Hello friends! Welcome to Market Sentiment. Join 13,806 other smart investors and traders by subscribing here:

This issue of Market Sentiment is brought to you by… Composer

Repeat after me: “I’m better than a Robo-advisor.”

You don’t read Market Sentiment every week to let a robot manage all your money, do you?

But picking stocks is a risky game: ~30% of all Russell 3000 stocks are down 40% or worse from their 12-month highs. So how do you invest your money to take advantage of volatility? You set up rules-based investing to capitalize on market fluctuations.

With Composer, you can easily build systematic-trading strategies with their no-code portfolio visualizer.

Take their “Buy the Dips Nasdaq” template and customize it to only buy the top ten holdings if they were up over 30% last quarter and rebalance every two weeks.

With Composer you can edit, click, drag, drop and quickly backtest strategies from their library or yours in a snap. No code, messy spreadsheets, or Terminal required.

And it's 100% free for Market Sentiment subscribers.

In case you are not familiar with Russian Roulette, it’s a game where a player places a single round in a revolver, spins the cylinder, places the muzzle against his head, and then pulls the trigger1. If he doesn’t die, he passes the gun to his opponent and gets an insane payout.

Well, in one of the backtesting analyses I did covering the most famous investment strategies, one user in wallstreetbets commented that he wants to be rich tomorrow and not 20 years down the line. My guess is he might be a bit too concerned about his long-term prospects given the current climate.

But, it did make sense. What if you do want to become rich tomorrow and are willing to risk it all today for that massive payout? What are the best strategies out there for that? What if you want to play the financial Russian Roulette?

Usually, I keep my disclaimers in the footnote, but for this article, I think it’s pretty important to know that none of this is financial advice. Just consider this as a thought experiment for the various ways in which you can lose money. I am 100% sure that 99.9% of you reading this would be much much better off just investing in a low-cost index fund.

With that out of the way, let’s get started. We will be ordering this from the least risky (relative to the list) to the riskiest options.

1. Investing with Leverage

“If you’re smart you don’t need leverage; if you’re dumb, it will ruin you.” - Warren Buffet

You know the list is going to be lit when the least risky option is leverage. Investing with leverage is simple. You borrow money to invest. Let’s deep dive a bit into how leverage works given that some of the other types of investments in this list are also in a way a variation of leverage.

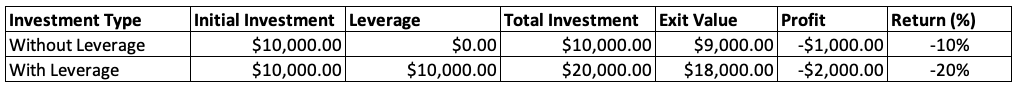

Let’s say that you had $10K in your brokerage account. You have a high conviction stock that you think is going to have a very good return in the next year and want to invest more than $10K in the said equity. You can take another $10K as a loan from your brokerage staking your entire position as collateral.

Assume the stock goes up 10% over the next month and you exit the position:

This is the magic of leverage. You used a 2:1 leverage on your investment and doubled your return. (It won’t exactly be double as you have to pay some amount as interest for the money lent to you. I have ignored the costs for ease of understanding)

Why leverage is known as a double-edged sword is because of what happens when the stock price tanks. Let’s assume that the stock went down 10% and you had to exit the position.

The 2:1 leverage would literally double your losses since your exposure to the stock was double that of your initial available capital. Imagine a scenario where the company you invested in files for bankruptcy. Then you would lose the 10K investment you made and still owe another 10K to your broker making it a 200% loss on your investment.2 If you are one of those who use credit card debt to get the leverage to invest in the market, all I have to say is

(I did a detailed analysis of the rewards and perils of leverage in one of my past articles. You can check it out here.)

2. SPACs / Penny stocks /Altcoins

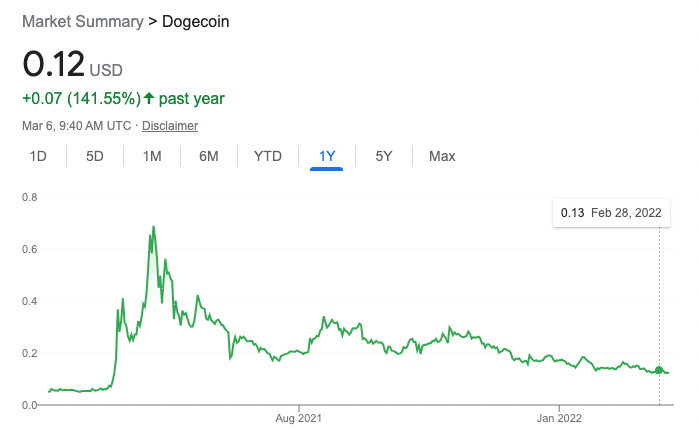

I have combined all of these into one bucket since they can be considered as the Wild West of the stock and crypto market. All of these usually get very low volume in daily trading, less regulatory oversight, and are extremely prone to pump and dump schemes and rug pulls.

But the fact that they are small is what makes them attractive. You cannot 10x your investment putting it into a blue-chip company such as Apple since the company is too big to make big moves in a short period of time. But this limitation is not applicable for smaller companies or coins. For example, Dogecoin grew 10x in less than a month and the SPAC company Virgin Galatic returned 5x investment in less than a year! (The losses are also proportional when things go south). If you can do adequate research and also stomach the extreme swings, these would be the perfect investments for you.

3. Venture Capital

Have you ever wondered how cool it would be if you could have got on the ground floor of companies such as Tesla, Facebook, Google, etc? - In most situations, by the time these companies IPO, they have already become pretty well established, and the growth prospects are substantially lower.3

Well, you can do it with Venture Capital. Granted, the barrier to entry is pretty steep with deep pockets and great networks required to get a foot in the door. Also, the insane returns come with insane risks. For every Google out there, there are hundreds of companies that went bankrupt. According to CBS, up to 95% of startups fail within the first 18 months! That means out of the 20 investments you make, 19 would go to zero and the other one should become big enough to compensate for all your other losses.

4. Art / NFTs / Collectibles

We have all heard stories of someone finding an old painting/Pokemon card in their basement only to have it evaluated to fetch millions of dollars. Well, there are investors who try to land these types of deals.

You can buy paintings from obscure painters for a bargain and hope that they get popular down the line, or invest in the exclusive watches that might probably appreciate in value, or even dip your toes into NFT land where the timelines are even more compressed. To give you an example of the absurdity, the below NFT was sold for more than $23 Million and there are 10,000 similarly designed tokens!

5. Shares of a Bankrupt Company

In most cases, when a company goes bankrupt, the common shareholders are wiped out. But not always. When Hertz went bankrupt, its stock price went as low as 56 cents before rallying to $5.53 (a 900% gain in just under two weeks) due to the retail investors coming into play.

While you cannot expect this to happen every time, there are a lot of strategies for trading shares of bankrupt companies. You can buy into the secondary shares offered after the bankruptcy proceedings (when Hertz was listed in the OTC market, its shares jumped 23% on the first day of trading). The idea here is that when a bankrupt company issues shares again, there would be sellers more than buyers hoping to get some portion of their initial investment back. If you believe in the long-term prospects of the company, you can buy and hold in the hope that you are getting the stock at a discount. But, once again there is a chance that whatever issues caused the bankruptcy still exist and your shares can go to zero!

6. Options & Futures

We have finally reached our riskiest investment play. Remember the leverage option we talked about in the beginning? While most of the margin accounts only give you up to 2x leverage (Basically the loan amount will match whatever you have in your account), Options & Futures can give you somewhere from 5x to 100x leverage4! The further Out of the Money and closer to the expiry date, the higher the leverage you will be able to take on for the same price.

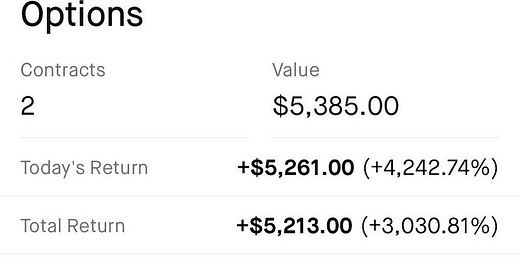

Say you have $1k to invest in a stock and it moves 20% the next day. Your profit on this trade would be $200. But if you had a call option that gave you say 50x leverage (very close to expiration), you would be ending with $10K in profit from the initial investment of $1k! This also works the other way around for your losses. 20% moves in one day are extremely unlikely and in 99.9% of cases, your options would expire worthless causing a 100% loss!

