Investor Interview with Matthew Tuttle

Interview #8: Going against the grain with Matthew Tuttle

Welcome to investor interview #8. I’m putting together this series to bring you diverse experiences and perspectives from other investors.

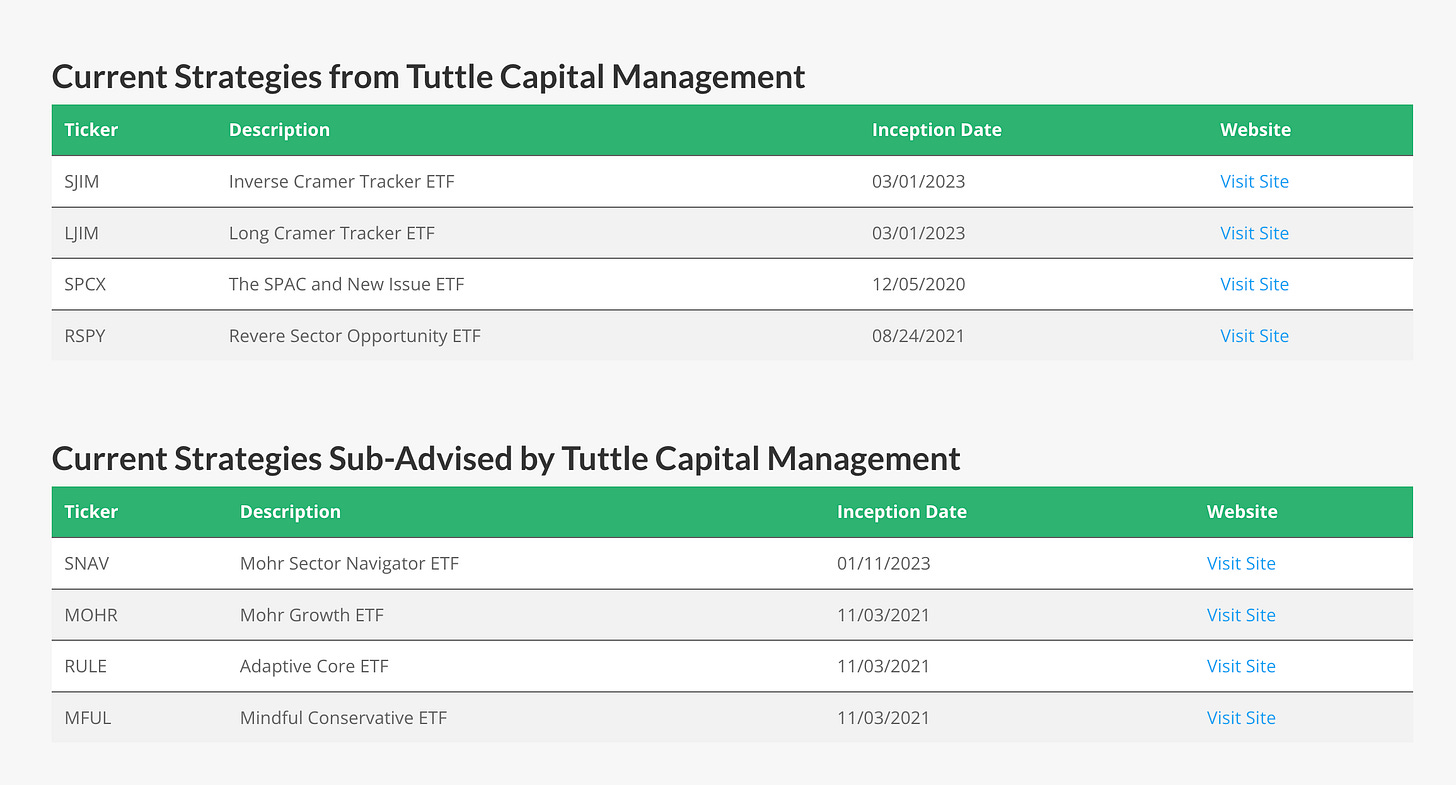

This week’s guest is Matthew Tuttle, CEO & CIO at Tuttle Capital Management. Matthew has been managing money since the mid-80s and now oversees 8 different ETFs with $350M+ in AUM. Tuttle is famous for going against trends and was successful with his anti-ARK ETF returning 100% in just 5 months. He is hoping to replicate these results with the recent launch of the Inverse Cramer ETF.

