Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 46,000 other investors to make sure you don’t miss our next briefing.

As Trump takes a wrecking ball to the global trade, investors are struggling to make sense of the long-term fallout. While we have written about how the implementation of tariffs can lead to stagflation, the dominant narrative is that U.S. exceptionalism is alive and well, and long-term investors should stay the course.

But long-term returns are a tricky promise if you are close to or already in retirement.

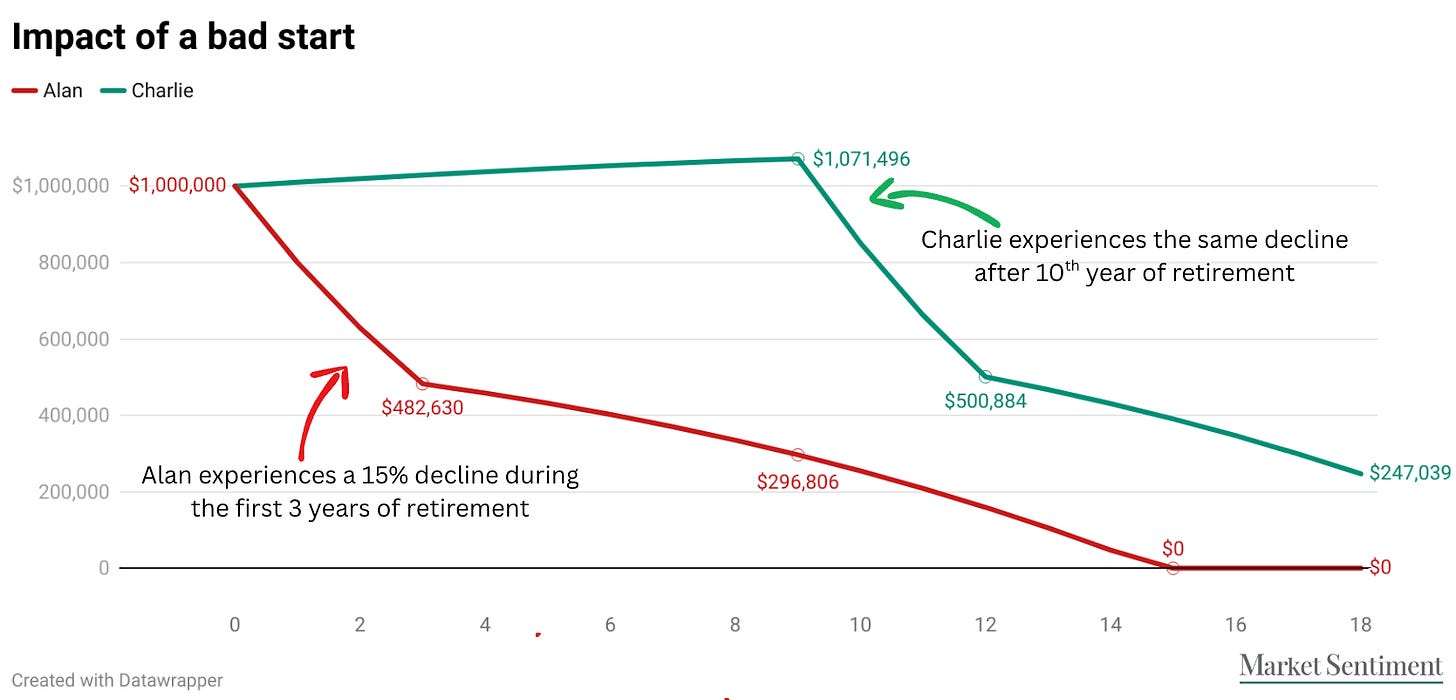

Consider the example of two retirees, Alan and Charlie. They both started with a $1M portfolio and took an initial withdrawal of $ 50K. They will then increase their withdrawal by 2% every year to account for inflation. Both of them get an annualized long-term return of 6% from their investments.

Alan was unfortunate1 — in the first 3 years of his retirement, the portfolio value dropped by 15% each year2. Whereas for Charlie, the drop only occurred after his 10th year in retirement.

While the overall long-run returns remain the same for both of them, the sequence by which the returns came had a significant impact.

Alan was never able to recover from the initial drawdown and ran out of money in his 15th year of retirement, whereas Charlie was still going strong in his 18th year.

This is the sequence of return risk — when you earn your investment returns matters just as much as how much you earn. The order of returns can have a dramatic impact on how long your retirement savings will last or how much you can withdraw.

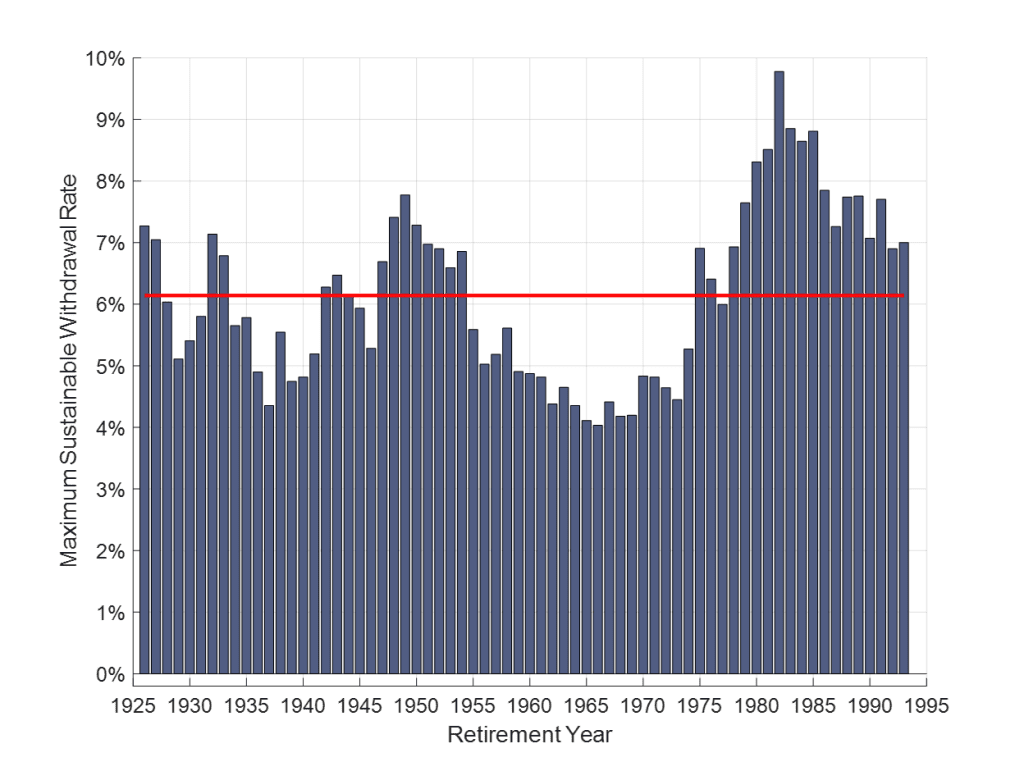

Sequence risks have real-life impacts. For someone who retired in 1966, the sustainable withdrawal rate was only 4% (due to the high inflation and stagnant stock market). Whereas, if the same person had retired in 1982, he/she could have sustainably withdrawn 10% due to the exceptionally high yield and strong stock market returns!

For retirees, the most important question is: how much can I safely withdraw from my portfolio? And in today's market environment, that question has never been more urgent, so let’s dig into:

Safe Withdrawal Rate

Does the 4% rule still hold in 2025?

Was the U.S. an outlier?

The factor all models miss

Managing the sequence of return risk

Cash reserve strategy

Bucketing Strategy

Variable withdrawal strategy

Greatest risk for retirees