Now I cannot end this without highlighting some of the best & worst options plays from Wallstreetbets to show what trading options and futures can do!

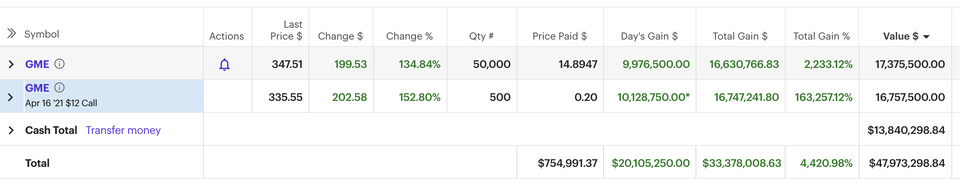

DFV: No introductions necessary. Invested $50K into the leap call options of GME at its lowest levels in history. When the stock hit $400 during the short squeeze, his 50K investment was worth more than $47 MM. (95,800+% return)

If_I_Was_Hayek: He saw the impending Covid 19 crisis before anyone else and then bought $150K in Put options into Disney and Carnival. Within days after the virus hit the U.S, his position rocketed to more than $ 4MM (2,500%+ return). He could have invested that in the S&P 500 and collected a cool $200k per year. But, he held on with diamond hands until the stimulus checks, PPP loans, and Fed’s money printing hit the economy causing the prices to rebound causing the value of his option to drop to $21K (an 86% loss on initial investment and 99.5% loss from his max value).

TheEmperorOfJenks: An undisputed legend for sketchy investments, he tried to make a killing by betting on Ornamental Gourd Futures5. Covid-19 crushed the market demand and he lost his life savings. He then tried to make it by investing in rhodium (only to be sent fake rhodium) and then moving to Uruguay to start a bee farm only to then run from authorities back to the U.S. for illegally introducing an invasive species of bees into the country. I am pretty sure that someday we will read his autobiography - or even see a Netflix Original.

Well, that’s a lot of different ways to lose your money - suited for those who want to spin that revolver wheel in the hope that it’s not gonna end up on a loaded chamber. Because if it does, it’s game over.

If your risk tolerance is on the higher side, one way to satisfy the itch is to allocate a small proportion of your portfolio into endeavors like this. What I do is allocate 5% of my portfolio to moonshots such as a new crypto coin or penny stock. It’s a meaningful amount for me that I would do adequate due diligence before investing. In case it ends up 10x ing the initial investment, that would amount to 50% of the portfolio. If it goes to zero, well it’s not such a big loss that it’s going to affect me in any real way!

So play around and figure out what your tolerance is. For those who still want to allocate 100% of their portfolio to an insane YOLO, I wish you nothing but green accounts and a one-way rocketship to the moon!

Until next week…

Footnotes

There are definitely variations of this with all except one barrel filled with bullets, playing alternatively, spinning the wheel every time before you pull the trigger, but the idea is that it’s an all or nothing game.

This is an extremely unlikely scenario and most margin brokers will automatically close out your account with a margin call when the stock price drops below a certain threshold.

Think about a company that IPOs at $10B. To get a 100x return, the company should grow to a $1 Trillion valuation. Whereas if you invested when the company was 10MM, getting the company to a $1B valuation would give you a 100x return.

This is why you see those insane gains from call options. You are only controlling and not holding the underlying shares for a premium. (Leverage = (Delta/Options Price)*Share price)

I didn’t know this existed till he made the post. Not sure if this is legit but something similar does exist.

If you enjoyed this piece, please do us the HUGE favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Fun piece! I'd note only that VC will usually take a decade to get the sweet returns even if you got lucky and only picked Facebooks. Also that in a note reminiscent of CDOs (if you're skeptical) and better risk adjusted returns (if not) there's an interesting bit where combining the instruments en masse gives some interesting investment strategies. But gambling is a heady drug.

Another masterpiece of article.

Ironically, one can now (try to) invest in russian companies for high risk strategies.