Motley Fool – Luck or Skill?

Evaluating Motley Fool's performance over the last 20 years

There are three kinds of lies: lies, damned lies, and statistics – Mark Twain

Robert Kirby was the legendary fund manager who popularized the Coffee Can investing method in the 80s. But, what most people missed in his paper was that he also gave a rare glimpse into the inner workings of Wall Street. Kirby talks about how an actively managed fund becomes popular: You start with a few million dollars and make some risky bets. If it works out over the next 2-3 years, you suddenly have a fund that “outperforms” the market. If the bets don’t pan out, you close the fund and then do it again with another strategy. Rinse and repeat till you hit it big.

Once you have a fund that’s outperforming the market for a short while, you put together a team of skilled marketing guys to raise funding for this new fund. Because of your “brilliant” performance and track record, you will be able to command a premium fee for managing the fund and raise a few billion for your fund. The funny part is that no matter how badly you perform, the new clients will stick with you for a few years in the hope that it will turn around (*cough* ARKK *cough*). During this time, your fund will be earning a fixed portion of the AUM (usually in the tens of millions of dollars range) no matter how you perform. Even if your fund is a total flop after 5 years, you will be set for life just from the fees!

Talking about fees, complete access to all Motley Fool premium services costs $13,999! While we can’t realistically think of any way someone can justify buying this plan, the truth remains that Motley Fool has nearly a million customers paying for their stock-picking services. Arguably, their most popular service is the Motley Fool Stock Advisor where they issue 2 stock picks every month. The overall strategy is sound where they ask their readers to keep a basket of 25 stocks from the historical list recommended by Motley Fool, and hold these stocks for a period of at least 5 years.

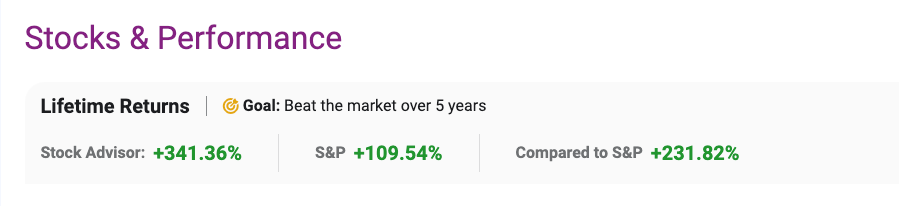

They heavily push the performance of their overall portfolio which has given close to ~3x the returns of the S&P 500. While these figures are certainly correct, it’s what they leave out of their claims that we are interested in. We created a custom backtesting solution (link to the portfolio tester you can use for your portfolio as well at the end) to put Motley Fool’s picks to the test.

Are a few companies they recommended back in 2003-06 driving the majority of returns as shown below1?

Source: Traderhq (independently verified by MS) Do they actually stick to their recommended strategy, and more importantly, are they performing better in terms of volatility & risk-adjusted returns?

Is the benchmark the right one? They invested in $NFLX when it was barely a $1B company & then compared their performance to the S&P 500 where the median market cap now is $29B!

Finally, what if you had started late? Say 2011 or 2015? Would you have still beaten the market following their recommendations?

Let’s dig in: