Warren Buffett was one of the first to popularize the concept of economic moats with his 2007 letter to Berkshire shareholders.

A truly great business must have an enduring “moat” that protects excellent returns on invested capital. The dynamics of capitalism guarantee that competitors will repeatedly assault any business “castle” that is earning high returns.

Therefore a formidable barrier such as a company’s being the low-cost producer (GEICO, Costco) or possessing a powerful world-wide brand (Coca-Cola, Gillette, American Express) is essential for sustained success. Business history is filled with “Roman Candles,” companies whose moats proved illusory and were soon crossed.

Buffett walks the talk by mainly investing in companies having incredible moats. One of our personal favorites from his portfolio is FlightSafety. The company was started in 1951 and provides flight training for pilots. Berkshire acquired FlightSafety in 1996 & Buffett argued that it had one of the best durable competitive advantages: Being a pilot is a highly skilled job and there is no room for error. Anyone who wishes to be a pilot would like to be trained by the best and FlightSafety is arguably the best flight-training provider. In Buffett’s own words

Going to any other flight-training provider than the best is like taking the low bid on a surgical procedure.

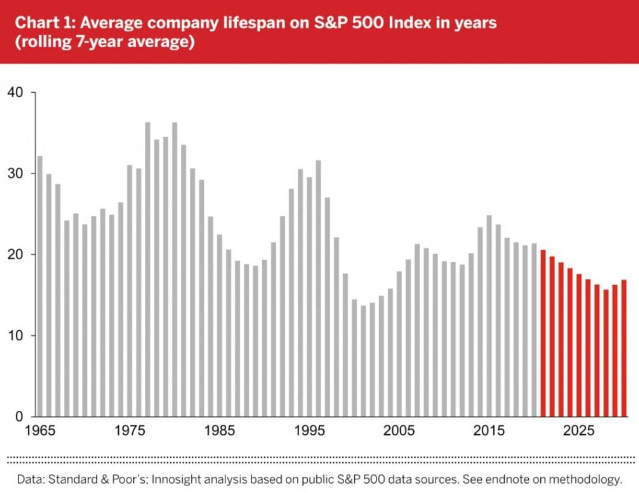

On the other hand, talking about companies whose moats proved illusory, the first ever Fortune 500 list was created by Edgar P. Smith and published in 1955. A look at the list over the years shows incredible churn; of the 500 companies in 1955, only 52 made it to 2022.

Think about that for a minute – These are not fly-by-night companies that hope that they make it to the next year. These are some of the world’s largest companies and only 1 in 10 stayed on the list after 6 decades. Nearly 2,000 companies have appeared on the list since its inception and most of them are now unrecognizable, forgotten companies today (e.g., Chrysler, Teledyne, Bethlehem Steel, etc.).

The average lifespan of a company on the S&P 500 list is continuously dropping and is now only 15 years compared to the 30 years in the ’80s. It’s only reasonable to assume that the list released 60 years from now would be wildly different from what it currently is.

Given the ever-growing churn in the top companies, investing in companies with durable competitive advantages becomes more important. So in this week’s deep-dive let’s dig into:

What is a moat and how do you identify companies having a moat?

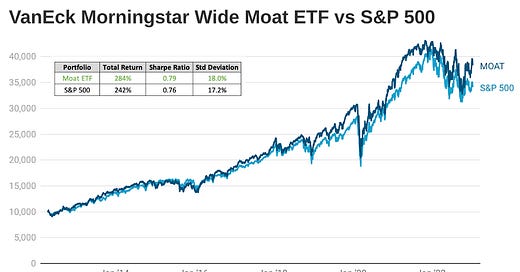

Do companies with sustainable competitive advantages outperform the market?

Finally, we explore how we can invest in companies with wide moats, the most popular moat ETF, and whether it beat the market.