The irony in finance is that windfalls make great headlines, but such occurrences are rare. The probability of you winning the lottery or signing a multi-million contract is lower than one in four thousand. Contrast this with the latest census, and there is a 1 in 11 chance that an adult in the U.S. has a net worth of $1M or more. In their excellent book the millionaire next door, Dr. Thomas & Dr. William argues that there are two types of people — PAWs and UAWs. PAWs are "Prodigious Accumulators of Wealth" who are typically frugal, live below their means, and invest religiously whereas UAWs are "Under Accumulators of Wealth" who may have high-income levels but also have high levels of spending and debt. The book goes on to give us excellent tips on how one can shift from a UAW to PAW.

But, what it misses out on is that most millionaires become millionaires by investing judiciously and not just through income. Many of our readers were curious about the investing habits of the wealthy and it was the most requested topic in our recent poll. Thankfully, recent reports from Vanguard, KKR, and Bank of America give us interesting insights into the portfolio composition of millionaires. By following their strategies, we can learn from their successes while also avoiding pitfalls that they have made.

Portfolio Allocation

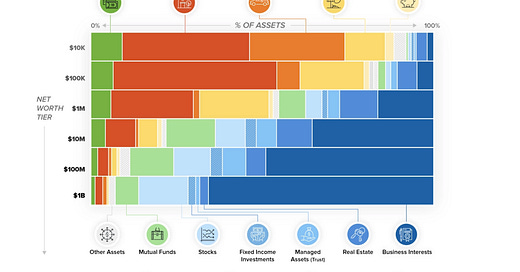

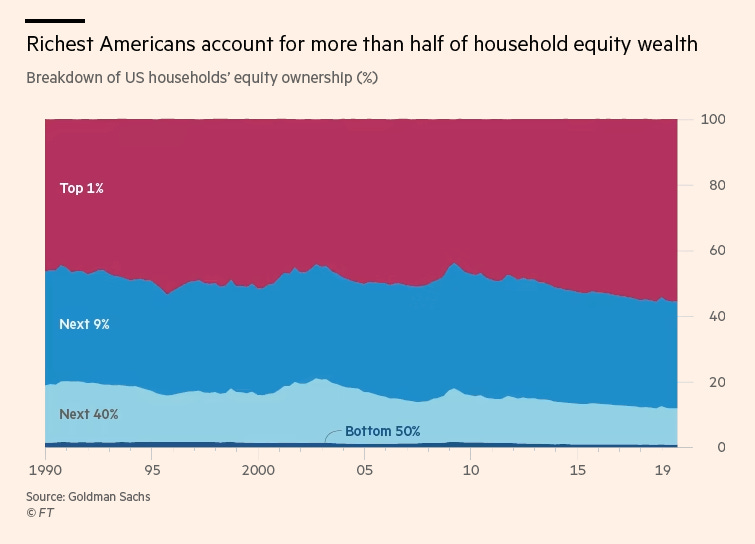

Before we get into the minutiae, here is an incredible stat — The richest 1% of Americans own more stocks than the other 99%. At the beginning of the ’90s, the top 1% owned 46% of all U.S equities and by 2020, it hit a record 56 percent.

The biggest difference between the average investor and the top 1% is how much of their portfolio is allocated to stocks. The bottom 50% of the households have only 4% invested in equities compared to an incredible 61% for the top 1%.

For the bottom 50%, this is not surprising since buying a family home is a critical foundation and is the first step towards building wealth. But the problem is that Real estate only had a 0.6% return over inflation in the last 130 years. Compare this to equity which had a 6.63% real return, and you see why being in the market is important. (It’s hard to comprehend the return difference just using CAGR. To put it in perspective, from 1890-2022 the U.S. housing market is up a total of just 122% compared to an inflation-adjusted S&P 500 return of about 515,782.66%)

While housing is a great first step towards generational wealth building, to grow your wealth faster, investing in equities is a must. So,

How do millionaires invest in equities?

Vanguard published the How America Invests report in 2020 that gave us detailed insights into how more than 800,000+ retail investors with an account balance of $500,000 or more invest (the median balance in their study was $1 million). We also got hold of this report from KKR that gives us a behind-the-curtains look into how Ultra High Net Worth Individuals (UHNW, > $30 million in assets) invest.

For those in a hurry, let’s take look at the key findings and then drill down deep into each one.

Affluent Retail Investors (median balance of $1M)

Long-term risk orientation — Affluent investors on average had 64% equities, 23% bonds, and 13% cash in their portfolio. Most of these were long-term investors and on average, a typical household traded just 8% of its assets.

Home bias — Though the U.S. stock market only constitutes about 50% of the global market, affluent retail investors had 82% of their investments in the U.S. Market.

Active funds are still popular — Surprisingly, despite all the negative press for active funds, 83% of investors had some exposure to active funds. A total of 43% of the funds were invested with active fund managers.

Diversification matters — Investors who have exposure to individual securities are well diversified and only have an average allocation of 5% to individual securities.

No panic selling — During the 2020 Covid crisis, only 1% of affluent households completely abandoned equities and on average the equity allocation dropped only 3% (from 64% to 61%)

Ultra High Net Worth (balance > $30M)

Dramatically different asset allocation — Compared to affluent investors, UHNWs have a very different portfolio allocation. They only have 29% investment in equities (compared to 64% for the affluent) and a whopping 46% allocation to alternatives (private equity and hedge funds). Cash allocation and Fixed Income allocation remain comparable at 10% and 15% respectively.

Capital Conservation > Appreciation — UHNWs focused on having lower portfolio volatility when compared to affluent investors. On average their portfolio volatility was only ~7% when compared to the 15% volatility of the S&P 500.

But blindly following these strategies will not get you optimal results. Each one has its own merits and demerits that require in-depth analysis. Let’s dig in: