Welcome to the 358 investing enthusiasts who have joined us since last Sunday! Join 19,701 smart investors and traders by subscribing here. Its completely free!

If you are new here, you can check out my best articles here and follow me on Twitter too!

It’s just so sad to see somebody spend so much money on something that isn’t real - Karen Boeker (Beanie Baby expert)

Our story begins in 1993. Ty Warner, Founder of a toy company Ty Inc. created these innocent-looking stuffed animals for kids. But what started as a simple $5 toy mass-produced in China became such a craze that people were paying thousands of dollars to collect them.

At one point, things became so irrational that police were trading their guns for Beanie Babies, couples were having custody battles over these toys, and people were smuggling these into the U.S from Canada!

What made these simple toys so valuable was a simple but very effective marketing strategy that Warner implemented in 1995. Warner started retiring animals to create artificial scarcity. This combined with their strategy of selling only 36 of any one animal to retailers created an instant marketing frenzy that pushed the value of these toys through the roof.

As with all bubbles, the party didn't last very long. The market for Beanie Babies crashed along with the dot-com bubble in 2000 and the dropping prices caused the market to be flooded with an avalanche of inventory. Millions of Americans were left with now nearly worthless Beanie Babies in their basements.

Looking back, it’s almost unbelievable that people were willing to pay thousands of dollars for a $5 mass-produced toy. But then again, just looking around, we can see the same trends repeating all over again.

Speculators are paying more than 6 figures for an image of a rock in the hope that down the line its value is going to increase. Investors are justifying the value by arguing that these are Non-Fungible (as in, one of a kind that cannot be duplicated). The irony is that this is exactly the same argument investors in Beanie Babies made stating that their toy was going to be one of a kind that others will buy for a fortune down the line.

It’s the classic case of the greater fool theory where you are buying an overpriced asset in the hope that someone will be willing to pay even more for it later on.

Given that the Bitcoin is down more than 60% YTD and the whole crypto market is going through another halving, let’s see how the NFT market is doing and whether there is some hope for a bounce-back - or would it go the way of Beanie Babies?

The Red Flags

If you are out of the loop on the whole NFT market and how it works, this excellent video by Johnny Harris is a great primer on the world of NFTs. What really caught my attention was when Jack Dorsey’s first tweet went on resale. It was bought as an NFT last year for a whopping $2.9 Million. It had everything going for it - The first-ever tweet by a famous person on one of the most popular social media platforms of our generation! It’s the poster child of what an NFT should be - rare, authenticated, and truly one of a kind.

But when the current owner listed it for resale at $48 Million on April first week, he ended up getting a top bid of just $280. Let that sink in for a moment. The first-ever tweet as an NFT has lost more than 99.99% value in just under a year.

The more I dug into this, the more common these occurrences became. EtherRock, an NFT containing literal images of some rocks has now dropped more than 70% of its ~$2MM price, a Cryptopunk that was sold for more than $1MM just a year back is now trading at < $60K (~94% drop) and arguably the most popular of them, the Bored Ape Yacht Club is now down more than 50%!

Before the crypto bros come at me for cherry-picking data, let’s see how the overall market for buying and selling NFTs is doing now. To know the current status of the NFT market, rather than just focusing on the total volume of sales (which can be skewed by one or two big purchases), we can focus on the number of sales, and the total number of unique buyers, and sellers in the market. The data used in this analysis was collected from NonFungible.com