You can follow his thoughts or connect with him on Twitter.

Hi Matthew, thank you for taking the time to do this interview. Excited to have you here! Can you please tell our readers a little more about your background and also about your investment firm Tuttle Capital?

I've been managing my own money since the mid-80s. I started on Wall Street in 1991 and worked for a bunch of different brokerage firms, insurance companies, and in 2003, ended up forming my own wealth management firm.

In 2012, other wealth managers started asking us if we could manage money for them and we formed a money management firm. Finally, in 2015 we started launching ETFs and have been doing that pretty much ever since. Right now we manage about $350 million in eight ETFs and got a bunch of other things we're planning on launching over the next couple of months.

Great. Out of the eight ETFs, we could see that you completely manage four of them and the other four, you partially manage. How does that work?

One of the things we do is to help other people who have great ideas launch ETFs. There are 5 that we are helping out on and in 4 of them, I am the sub-advisor.

We're always looking to partner with other investment managers who have interesting ideas. So we have always got a bunch of that stuff on the drawing board.

Something we are always curious about while interviewing fund managers is how much of their own portfolio is with their fund.

I've been trading since the mid-80s and I spend a lot of time trading my own account. I have got probably 10% of my portfolio on SJIM, which is our inverse Jim Cramer ETF, and the rest of the portfolio I actively trade.

Right now, I am sitting on a lot of cash and some small positions. What I've been doing lately is buying gold miners, shorting REITs, and shorting regional banks. We launched SARK, which is the inverse Cathy Wood (ARK), which we're not involved with anymore, but I actively trade in and out of that.

Overall, I would say that I have around 10-20% of my portfolio in our ETFs, and the rest I actively trade.

Got it. So what’s your investment strategy in a nutshell?

It very much depends on the environment — I'm more comfortable as a short-term investor. But you know, if we get a period where the markets are ramping up, I just buy stuff and sit on it.

Right now I am a short-term investor. I prefer counter-trend types of methodologies of buying weakness and selling strength. But again, if we get into a trending market, I will go back to being a trend follower. It just really depends on what's going on in the marketplace.

Does that mean that almost all of your portfolio is composed of individual positions?

Yes. It's all individual positions. I just sold all my gold miners recently because I didn't think that they should be going up that much. The only thing I had is I've got a bunch of puts on some regional banks and some REITs. I am long few companies. Overall, I've got about 12 positions right now.

Can we discuss a bit about how you finally came to this strategy? You have been investing for 30 to 40 years — how did it change over time?

The strategy has obviously changed a lot over time. When I started out in the 80s, companies were getting taken over. Then the strategy was pretty simple — You hear a rumor, and you know, you buy it, and then you wake up the next morning and find out it’s being taken over and it’s up 40%.

One of the best learning experiences I had was when that changed in the 90s. I was still trying to do what worked in the 80s and ended up losing a lot of money. My biggest loss was in 1991, when I was still trying to buy things on takeover, speculation, and the whole takeover boom was over. I then realized, alright, I gotta get smarter about what I'm doing. And from there, it's just been a constant and continual learning process.

What would you say are your top three long ideas or short ideas right now?

A quick note from MS — We first did the interview on April 12th and Matthew mentioned that he was still skeptical of regional banks and was short Metropolitan Bank ($MCB). As of today, the stock was down 20%! We reconnected with Matthew and here are his current positions.

I am still short a couple of regional banks, but I think the easy money is now over and you have to be very cautious on these trades.