Simple Portfolio #1: 3 Fund Portfolio

Complexity sells, but simplicity wins.

Welcome to the Simple Portfolio series by Market Sentiment. In this exclusive 5-part series, we are focused on finding and evaluating the performance of some of the best portfolios on the planet — but the best doesn’t have to be complicated.

We often equate complexity with superiority, especially when it comes to investing. Jargon-filled explanations can leave us confused but impressed, leading us to trust the 'expert' without fully understanding their ideas.

Since this type of selling complexity is exceedingly common in investing, we have decided to put together 5 simple portfolios that can serve as the foundation for successful long-term investing. These portfolios are designed to be easy to understand, build, and maintain, allowing you to set them on autopilot for decades.

So, without further ado, let's jump in:

Does the Three-Fund portfolio seem overly simplistic, even amateurish? Get over it. Over the next few decades, the overwhelming majority of all professional investors will not be able to beat it. - Bill Bernstein, author of The Four Pillars of Investing

In the early 20th century, the paper clip was a complex and often frustrating tool. There were dozens of different designs, each with its own quirks and flaws. Some clips were too weak and would bend easily, while others were too strong and would damage the paper they were holding. Some clips were too difficult to insert and remove from the paper, while others were too easy to accidentally dislodge.

In 1901, a Norwegian engineer named Johan Vaaler decided to simplify the design of the paper clip. He came up with a design that was simple, elegant, and efficient. His clip was made from a single piece of wire, bent into a loop with two long, straight ends. The wire was strong enough to hold the paper securely but flexible enough to be easily inserted and removed.

Vaaler's design quickly became popular and is still used today, more than 90 years later. Despite numerous attempts to improve upon it, no one has been able to create a better design for a simple, effective paper clip. Similarly, in investing, what is complicated is rarely the right approach.

Successful investing comes down to just three core principles: diversification, low costs, and discipline. By investing in a diversified portfolio of low-cost index funds and sticking to a long time horizon, individual investors can achieve excellent long-term returns without taking on unnecessary risk.

The 3-fund portfolio is one of the best examples of asset allocation that meets all the criteria for successful long-term investing.

What is the 3-fund portfolio?

At its core, the 3-fund portfolio is built using just three market index funds –

Total U.S. Stock Market

Total International Stock Market

Total Bond Market

While we don’t have to tell you the importance of having U.S. stocks in your portfolio, it’s crucial to understand why the 3-fund portfolio has exposure to the international stock market and the bond market.

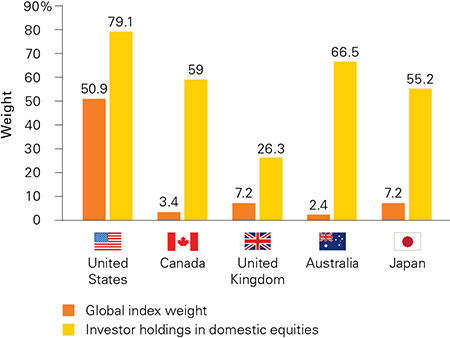

Avoiding the home country bias with international stocks

When it comes to investing, investors are very reliant on the market in their home country. Investors irrationally expect higher returns in their domestic market compared to other markets. The U.S. stock market only constitutes about 50% of the global market but on average U.S. investors allocate 80% of their portfolio to U.S. companies. The proportion is even more skewed in the case of smaller countries such as Canada and Australia. Canadians allocate ~60% of their portfolio to the Canadian market while it only constitutes 3% of the global market.

The U.S. stocks have performed phenomenally well in the last decade but that does not mean it’s going to last forever. Since 1975, the outperformance cycle for the US versus international stocks has lasted an average of 7.8 years. Currently, we are in a place where the local stocks are outperforming the international ones. The tide can and will turn some day.

Cushioning the inevitable downturn with bonds

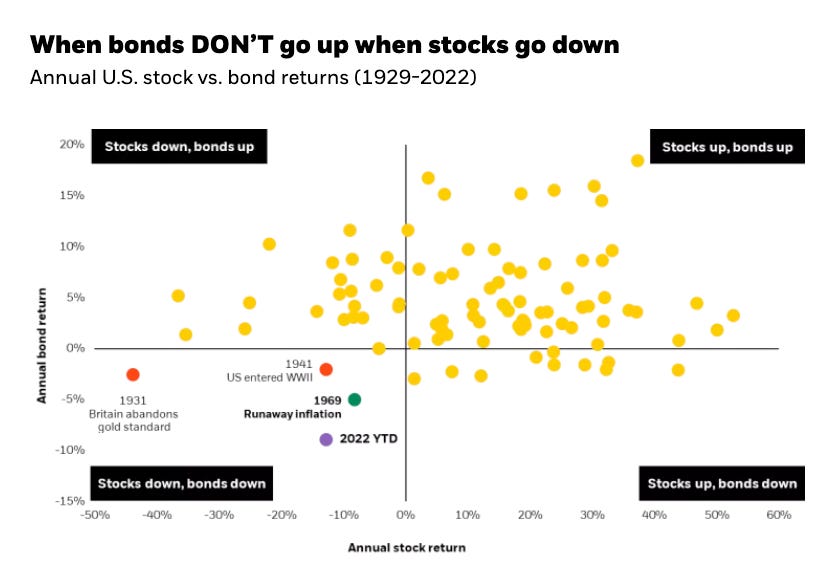

Over the past 90 years, stocks and bonds have been down together only four times. Even though bonds cannot match stock market returns, their steady and predictable cash flow is a huge boon during stock market downturns.

For example, during the Subprime crisis of 2007, if you had 100% stocks, your portfolio would have been down by a harrowing 51%, whereas if you had a 60/40 portfolio, you would have only been down by 26%.

Now that you have a flavor of why international diversification and bonds are important, let’s dig into how to build the 3-fund portfolio, what proportions each segment should have, and how the 3-fund portfolio has performed over the last 4 decades:

Building the 3-fund portfolio

The beauty of the 3-fund portfolio lies in how simple it is to build – and it works even if your portfolio is $10K or $10M just as effectively. The most well-established 3-fund portfolio is built using:

Vanguard Total Stock Market Index Fund (VTSAX)

Vanguard Total International Stock Index Fund (VTIAX)

Vanguard Total Bond Market Fund (VBTLX)

Just by using these 3 funds, you will have exposure to more than 12,000 stocks from all across the world and 10,000+ bonds while having an overall expense ratio < 0.1%. Now go back and look at your current portfolio and see if you are anywhere this diversified.

The key question here is how much to allocate to each fund – While there is no one right approach, and the allocations are mostly dependent on your risk profile, the most popular distribution is 50% to the U.S. stock market, 30% to the international markets and 20% to the bond market.

As expected, just putting 100% of your portfolio in the U.S. stock market got the best return over the last 4 decades. But, as we discussed in the beginning, this comes with hindsight bias and a 100% stock portfolio has higher volatility and greater drawdown during crashes.

The classic 50|30|20 3-fund portfolio gave excellent returns while having lower volatility than the S&P 500. If you are closer to retirement, you can skew all the way to the other side, keeping 80% of your funds in a bond, and your max drawdown will be 1/3rd that of the stock-heavy portfolios.

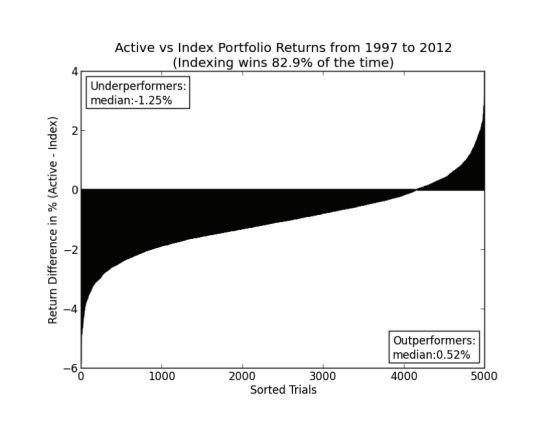

To put the performance of the 3-fund portfolio into perspective, let’s take a look at the study conducted by Rick Ferri in 2013. The simple 3-fund portfolio beat ~83% of 5,000 randomly selected, comparable, actively-managed funds during a 16-year window.

Endowment funds are famous for only investing in the best money managers. They have access to both public and private markets, the best analysts, million-dollar data streams, and funds reserved for those who cut multi-million dollar checks. Yet, the average return on the three-fund portfolio was much higher than the average endowment return.

3-fund portfolio variations

As a team that does optimizations for a living, we could not end this without highlighting the various ways in which you could improve upon the 3-fund portfolio. You could add some alpha/diversification by allocating some portion of your portfolio to

Small Cap Value Index

FTSE Emerging Market Index

International Bond Market Index

Real Estate Index

The real beauty of the 3-fund portfolio lies in how simple it is to build and by just putting in 15 minutes of effort every year, you can beat the vast majority of active funds and fund managers employing complicated strategies.

As DaVinci would say, simplicity is the ultimate sophistication.

There may be better investment strategies than owning just three broad-based index funds but the number of strategies that are worse is infinite - John Bogle

Thank you for reading Market Sentiment.

If you are a free subscriber, you will only receive this report. To get the next 4 reports diving into other portfolios, please upgrade your subscription ($25/month or $180 per year)

Good thoughts and analysis. Though I do disagree a bit.

You can see how US stocks started outperforming International stocks right after 2009 and the GFC. That's when the US realized we can just print money to "fix" any bad market situation that arises. Since 2009 we've seen and used that playbook many times. That playbook is unlikely to stop, in fact, it's likely to accelerate exponentially over time. That likely means the US market will be the best place to invest unless that stops.

As for bonds, they had periods of great bull markets because of how much we manipulated interest rates over time. It's safe to say we'll never see 10% or 20% interest rates again, and we're probably unlikely to see 0.25% interest rates again. Bonds will likely just fizzle sideways over time and the foreseeable future so long as that's true.

Thanks for the analysis though!

Annual Subscription of 180 Dollars is too high as far as Small Indian Investors are concerned.