Patience as an edge

Roger Federer was arguably one of the best tennis players of all time. Yet, in his commencement address at Dartmouth, he highlighted this fascinating statistic.

In the 1,526 singles matches I played in my career, I won almost 80% of those matches. Now, I have a question for all of you. What percentage of the points do you think I won in those matches?

Only 54%.

Even Federer, who won an astonishing 20 Grand Slams, only had a 4% edge over his opponents. So, how do you improve your odds when you have a slight edge?

Simple — Play Longer

In tennis, there are two types of matches — It can either be the best of 3-sets (like the Cincinnati Open) or the best of 5-sets (Wimbledon, U.S. Open, etc.).

Let’s take a look at how Federer performed in both types.

Even though his edge remained the same, changing the type of game from best of 3 sets to best of 5 sets increased his percentage of matches won by ~10%!

The same applies to investing. If you look only at the daily returns for the S&P 500 from 1928 to 2023, the returns are positive only 54% of the time. So, for someone who watches the market daily, it’s almost a coin toss as to whether their investments will go up or down. But the same slight edge transforms completely as you expand your investment horizon.

On a given day, you only had a 54% chance of making money. Expand it to a month, and it jumps to 62%. Expand it to 1 year, and now it’s at 75%. Finally, if you hold on for more than a decade, it’s virtually guaranteed that you will not lose money.

What if you did nothing?

The S&P 500 is the most popular index fund. For a company to be included in the S&P 500 index, it has to satisfy the following criteria

The company should be from the U.S, and shares should be highly liquid

Market cap > $8 Billion

Positive earnings in the recent quarter and positive total earnings in the previous year

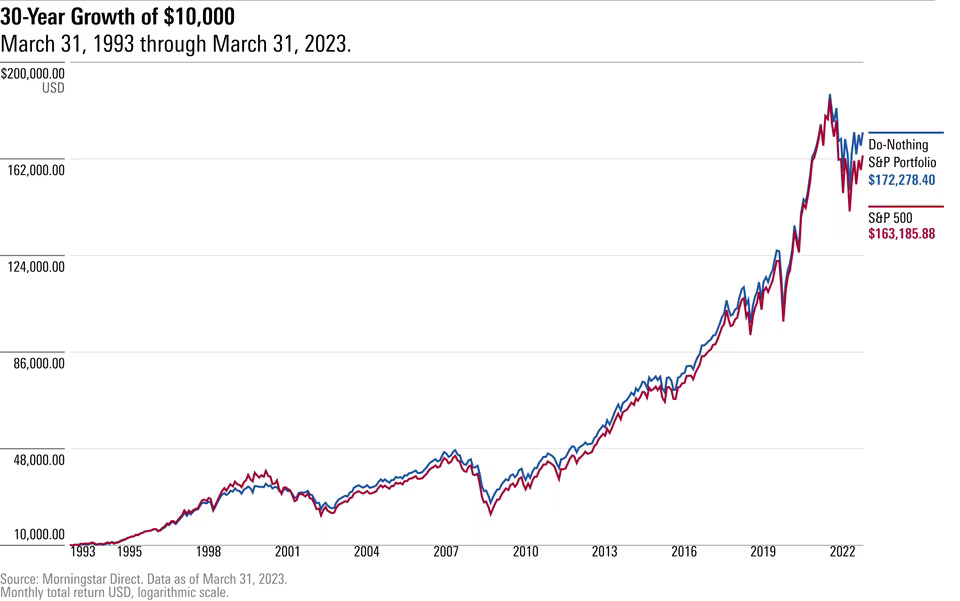

The strategy is as simple as it gets. The index committee meets every quarter, reviews the existing list, and sees if new companies can replace the existing ones using the above three rules. On average, ~20 companies are added/removed from the S&P 500 annually. This strategy has performed phenomenally well, growing $10K invested in 1993 to $172K in 2023 — by paying a meager fee of ~0.1% annually.

But what if you did nothing? What if we picked the S&P 500’s holdings as of 1993, invested in those stocks, and left the portfolio alone for 30 years?

This is exactly what Jeffrey Ptak of Morningstar did. He put together an interesting analysis where he evaluated the performance of the S&P 500 if it stopped rebalancing and adding new stocks.

For his test, he picked the S&P 500’s holdings as of 1993, invested in those stocks, and left the portfolio alone for 30 years. The dividends were reinvested, and if any company was acquired/delisted, that proportion was shifted to cash.

Over the 30-year period from ‘93 to ‘23, the Do Nothing portfolio outperformed the S&P 500 with less volatility. This performance is incredible considering that a portfolio frozen in ‘93 would not have added companies like Tesla, Etsy, Domino’s (one of the best-performing stocks of the last two decades), etc.

The outperformance was repeated even if you started the backtest in 2003 or 2013.

The lower volatility of the portfolio was attributed to the cash component (for the portfolio started in 2013, by 2023, it was 5% cash) in the portfolio, which provided downside support during the crash of 2000, 2008, and 2020.

By avoiding high-growth companies that usually join the index with much fanfare (*cough* Tesla *cough*), the Do Nothing portfolio tilted more toward Value than Growth.

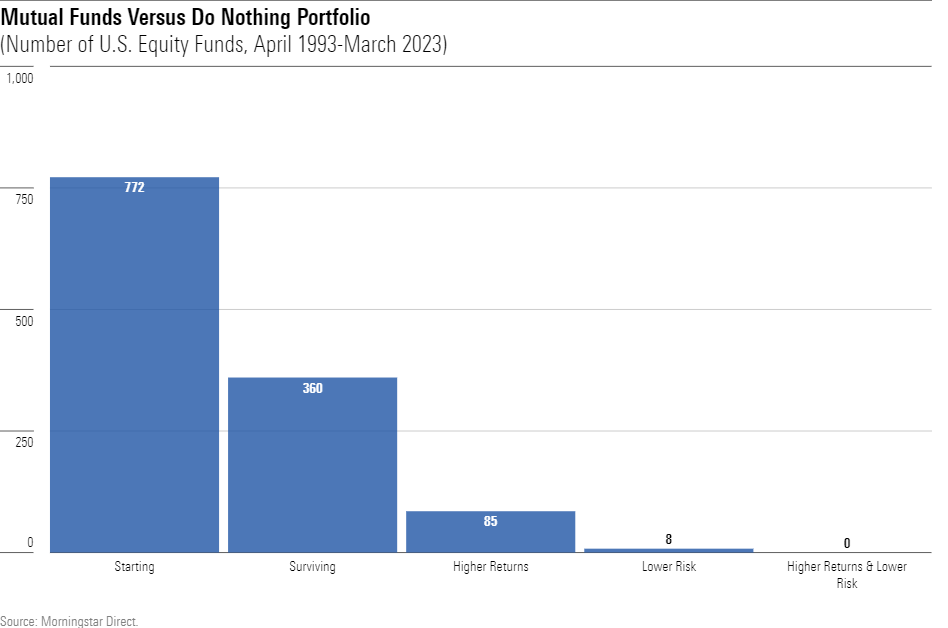

John Rekenthaler went on to expand the analysis and showed that no actively/passively managed fund could beat the Do Nothing portfolio:

The next chart shows, from left to right, the number of U.S. diversified equity funds that:

1) existed in April 1993;

2) remained in existence for the next 30 years;

3) outgained the Do Nothing Portfolio,

4) were less risky than the Do Nothing Portfolio, and

5) accomplished both the third and fourth tasks.

That final bar represents the null set. From April 1993 through March 2023, no U.S. equity fund of any flavor—I included funds that invest in small and midsized companies, as well as those that buy growth or value stocks—managed to make more money than the Do Nothing Portfolio, while also being less volatile.

What about valuations?

One major reason investors are skeptical of investing in the current market is the high P/E ratio. The current value of 36 is more than 2x the median value of 15.9. In addition, the average P/E ratio of the Magnificent-7 is now 51. Higher valuations always indicate poor future returns — so should the long-term investor be worried?