Friends,

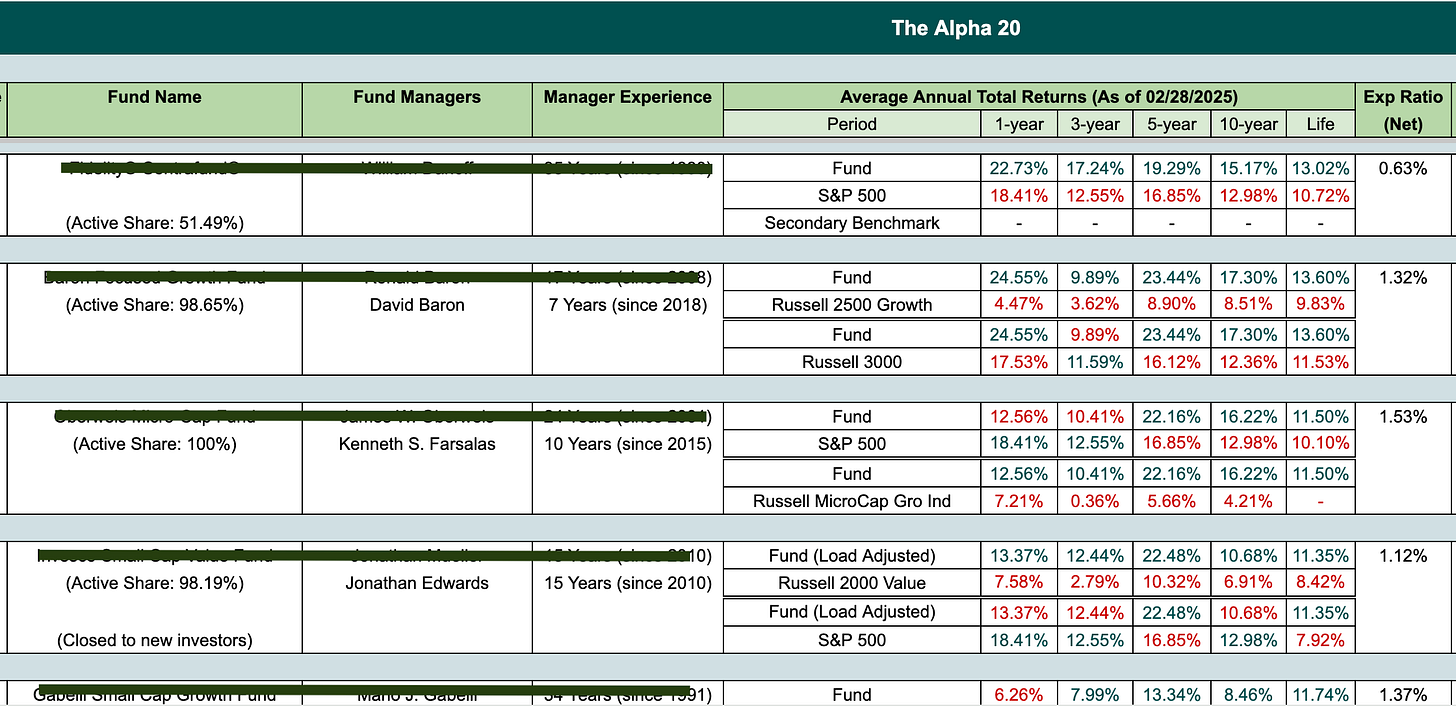

We are thrilled to introduce The Alpha 20, a database of the 20 highest-performing active managers and their funds. It’s the product of hundreds of hours of research combing through 6,000+ mutual funds and ETFs.

The Alpha 20 is a benefit only for premium subscribers. If you are not a member yet, consider joining by following the link below.

While index funds are all the rage now, when you dig into the numbers, the total Asset Under Management is almost equally split between active and passive. So, if you have an equity-heavy portfolio, chances are that you have some exposure to active managers. With more than $13 trillion invested with active managers, we started with a simple question:

How can we ensure that Market Sentiment readers are aware of the best-performing active managers who have beaten the market for decades?

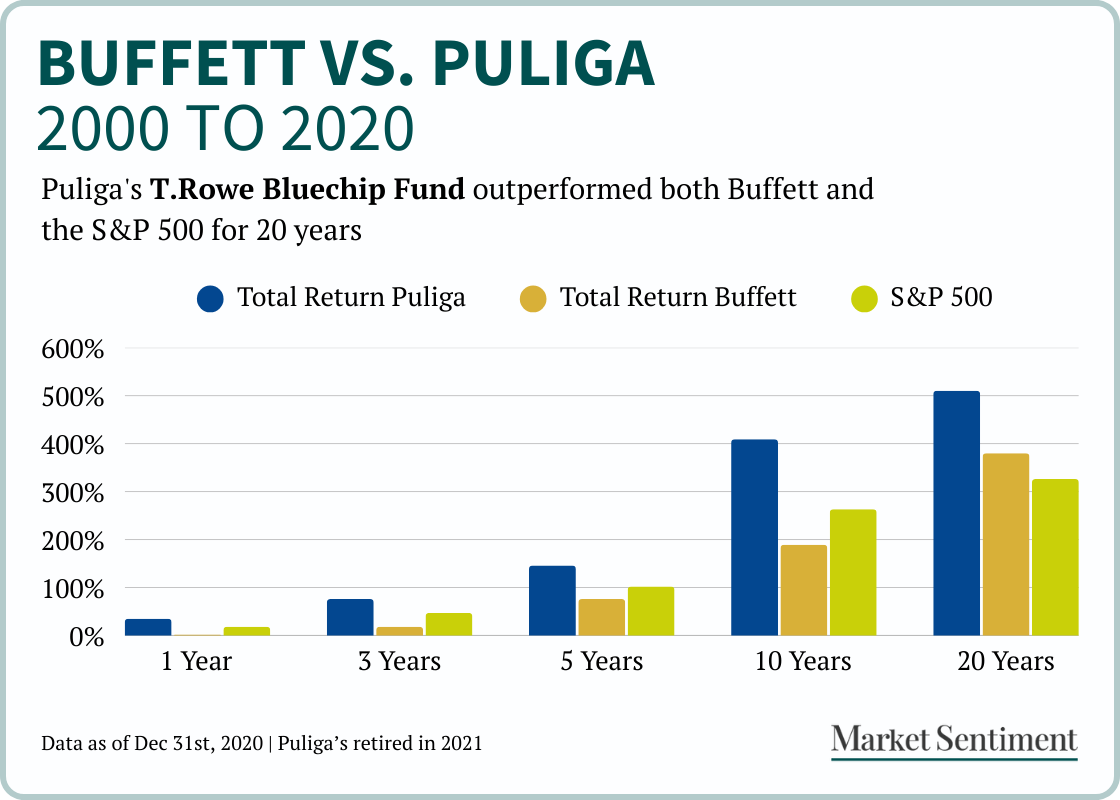

Case in point: While everyone knows about Buffett and Berkshire, virtually no one knows about Larry Puliga. Puliga launched the T. Rowe Bluechip fund in 1993, and by the time he retired in 2021, he had grown the fund to $102 billion in AUM. While the longevity in itself is very impressive (large growth funds have a 70% failure rate over a 20-year period), what is stunning is that he managed to beat the S&P 500 over 28 years.

His fund returned 12.2% during his tenure (After fees) compared to 10.5% for the S&P 500. While the difference might seem small, a $100 monthly investment in his fund since its inception would have grown to $284K compared to only $202K in the S&P 500 — a 41% higher portfolio.

If you are still not impressed, Puliga also managed to beat the “Oracle of Omaha” in the last 20 years running up to his retirement.

While it’s well established that past fund performance is not predictive of future performance, if a manager has outperformed for a sufficiently long time, it deserves a closer attention. Especially, when all existing research focus on the fund performance and not the manager.

