few that we enjoyed writing and resonated with you.

Alpha Ideas

If the market benchmark (S&P 500) is based on “buy the biggest companies that are profitable”, shouldn’t we be able to do better by just going one or two steps deeper?

Buying and holding the index is the bare minimum.

We wrote a 9,000-word guide on how long-term investors can generate alpha. It covers factor investing, family-owned stocks, power of brands, Lindy effect, and much more.$10,000 invested in QQQ (Nasdaq-100) in 2010 would have grown to $120K (12x return)

$10,000 invested in TQQQ (Triple leveraged Nasdaq-100) in 2010 would now be worth $2.1 Million (210x return)59% of crypto investors use Dollar Cost Averaging as their primary investing strategy.

But, unlike stocks, crypto markets are relatively new, with limited data on long-term DCA strategy performance.

Here's your complete guide to building a crypto DCA:One of Buffett's key advantages wasn't just good capital allocation, but also the unique structure of his investment vehicle – Berkshire Hathaway.

We dug into the research and had a chat with an expert who spent 2 decades of his life identifying the best holding companies across the world and constructing a portfolio.Alternative Thinking | Thought Experiments

There are 11 cards face down on a table. 10 are double cards, and 1 is the devil card.

You start with $1 million, and then you have to choose the cards one by one (without replacement).

As the name suggests, you double your money if you pick a double card. But, if you pick the devil card, your money gets divided by 2048 (i.e., you lose 99.95%).

You are free to stop picking cards anytime and walk away with whatever money you have at that point.

How will you play this game? And when will you walk away?You always hear about the guy who made $100K by betting $100.

You never hear about those who risked thousands and are left with nothing.

Out of 40,000+ crypto coins analyzed over the past 10 years, only 1.7% delivered a 100x return! $1,000 invested in "excellent" stocks every year since 1972 appreciated to $502K by the end of 2013.

But, the same invested in "un-excellent" stocks grew to $1.6 million!Asset allocation contributes more than 100% of your total portfolio return.

It’s also the only factor that you have full control over as an investor.

Why asset allocation is the only thing that matters:What if you did nothing?

What if we picked the S&P 500’s holdings as of 1993, invested in those stocks, and left the portfolio alone for 30 years?Our take on the most common investor questions:

In investing, we rarely choose the optimal solution.

Here's why you shouldn’t you just put all your investments into an index fund and then call it a day.If Buffett trims stocks that he thinks are over-valued and since data shows over-valued stocks had lower returns than the market...The S&P 500 performance in the last decade was driven by strong earnings growth and richening valuations.

In all realistic scenarios, for a repeat of the last decade's performance, the company valuations have to rise higher than even the tech bubble peak:Do elections affect the stock market?

We have created the most comprehensive guide on what you should do, drawn from over 100 years of data.The biggest stocks get the most attention, but rarely do they live up to the hype.Retirement Planning

How to live to 100 and not go bankrupt: For an investor who retired on Jan 1st 1966, the real return of the S&P 500 was zero for the next 17 years! Simple Portfolio Series

In this 5-part series, we focused on finding and evaluating the performance of some of the best portfolios on the planet: Meta

If you invested equally in all YC companies on their IPO day, you would now be down 49% compared to the +58% return of the S&P 500!

14 of the 17 companies lost money for the investor, and 3 companies lost more than 99% of their IPO value.Buffett warns that the market is becoming "casino-like."

0DTE options popularity has exploded after Covid.

“Investors” are buying literal images of rocks for over $100K.

Why is everyone betting on everything? Thank you for reading and being a continued supporter of Market Sentiment.

Hit reply to this e-mail to let us know what you think or if you have any suggestions.

Happy New Year!

Great summary, keep up the good work!