Investor Interview with Jacob Rowe

Company in focus: ASP Isotopes (NASDAQ: ASPI)

Hi there,

In our last survey, we found that 41% of our readers’ main portfolio strategy is buying and holding individual stocks. The most common suggestion when asked how we can improve Market Sentiment was to introduce a section where you can get exposure to new companies and industries.

To do this, we are interviewing some of the top hedge fund & mutual fund managers to dive deep into their highest conviction ideas. These investors have already spent weeks and months building conviction in their idea before investing.

With that, we are interviewing Jacob Rowe this week, founder of Rogue Funds, a small hedge fund based out of North Carolina focusing on value-oriented and special situation stocks.

Quick Facts

Fund manager: Jacob Rowe

Fund: Rogue Funds

Established: Q2 2023

AUM: ~$2 million

Unaudited returns (net of fees since inception): +57% (S&P 500: +38%)

Company in focus: ASP Isotopes (NASDAQ: ASPI 0.00%↑)

Hi Jacob, thank you for doing this interview. Can you please tell our readers a little more about your background and how you started Rogue Funds?

Sure thing. I started investing when I was 14 after reading 'You Can Be a Stock Market Genius' by Joel Greenblatt – that's what kicked everything off for me. Like many investors, I tried my hand at swing trading early on, but that didn't work out so well.

After graduating with a mechanical engineering degree and working in aerospace for a bit, I started building a track record portfolio in 2022. Things went well, and by May 2023, I was ready to launch the fund. While I was supposed to start with five investors, I ended up launching with just one who put in $100,000. From there, we've grown to manage a bit over $2 million today.

By focusing on distressed opportunities and spinoffs, we aim to identify companies that are undergoing significant changes and offer the potential for high returns. Our approach is characterized by a concentrated portfolio of high-conviction investments, backed by rigorous research and analysis.

We take a value-oriented approach, seeking to purchase assets at a price lower than their intrinsic value, and holding on to them until their value has been realized. Since our inception last year, the fund has returned 57.4% compared to the 38% return of the S&P 500.

Congratulations on your success. Why did you go with a hedge fund model? Why not an ETF?

I’ve always wanted to run a hedge fund. I think the fee base for performance is a lot friendlier, whereas most ETFs are just an allocation game. You just try to get a large allocation subset. With ETFs, you also have to deal with redemptions — I've never had a redemption – all my investors have stuck with me. I’m going on a year and a half now and I’ve had exactly one investor that said in a few years they might need a redemption.

Also, by running a hedge fund, I can have a personal relationship with my investors that I can’t have with ETF holders. This helps when I am making a new investment and makes it easier to convey all the risks associated with that investment.

Great. What’s your research process like? How is your filter set up to find distressed opportunities that traditional investors miss?

My research process starts with several screeners, including low price-to-sales ratios and a modified version of the magic formula. Being a smaller fund gives me more flexibility, which allows me to be highly selective. I'm not looking for modest returns like one or two-baggers over five years – I'm searching for potential 20x returns.

I review thousands of companies, and over time, I've developed the ability to quickly eliminate opportunities that don’t meet my strict criteria. This efficiency comes from evaluating companies based on their valuations, growth prospects, and other key metrics that align with my investment goals.

What’s the most interesting idea on your radar now?

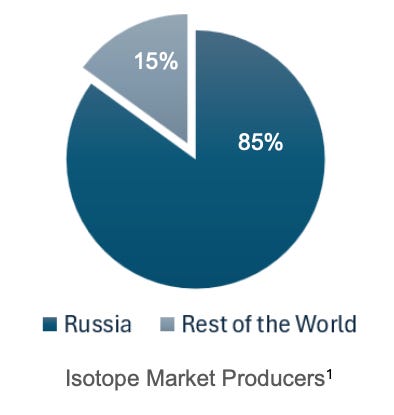

Our highest conviction position is ASP Isotopes ASPI 0.00%↑ , a nuclear enrichment company that I believe is significantly undervalued even after its recent price appreciation. The company operates in a critical space where Russia has historically dominated the market since the '90s when they flooded it with enriched materials from decommissioned nuclear weapons. With Russia now facing U.S. sanctions, there’s a major supply gap emerging.

Congratulations on making that call. I saw you were one of the first to analyze the company in September, and it’s now up 278% in 2 months! Can you explain what the company does in simple terms? Is it still a good opportunity?

Let me break down what they do in simple terms. Take carbon for example – every carbon atom has 6 protons, but it can have different numbers of neutrons. Carbon-12 has 6 neutrons, Carbon-13 has 7, and Carbon-14 has 8. These different versions are called isotopes, and adding those extra neutrons changes the physical properties of the atom.

To see how valuable this process is, a kilo of Carbon-12 (Charcoal) only costs $1. But a kilo of Carbon-14 costs $24 million!

The challenge is that useful isotopes are incredibly rare in nature - sometimes only one in a trillion molecules. ASP Isotopes’ job is to increase the concentration of these valuable isotopes. They do this using two technologies: one that's like a super-fast centrifuge, and another that uses lasers to identify and extract specific isotopes.

Deep Dive into ASPI Technology — Corporate Overview Deck

As for the valuation, even at the current market cap of $500 million, I think we’re still in the early innings. Their biggest competitor, Centrus, won’t be producing HALEU (High-Assay Low-Enriched Uranium – The fuel used in new nuclear reactors) until 2032, and they need billions in capital expenditure. ASP only needs $100 million per plant and could be up and running by 2027. This gives them a potential five-year monopoly in a rapidly growing market.

The recent 200% jump was primarily driven by two events:

Proving their laser enrichment technology works (which was a huge technical risk that's now behind us) — Source

Securing a contract with Terra Power — Source

These developments significantly de-risked the company, but I believe the market still hasn’t fully appreciated how important eliminating the technology risk was. With revenue expected to start flowing in Q4, a potential HALEU license coming soon, and their capital-efficient approach, I think they could reach a billion-dollar valuation much sooner than most expect.

What's your hypothesis on valuing the company given that it’s pre-revenue with a $500M market cap?

At the end of the day, valuation is an estimate of future cash flows. I mean, that's what it is. Anyone who says they can put a solid number on a pre-revenue company is a liar – just outright. Unless there are already contracts in place, which doesn't always mean anything either, you should always play it safe on your valuation until that revenue starts coming in and you can actually see it.

That said, what makes ASP unique is the multiple paths to significant revenue. Once they start uranium enrichment, they could go from zero to $300 million in revenue almost overnight. Paul (the CEO) expects 70% gross margins across the board, which makes sense given what we see from other enrichers and the fact that they're the only ones who can do a lot of these isotopes right now.

Their capital efficiency is also a huge advantage – they need $100 million per plant versus billions for competitors. And much of this capex isn't even coming from them – Terra Power is paying for their HALEU facility, which significantly reduces the risk.

You also have to consider the macro backdrop where Russia's been basically monopolizing enrichment since the '90s. Now with sanctions, Western companies are scrambling for alternative suppliers. ASPI is positioned to be one of the few viable options, especially in the HALEU space where they could have a five-year head start on competition.

The recent technology validation and Terra Power contract weren't just good news – they fundamentally de-risked the business. I think the market hasn’t fully processed how significant these developments are.

Personally, when we were looking into the company, we found three red flags:

The company seems to be spreading itself too thinly across various industries by trying to get into nuclear energy, medical applications, AI Silicon chips, etc.

The CEO diluted once again after repeatedly stating that they were done with dilution and would raise future funding via debt.

There was a short report by J Capital in Feb ’24

What do you make of this?