Just analyzing fund returns could mean missing the forest for the trees. Here’s what happened with the famous Magellan Fund:

Peter Lynch became one of the world's most famous investors by beating the S&P 500 index by an incredible 150% from 1980 to 1990 as the fund manager for Fidelity Magellan. During the 13 years Lynch managed the fund, it averaged 29% annual return and made Magellan the best-performing mutual fund in the world.

After Lynch retired in 1990, the next two managers were only barely able to beat the market. Jeffrey Vinik, who managed the fund from ‘92 to ‘96, ended up taking a conservative approach and moving the majority of the portfolio to bonds just before the dot-com bubble started. His move was so ill-timed that investors fled, forcing Fidelity to change course.

The next manager, Robert Stansky, did not fare better. His strategy of closely mirroring the S&P 500 led to a decade of underperformance. None of the managers after Peter Lynch was able to replicate his performance, and by the end of the 2000s, Magellan was a shadow of its former self.

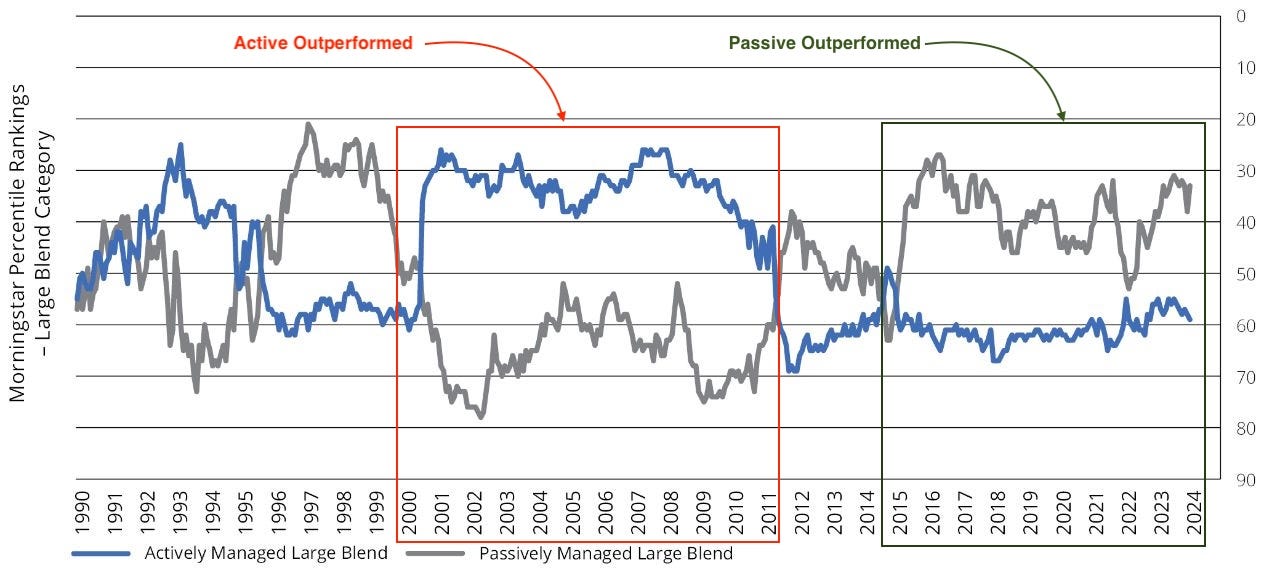

While passive has outperformed active funds for eight consecutive years leading up to 2022, if you look at the past 35 years’ data, it’s almost an equal split (Active 17 times, Passive 18 times).

Active managers tend to perform better during corrections and market stress, while passive strategies excel when business is as usual.

We are in anything but a 'business as usual' situation.

What you can expect

By joining as a member and unlocking the Alpha 20 list, here’s what you can expect:

An incredible list: A curated list of twenty high-potential active managers and their funds who have beaten the market for decades.

Quick overview: Of the investment strategy, fund manager specialty, and long-term track record.

Fund-specific details: Active share, expense ratio, AUM, Sharpe Ratio, Beta, and more.

Here’s a hint of what it looks like:

Join us now to unlock the entire database: