Welcome to the 340 investing enthusiasts who have joined us since last Sunday. Join 21,525 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

"How did you go bankrupt?" Bill asked."Two ways," Mike said. "Gradually, then suddenly."- Ernest Hemingway's The Sun Also Rises

Our story this time begins in a mandatory humanities course we had to take as part of our MBA curriculum. The prof was unsurprisingly pessimistic about how our society was shaping up and was of the opinion that our current capitalistic system’s unrelenting focus on endless growth was going to blow up in our faces down the line1.

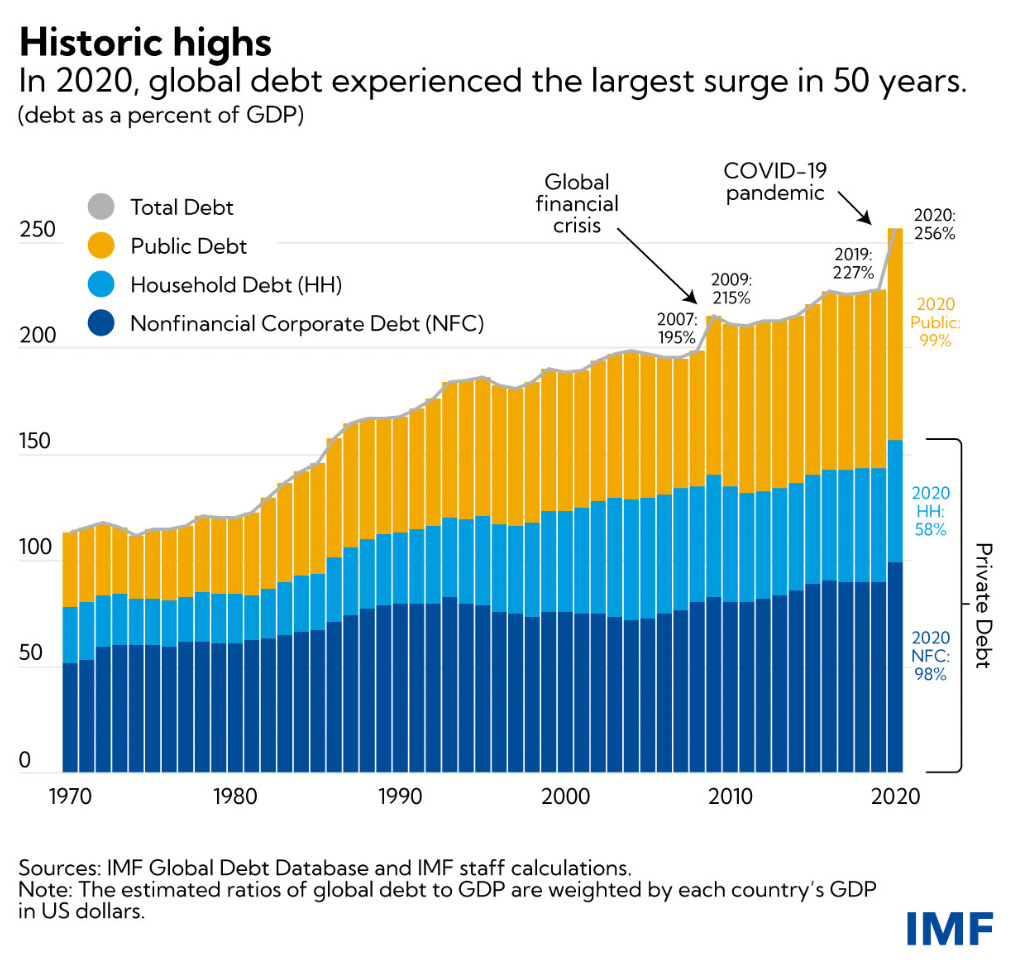

One of his key arguments was how the global debt kept on rising and how nobody seemed to be worried about it. Right now, it’s more than 250% of the world's GDP, and paying it back is going to be a nightmare. For the U.S, the national debt currently stands at more than $30 Trillion (~91k per citizen) while the federal tax revenue is just $4 Trillion (~13k per citizen) - So, if we decide to pay back this ‘debt’, we will have to use close to 8 years of the entire tax revenue just for loan repayment.

But we brushed off these doom & gloom claims by the prof, attributing them to his lack of knowledge in corporate valuation. If the interest rate on the loan that the federal govt borrows is lower than the economic growth, the govt can just roll over the debt by borrowing new money to pay off the interest on old money. The debt will grow forever, but the economy will grow even faster - bringing down the debt to GDP ratio and you technically will never have to repay the debt in traditional terms. Also, before you judge our past selves for being naive, listen to what the chief economist at the International Monetary Fund had to say…

First, I show that the current US situation, in which safe interest rates are expected to remain below growth rates for a long time, is more the historical norm than the exception. If the future is like the past, this implies that debt rollovers, that is the issuance of debt without a later increase in taxes, may well be feasible. Put bluntly, public debt may have no fiscal cost - Olivier Blanchard (2019 - American Economic Review)

As you would have guessed by now, things are not always that simple. With the current rate hikes by the Fed and a looming recession, our growth story might not hold up. At the same time, the U.S has faced multiple recessions and come out relatively unscathed, all things considered.

Finally, adding to all of this complexity is the fact that the National Debt is a highly politicized issue and your take on it is going to be heavily influenced by which side of the political spectrum you lean towards. So, in this week’s deep-dive, let’s leave the politics aside and understand what the National Debt is, the arguments for and against it, and whether we should be concerned.

National Debt - The TL;DR version

There are innumerable articles out there covering national debt2. It’s the debt that’s caused by excess govt spending, i.e an expansionary fiscal policy. This is where the govt spends more money than they bring in tax revenue so that the country can grow at a faster phase.

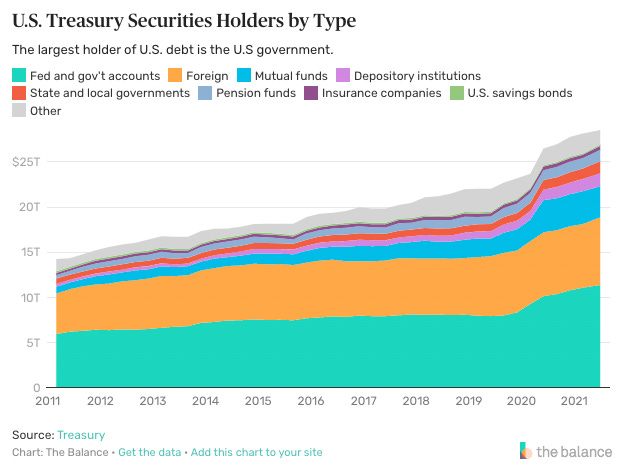

Surprisingly, the largest holder of the U.S debt is the U.S govt itself. If you are wondering why the U.S govt would owe money to itself, it’s pretty simple - There are agencies like Social Security that are bringing in more money than they are spending right now. So, instead of keeping the cash in a checking account, they buy U.S bonds so that they get a decent return and the govt in turn has more cash for investments.

Also, fun fact - for all the uproar that China was buying up all of our debt, they own less than 3% of our total outstanding debt. It’s still a substantial amount and them reducing it drastically can definitely affect the dollar but nowhere near what the general public worries about.

Why debt makes sense - (r < g)

This simple-looking equation is by far the best argument for taking on more debt. Here, ‘r’ represents the rate of return on the Govt. Bonds and ‘g’ is the economic growth rate.

If the country is growing at say 5% and the rate of return on Bonds is only 2%, then the country can run a 3% deficit forever without increasing the debt/GDP ratio3. If you want to say, pay off the debt, then just don’t run a deficit and the growth would make the debt shrink in comparison to your GDP, making it irrelevant in a generation or two.

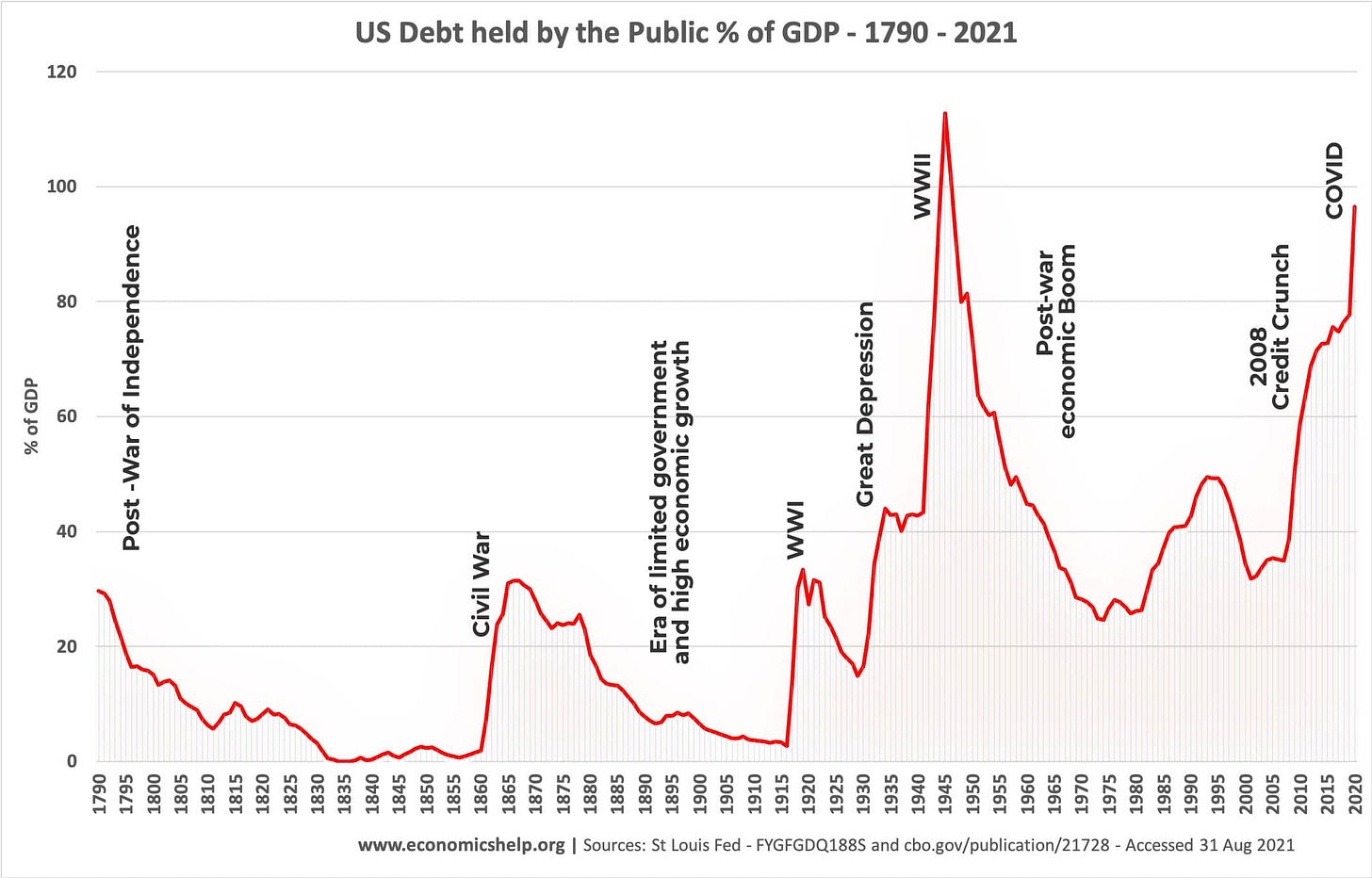

The U.S was successfully able to reduce the debt even while running a deficit just after World War 2 with extremely high tax rates and a massive post-war growth boom that accelerated our GDP.

The problem with running high deficits

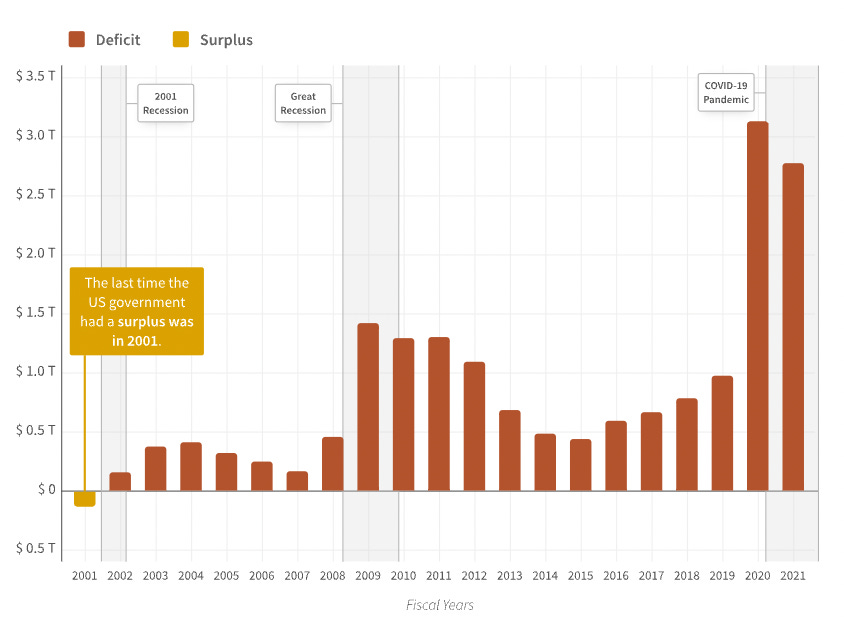

The limitation of this approach is that it only works when everything is going well. In the last 2 decades, the US has never run a surplus (even in the good times) and when a recession inevitably occurs, we have to run more deficits to stimulate spending as we can see from the 2009 & 2020 scenarios. The issue is compounded by our slowing growth rate. The U.S saw an average growth of 4% from 1950-2000 but only a 2% growth from 2000-2022.

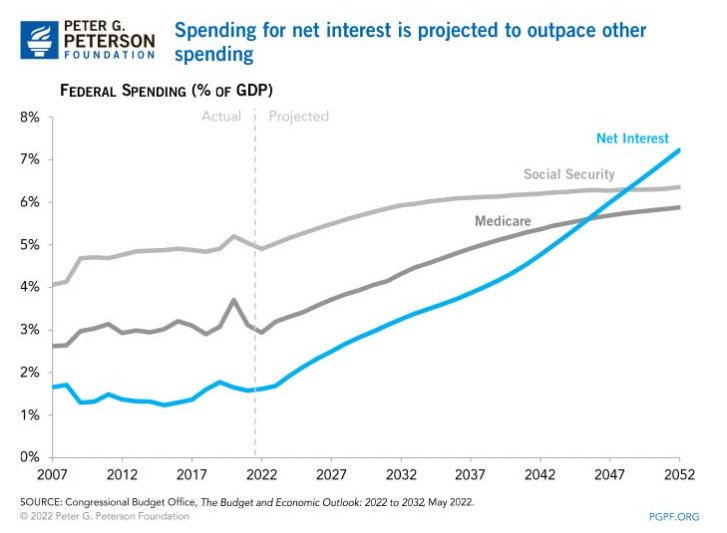

The final key to the puzzle is interest rates. The r < g theory only works if ‘r’ is actually less than ‘g’ - With the Fed hiking interest rates to tame inflation, we are increasing the rate of return of the bonds, which will cause our overall interest payment on our debt to rise. A prolonged period of high-interest rates and low growth can push us into a debt crisis where we have to prioritize interest payments over Infrastructure, Social Security, Healthcare, etc.

As projected by the Congressional Budget Office, interest payment on the debt is projected to surpass both Medicare and Social Security by 2049.

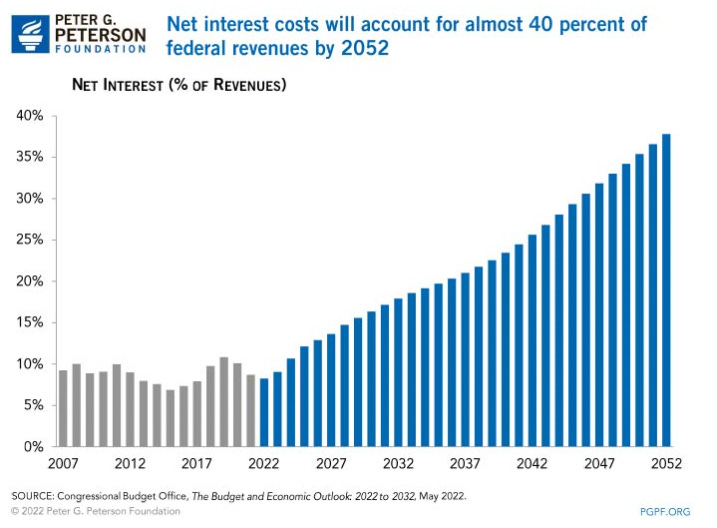

This has stunning implications. The rising interest cost would force the government to take on more loans to cover the deficit which in turn would increase the interest rates creating a debt spiral4.

It’s expected that these increasing interest costs will account for close to 40% of federal revenue by 2052. Imagine a situation where you are spending 40% of all the tax revenue just paying interest on your debt and you are left with only the remaining 60% to run the country!

Well, it does look like if we follow the current trend of high deficits and low growth, we are going to face a debt crisis down the line. And, when it happens, there won’t be a single country in the world that will be able to bail us out like how Germany did with Greece.

Coming up with a long-term solution to this problem is definitely not rocket science. You just need to bring in more money while spending lesser - All the while having a decently growing economy. This would need:

Tax Reforms - During and just after World War 2, the top tax rate in the U.S stood at 94%5, and over the next 3 decades, it never dipped below 70% - This, along with strong growth, enabled us to drop the debt from 110% of GDP in 1945 to 25% of GDP in 1980. Simple reforms of our existing tax system can enable the govt to bring in substantially more revenue.

Strong Growth Policies - We currently only spend 2.5% of our GDP on R&D, Infrastructure & education combined6 - Pushing this % up is vital for improving long-term growth.

But, as captured perfectly in the infinite wisdom of YouTube comments on one of the policy reforms videos:

I feel like the Detroit Lions will win three super bowls in a row before the US does these simple policy reforms.

If you want to explore this further, check out my earlier article on the debt ceiling crisis.

Until next week…

Footnotes

If you already have a large outstanding loan, lenders would allocate a higher risk to you leading to a higher interest rate.

For taxable income over $200,000.

And spend 3.1 percent of GDP on Military alone - The Irony.

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Interesting.

I am not crazy about the solution: Tax Reforms (aka Tax Increases) because, in our current situation they would stymie the growth part - this is not the 1950s any more. However, I would agree on condition we have a truly balanced budget - no borrowing and includes all debt service and a debt pay-down no matter how small.

I agree with the comment about the Detroit Lions. No one riding the gravy-train in DC will do anything after the SHTF, new leadership will emerge and go to work.

'After me, the deluge', Louis XV of France (1710–74) -- French Revolution began in 1789.

I have three comments on this issue.

First, Japan's national debt is already so high that half the annual budget goes towards its servicing. I keep waiting for them to collapse but they never do, though there are many differences in their situation of course.

Second, I doubt that higher spending on education will help improve productivity. The US already spends more per capita on education than most other developed countries.

Third, you know the old joke: if you owe the bank a million dollars you have a problem but if you owe the bank a billion dollars the bank has a problem. If the United states can't service its debts, the world has a problem.