The Permanent Portfolio

A portfolio for all seasons

Welcome to the 400+ investing enthusiasts who have joined us since last Sunday. Join 26,700 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

Help Improve Market Sentiment

Hey folks, I am trying to improve the type of content and analysis I am doing in Market Sentiment. For this, I need your feedback. If you have been reading MS for more than 1 month, please fill out this survey. In line with all our investment strategies, I have optimized it to the maximum. It’s just 4 questions - it should take you 5 minutes at most and will help me out massively.

There are old pilots and bold pilots, but there are no old, bold pilots.— E. Hamilton Lee

Tennis is a beautiful sport. Watching how Federer makes his forehand look so effortless or rooting for yet another impossible comeback from Nadal is what makes it magical. As an amateur tennis player, it’s one of the sports where I see the greatest difference in how amateurs and pros play.

Anyone who’s played tennis long enough at an amateur level would have come across the dreaded “pusher”. For those who don’t know, a pusher is someone who plays a passive game. They never try an outrageous serve or that impossible shot. They are happy chipping away at your patience, keeping the ball in play, and waiting for you to make a mistake. Inevitably, you will be forced to try an ambitious shot that ends up in the net or goes out of play.

It used to drive me crazy how someone who is slower than me, hits weaker than me and plays a boring game ends up winning. It took me some time but I eventually figured it out - I was trying to play a Winner’s game but they were trying to play the Loser’s game. The idea originates from Simon Ramo who identified the crucial difference between the two in his book, Extraordinary Tennis for the Ordinary Tennis Player.

He found out that in professional tennis, 80% of the points are won due to brilliant execution whereas, in amateur tennis, 80% of the points are lost due to unforced errors. Professional tennis players are playing a winner’s game but amateur tennis players play a loser’s game. So, to win in amateur tennis, you only need to avoid mistakes. And the way to avoid mistakes is to be prudent, keep the ball in play, and let the other guy defeat himself in doing so. That’s exactly what the “pusher” does.

There is another loser’s game that fools millions of people into thinking that it’s a winner’s game - Investing.

Minimize the downside

Before we jump in,

As you know, I am a big fan of alternative investments. What if instead of buying stocks, you could invest in the likelihood of a future event or hedge against a situation? Now with Kalshi*, for the first time, traders have the ability to buy this asset class: regulated Event Contracts.

Simply put, on Kalshi, investors can buy “Yes” or “No” shares* tied to specific future events — think, “will a recession begin by Q1 2023?” or “Will we have a soft landing?” As the event becomes more likely to happen, the value appreciates. Simple as that.

Concerned about an overly-exuberant Fed raising rates more than expected and denting markets? Or inflation climbing any further? Check it out on Kalshi.

Market Sentiment Subscribers get priority access to this new platform*.

*This is sponsored content

Now, back to it: 10-k diver recently did a thought experiment about the importance of avoiding drawdowns to your portfolio. Consider an investment that grows by 10% in value every year and goes down by 50% once in 10 years. So every year, there is a 90% chance that the investment will go up 10% and a 10% chance that it will crash by 50%. Would such a volatile asset be a good long-term investment?

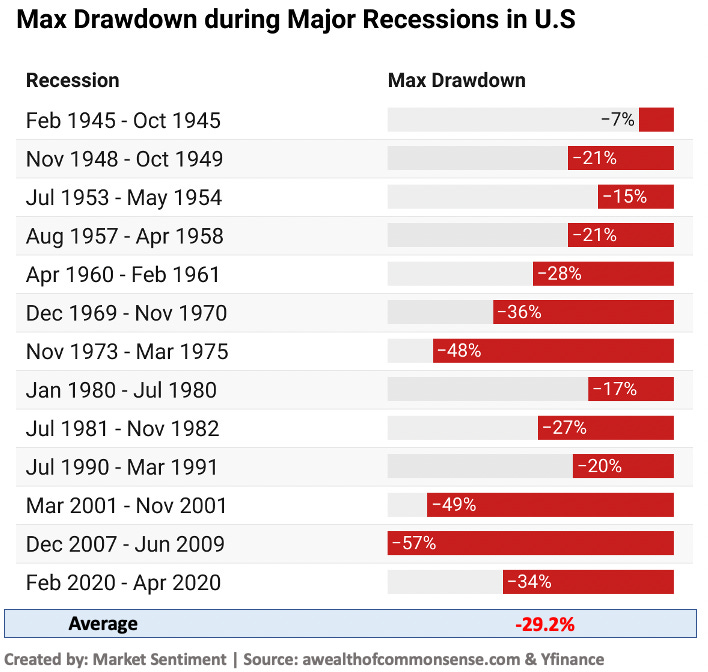

Even though you were up 10% every year for 9 years, the 50% drop brings your overall CAGR to just 1.66% per year. A 40-50% drawdown is not as rare as we think. Going through historical data, we can see that 20% drawdowns are common and a 50% drawdown has occurred 3 times in the last 5 decades!