Flatlining Metrics

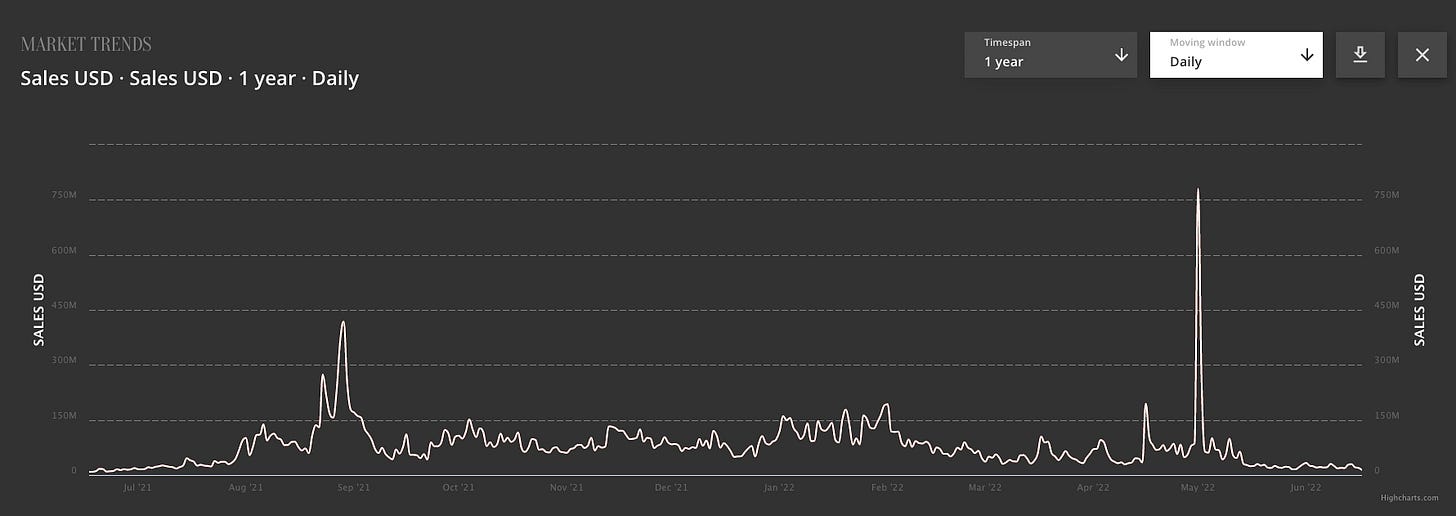

No matter how you slice the data, NFT metrics are not showing a rosy trend. The monthly average number of NFT sales has seen a steep 87% drop from its top in Aug’21 and has been on a continuous decline over the past 8 months.

Even if you consider the dollar value in sales every day, other than a single big spike in May ’22, the sales are 80-90% down when compared to the Aug ’21 period.

The most concerning metric of them all is the number of unique buyers and sellers in the market. After all, for a marketplace to work, you need both active buyers and sellers. Both the number of buyers as well as the number of sellers in the NFT space have seen an ~80% drop in the past 6 months. Similar to the sales metrics, these figures have also been continuously dropping with no sign of a bounce back.

Play-to-Earn

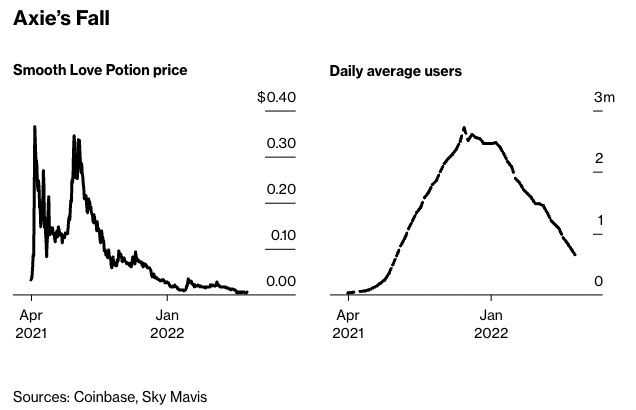

If there was one thing that I was confident about in the whole NFT space, it was the rise in Play-to-Earn games such as Axie Infinity. I first read about this in Packy McCormick’s Not Boring in Jul’21 and was fascinated by their business model. To put it simply, it’s a Pokemon-like game built on the blockchain platforms where you can buy digital pets called Axies (as NFTs) and breed, battle, and trade them inside the Axie ecosystem. People who were playing the game daily (mainly from the Philippines) were making more money than they were able to make from their regular jobs.

Multiple things went wrong with Axie at the same time - The company was losing a large chunk of its daily active users, the cryptocurrency market got into a deep recession, and finally, hackers robbed around $620 million in cryptocurrencies from the company. All of these made it uneconomical for the existing players to keep grinding as their rewards were directly tied to the price of their crypto on the open market.

What made the situation worse is that only 15% of their users were playing the game for fun. That's a staggeringly low number and points to the fact that a vast majority of players were just playing to make money instead of actually enjoying the game.

The unanswered question right now is whether Axie Infinity can be self-sustaining. New players are expected to shell out anywhere between $200-$300 to start playing the game. Unless new players come into the ecosystem, the existing players have no way of generating money. If the new users are only coming in because they think they can make money from the game, it will not work in the long term as it just becomes a very complicated Ponzi scheme - where new users are bankrolling the payouts of the existing players.

The only way this can work long-term is if a large majority of players are there just to enjoy the game and are willing to put more money into the game ecosystem. The company is also thinking exactly the same with them quietly altering its mission statement, deleting the phrase “play-to-earn” and replacing it with “play-and-earn.”

Price & Value

Price is what you pay. Value is what you get - Warren Buffet

They say that hindsight is 20/20. But deep down we all knew that this rally was never going to last. It’s unrealistic to expect that the image of a rock can be worth more than that of an actual house.

Even if the market bounces back by some miracle, it’s very unlikely that the existing NFTs will rise in value. It’s going to be something new and exciting that’s going to take the bulk of our attention. Does anyone remember the CryptoKitties craze from 2017 where virtual cats were being sold for tens of thousands of dollars? They never made a comeback after the 2017 crash.

I am not saying that the whole NFT market is going to zero. There are still some Beanie Babies that are being sold for thousands of dollars. But, almost all of them became worthless after the market crashed. I expect the same for the NFT market where a very few collectible ones will retain or increase their value while a vast majority of others would just go to zero.

But, on the plus side, at least this time around, they would not end up taking space in your basement like the Beanie Babies and would just exist in some random corner of the internet.

Until next week..

If you liked this analysis, do check out my report on activist short sellers where I analyzed the performance of the most famous activist short sellers over the past 5 years.

I agree with you, and it is simple as that. Market will find something else after this pull-back/recession and those new things will be purchased heavily again until it can't be.

As an automotive journalist I've been under extreme pressure to praise and promote NFTs to car collectors globally. They're an absolute fad, but there's a huge machine promoting them for the enrichment of a few.