Investor Interview with James Bulltard

Interview #7: Spotting opportunities using Options Flows with James Bulltard

Hello readers! This week, we have another investor interview for you instead of a deep dive. We will be back with an in-depth analysis next week.

Welcome to investor interview #7. I’m putting together this series to bring you diverse experiences and perspectives from other investors.

This week’s guest is James Bulltard. James has vast experience building tools to study options trades and selling puts using the strategies he develops. He writes “The Running of the Bulltards” on Substack where he shares his insights and data. You can follow his thoughts here and connect with him on Twitter as well.

We got to ask him about:

His journey in the options trading world and performance

How he shares his insights and picks

Why options flow is important, even for fundamental/long-term investors

How he allocates his portfolio

Why he disagrees that price action is based on fundamentals

Also, for premium subscribers:

What are James’ favorite ideas and themes on the radar right now?

What can fundamental investors learn from technical analysis?

What does his research process look like?

What red flags does he look for in a company?

Subscribe here for full access to all paid posts and investor interviews:

Hi James, great to have you with us. I discovered you through this Twitter thread where you share your journey and performance. Can you please tell our readers a little more about your background and also about what you do?

I worked as a trader at a vol firm in Chicago right out of school, and spent years working in various roles in New York and Miami afterward. Afterward, I ended up managing a family office for a previous client of a firm I worked for. I did that up until my retirement in 2022 to spend more time at home with the birth of our second kid.

I wrote that thread you are referencing in March after 9 months of publishing all my work on my substack. When you post things online, it’s hard for people to believe you until you show them. That thread has all 9 months of my postings where I outperformed the S&P by 90% in a fairly horrible market. For me, it all began in June 2022, when I saw one of the oddest options trades I’ve ever seen be placed. I began writing on Substack that day because I couldn’t rant on Twitter with character limits and it just took off when Sierra Wireless was acquired a couple of weeks later. That trade I noted was the first in a series of giving people insights into the real inner workings of the market. My Substack has turned into one of the fastest growing ones on their platform: my objective is to take the millions of options placed daily, sort them into a curated list of the most unusual ones every day, and input them into my database to model trends in the hopes of finding a direction to trade.

Is there a place where you share your picks publicly?

I do not make “picks” but I do post my open book every day on my Substack just in an effort to be open and transparent about what I’m doing for those who care, but the reality is that most are on my Substack for a cheap way to obtain institutional data. Retail investors typically aren’t going to pay $2,000/mo for a Bloomberg Terminal to have access to a platform where you can gather data. I took a problem I saw in that all the existing platforms that offer options data offer too much and most of it is not important. I try to cut out the noise and share the best data for a low fee. For me, I do this work anyways for my own daily homework to see what tomorrow’s game plan is. I’m just publishing it now for others who want the same data for their own discovery process.

Why are the options flows important?

They’re giving a live look at huge bets institutions place. I know long-term investors like looking at 13fs to see who is doing what, but that is backward-looking data. By the time investors see it, the funds have already made a fortune – but the options market is live. I’ve called out so many moves in advance whether it be Pinterest before the massive Elliott Management stake was disclosed or even that recent 30% move in Alibaba. The option flows show what the big funds are doing and when you see one ticker attacked over and over, you can tell something is brewing, the what isn’t my concern.

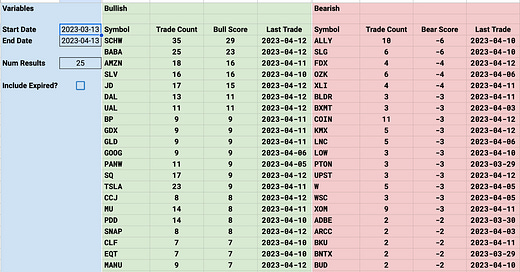

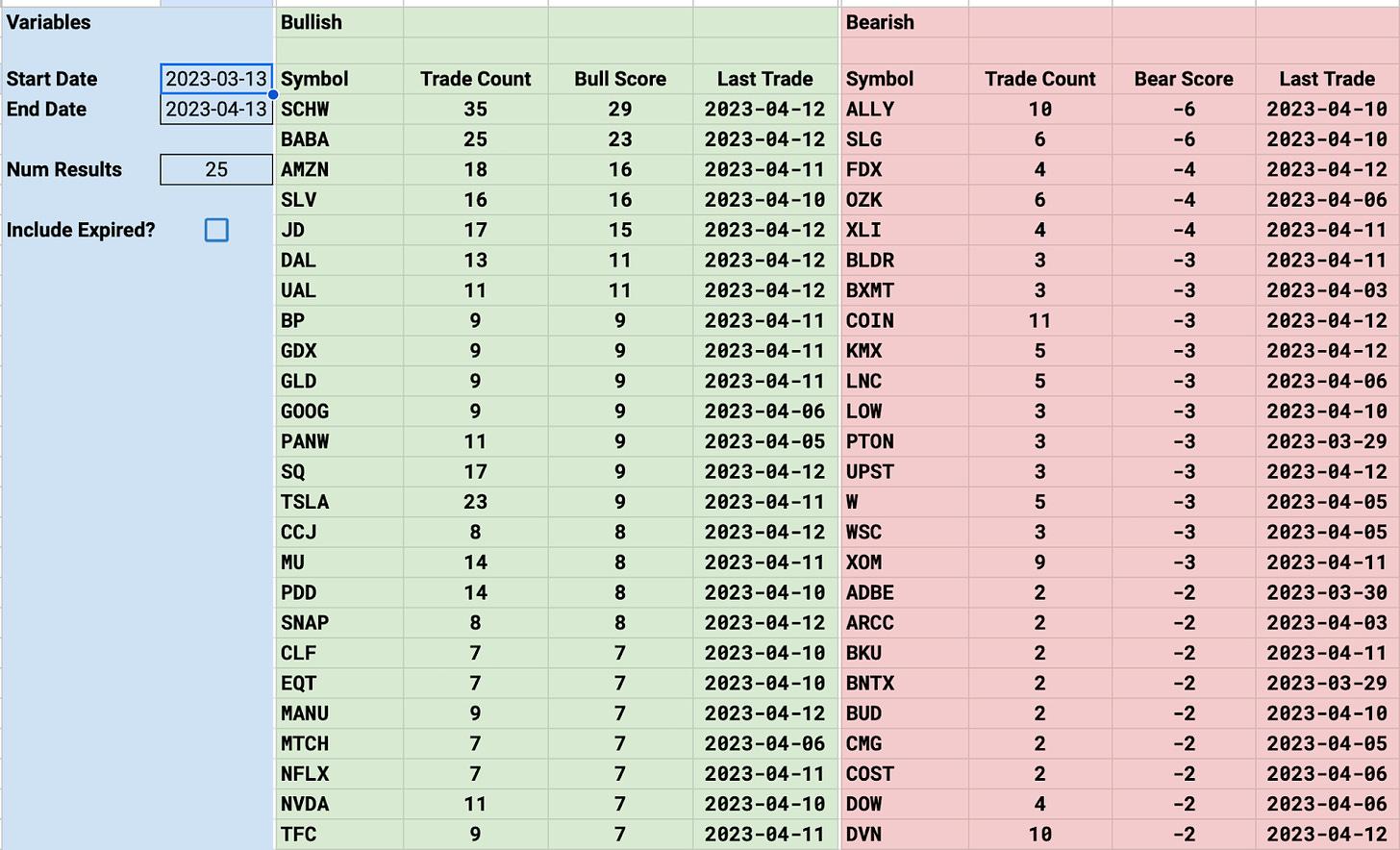

Having my custom database allows me to share with readers every day not only a list of the day odd action, but also share trends over multiple timeframes ie weeks, months,etc. Something like this is simply just taking all the unusual trades I input into my database to give me a bull/bear score which is just a net of all the trades. This gives me an idea of pockets of emerging strength which allows me as a trader to attack areas of strength as they are gaining steam. What you can see below is a screenshot I took of the trends I am seeing over the past month (the timeframe is on the left). You can see the total amount of unusual action I’ve noted and the net of them. I don’t know anyone who uses anything like this – it is all my own modeling after years of working with this data and wanting something customized for my own needs:

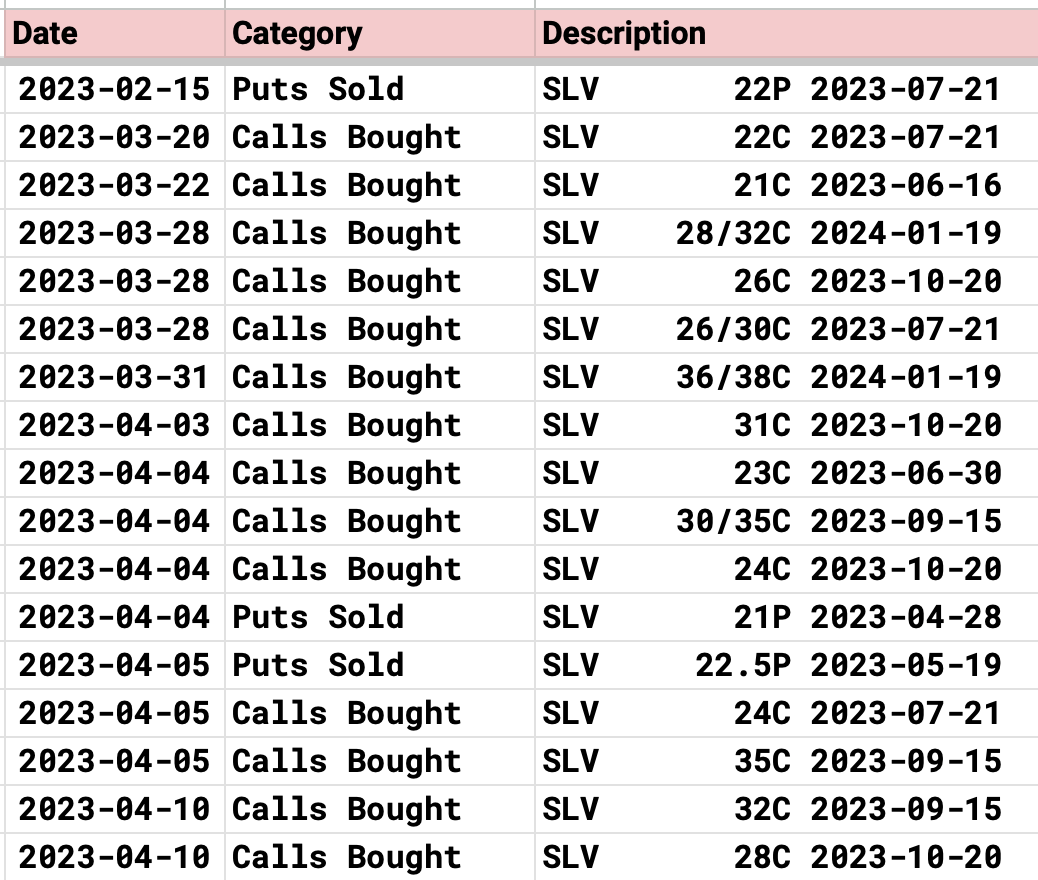

As you can see above something like SLV has been trending hard for the past month, and if you look Silver has had quite a run, I can then search my database ticker by ticker to see all the trades that my parameters caught and for SLV this is what it shows. This allows me to see pockets of demand for the equity from institutions, and it helps guide me in my decision-making in terms of what levels I want to sell puts at.

That’s an interesting strategy. How much of your portfolio do you use for this? Do you have any exposure to passive index funds? Something we are always curious about while interviewing fund managers is how much of their own portfolio is with their fund.

When I retired, obviously protecting my assets was the number one objective. I am younger so I have a long time to go. Obviously, I could go back to work whenever, but that isn’t the goal – so the first thing I did was to invest the bulk of my capital into some NNN properties. I wanted a really hands-free experience, I know lots of investors prefer single-family or multifamily, but NNN offers lower returns in return for longer-term corporate-backed leases and a mostly hands-off experience. I would say probably 60% of my portfolio is commercial real estate. I would say another 30% is in various equities and private investments, I do not own any passive funds, and lastly, 10% or so is in my trading book that I focus on every day.

What made you get into investing and what’s your investment strategy? Which industry do you focus on? Would you consider yourself a long-term or short-term investor?

I got into investing at maybe 14 years old. I had an older cousin who was my big brother so to speak, he was a stockbroker back in those days and he would always work with me when he was in town visiting. He helped me buy my first stocks. He helped me learn a lot about the market. I was always fascinated with his nice cars and as a little boy who loved cars, I wanted to do whatever it took to get something like that so I listened intently to everything he would teach me.

What’s my investment strategy? If I had to explain it, I would say it is basically taking all the available data known to investors using options flow, along with technical analysis to model direction, and then selling puts into strength in an effort to generate income. That sounds like a lot but I sell puts because I always want to enter equities lower. Why would you pay full price ever for a stock? Even Warren Buffett sells puts to enter trades. The way I model data is simply an effort to find equities that institutions are buying and then selling puts lower, to try and ride the wave so to speak.

“Fundamentals drive stock prices, that couldn't be further from the truth, what drives stock prices is simply, is someone buying it.” – Can you explain this further? Also, if this was the case, why is someone like Warren Buffett extremely successful while we don’t have any comparable in the day trading world?

As for the second part, there are many comparables in the trading world that blow away Warren Buffett, I wouldn’t call it the “day trading world”. Look at guys like Jim Simons, Ken Griffin, Steven Cohen, and many more. Their returns are amazing but Buffett has definitely done it for longer so he is more prominent. But there are plenty more active managers who have significantly higher returns, though not everyone has access to capital like Warren Buffett.

What drives a stock price is the amount of buying going on, that’s it. Look at something like NVDA – fundamentally it doesn’t make sense and a lot of short sellers have learned a hard lesson this year trying to use fundamentals to justify their trade. Stocks don’t have to make sense short term, if they did, we would have an efficient market, but we don’t. We have a market driven by trends in the short term. If the fundamentals of the company you’re looking at are as good as you think they are, these funds and their armies of number crunchers will have established a position long before retail at home is all I’m saying. In the end, these funds and their positioning are what drive markets and my objective is trying to align my positioning with them.

What are some of your favorite ideas on your radar now? (Long/short companies or industries)

As a trader, that isn’t something I think about. Trends are constantly changing and new sectors of strength are always emerging. There is always a bull market somewhere and my focus is on finding and utilizing all the data that is out there. In terms of my long-term investments and the themes I’m interested in…