Significant drawdowns can wipe out all the gains made over the past few decades if we are not careful. This is why protecting the downside is much more important than optimizing for returns.

What if you could build a portfolio that could withstand almost anything?

Portfolio for all seasons

Most of us (at least the ones reading this) have invested predominantly in a period where stocks and bonds have performed exceptionally well. We inevitably have a strong bias towards these investments.

But, there were 4 multi-decade periods just in the last century (1901-20, 1929-47, 1964-81 & 2001-13) where stocks had zero return (These periods are known as the lost decades). Given that we are probably heading towards a period of high inflation, rising interest rates, and low growth, let’s look at a counter-strategy developed by someone who grew up in the middle of such conditions.

Harry Browne created the permanent portfolio in 1982 - An era where inflation was rampant and growth was stagnating. The fund was born in an environment where investors didn’t know where to turn. Regardless of what an investor did (either stocks or bonds), they were losing money. Browne wanted to create a portfolio that gave positive returns regardless of the macroeconomic conditions.

The most common type of portfolio consists of stocks and bonds that only do well during periods of growth (stocks perform well) or during periods of deflation (bonds perform well). But what if we are in a period of decline with high inflation? This is where the permanent portfolio comes in!

The permanent portfolio is built up of 4 components that perform well during different periods

25% Stocks for Growth

25% Bonds for Deflation

25% Cash for Recession/Decline

25% Gold for Inflation

Let’s see how this portfolio has performed over the years.

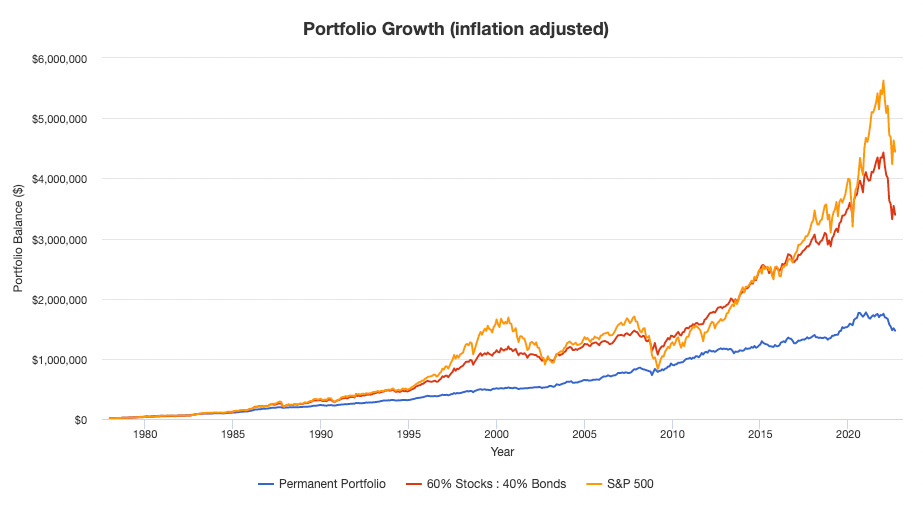

As expected the growth rate (CAGR) of the permanent portfolio is lower than both the stock-bond mix and pure stocks. But both the max drawdown at just 12.6% and the standard deviation at 7.1% are significantly lower. The cherry on top is that the return created by this portfolio is not strongly correlated with the market.

The astute among you might have noticed that the CAGR is ~3% lower when compared to stocks and it will have a massive impact over long time frames. Considering a $10K initial investment and a monthly addition of $1K, you would be left with $14M in the case of the permanent portfolio but a whopping $44M in the case of just investing in the S&P 500 (Both adjusted for inflation).

So where does that leave us? The permanent portfolio does give us very good returns with incredibly low volatility. But that is at the cost of higher returns that could have been generated by just investing in stocks.

My take is that the type of portfolio that you should go with depends on your investing timeline. If it’s extremely high (20+ years), sticking to stocks is the best bet for long-term wealth creation. If you need your funds in the next 5 years or are planning your retirement soon or can’t handle the volatility of the market, moving to a permanent portfolio would give you much-needed stability and peace of mind.

That’s it for this week’s deep dive - Let me know what your portfolio is like in the comment section below

If you forgot to take the survey to help improve MS, please take it here.

More interesting stuff

Portfolio visualizer - I can’t believe that it took me so much time to find a decent backtesting platform. Portfolio Visualizer makes it super easy to do backtests and they have data going back up to 1971 - It’s free and you can play around with the above backtest I have created here.

The best sports article you will ever read - Federer just retired from competitive tennis and I wanted to highlight one of the best articles written on him from way back in 2006 - Enjoy!

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Question:

1. for each of the quadrants, what are the best strategies (growth vs value, gold vs BTC, local vs global) and how can it be remixed?

2. why are the ratios 25%, and should it be adjusted given the four core assets are pre-defined?

Fellow tennis amateur here, thanks for the book recommendation! If you haven't already The Inner Game of Tennis by Timothy Gallwey is worth a read as well.