International Diversification

Importance of investing outside your home market.

In the 2018 Berkshire Hathaway shareholder letter, Warren Buffett brilliantly explains how “The American Tailwind” was instrumental in the success of Berkshire.

On March 11th, it will be 77 years since I first invested in an American business. The year was 1942, I was 11, and I went all in, investing $114.75 I had begun accumulating at age six. What I bought was three shares of Cities Service preferred stock. I had become a capitalist, and it felt good.

Buffett highlights that if he had invested it into a no-fee S&P 500 index fund, it would have grown to $600K+ by 2019 — a gain of 5,288x in 77 years.

Our country’s almost unbelievable prosperity has been gained in a bipartisan manner. Since 1942, we have had seven Republican presidents and seven Democrats.

In the years they served, the country contended at various times with a long period of viral inflation, a 21% prime rate, several controversial and costly wars, the resignation of a president, a pervasive collapse in home values, a paralyzing financial panic and a host of other problems. All engendered scary headlines; all are now history.

Christopher Wren, architect of St. Paul’s Cathedral, lies buried within that London church. Near his tomb are posted these words of description (translated from Latin): “If you would seek my monument, look around you.”

Those skeptical of America’s economic playbook should heed his message.

Yet, in the end, Buffett acknowledges the importance of investing in other countries apart from the U.S. [emphasis by author]

There are also many other countries around the world that have bright futures. About that, we should rejoice: Americans will be both more prosperous and safer if all nations thrive. At Berkshire, we hope to invest significant sums across borders.

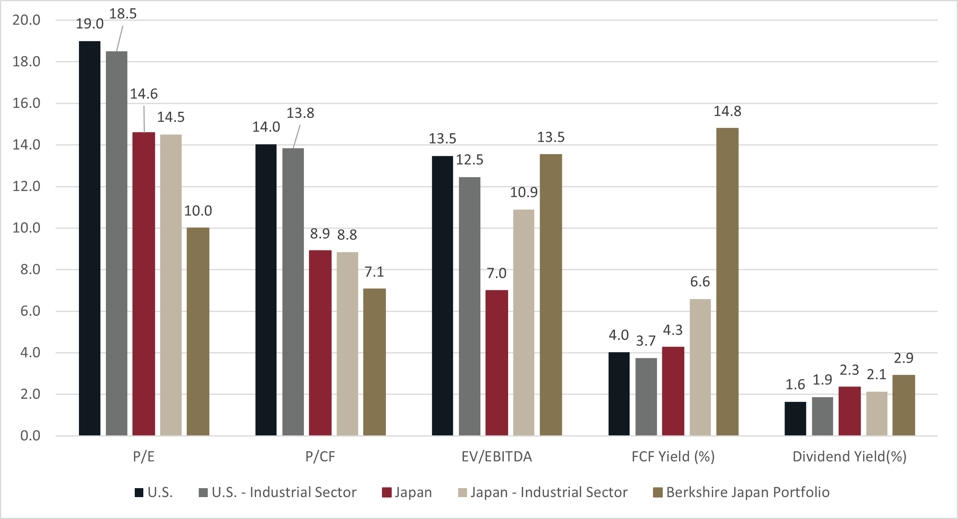

Buffett soon walked the talk by buying up shares in a series of Japanese Conglomerates1 in 2020. Charlie Munger went on record to say that the investment was a no-brainer as they could borrow money in Japan for as low as 0.5% and then buy high-quality stocks that paid 5% dividends2.

If you’re as smart as Warren Buffett, maybe two or three times a century, you get an idea like that. — Charlie Munger on Berkshire’s Japanese investments.

The investments have paid dividends — literally! In just 3 years, the $6 billion investment has grown to $17 billion, a ~3x return in 3 years. Buffett remains a value investor at heart, investing in companies trading at a sizable discount to U.S. and Japanese market valuations.

In investing, there is a well-known phenomenon known as the home country bias. It’s where investors favor companies from their own country and tend to be either pessimistic or indifferent toward foreign markets. Expecting your country to outperform all other markets is definitely patriotic, but it sure isn’t rational.

The U.S. Story

For a generation of investors, investing in the U.S. market has been a winning experience:

The U.S. accounts for 58% of the world stock market capitalization.

From 1900 to 2021, the U.S. market outperformed non-US by 2.1% annualized3.

For the last 12.6 years, US equity has outperformed International equity.4

This incredible outperformance has caused virtually all U.S. investors to overweight U.S. stocks in their portfolios. This continuous outperformance and the expectation of outperformance have caused some worrisome trends to emerge:

U.S. equities are now trading close to ATH vs the Rest of World stocks.

BofA recently put out this stunning chart showing how U.S. equities are trading compared to Global equities. The U.S equities reached an all-time high against the “rest-of-world” stocks in Oct’22, and now we are trading at 5% below the high.

This outperformance over the last 15 years is chiefly due to a dominance in technology and large amounts of liquidity injected by the central bank during the COVID-19 crisis. If we are betting on the U.S. market, it means that we are betting on continued U.S. exceptionalism.

2. Tech stocks contribute more to the S&P 500 than they did during the dot-com bubble

As of Oct’30, 2023, the S&P 500 gained 8.5% this year, but the equal-weight S&P 500 index was down 4%! The top 7 tech stocks5 are contributing close to 28% of the index, and investor excitement about Artificial Intelligence is driving up tech stocks. The last time we saw such a significant outperformance in tech stocks was during the dot-com bubble.

3. The majority of U.S. market outperformance comes from valuation change and not fundamental improvements.

AQR research recently published a report in which they argued that the U.S. outperformance was mainly driven by valuation changes rather than fundamental improvements in the economy [emphasis ours]

Since 1990, the vast majority of the US’s outperformance versus the MSCI EAFE Index (currency hedged) of a whopping +4.6% per year, was due to changes in valuations.

The culprit: In 1990, US equity valuations (using Shiller CAPE) were about half that of EAFE; at the end of 2022, they were 1.5 times EAFE. Once you control for this tripling of relative valuations, the 4.6% return advantage falls to a statistically insignificant 1.2%.

In other words, the US victory over EAFE for the last three decades—for most investors’ entire professional careers—came overwhelmingly from the US market simply getting more expensive than EAFE.

Almost everyone considers the U.S. to be the best market, which in turn pushes the prices of securities upward. As value investing teaches us, winning simply because the other person is willing to pay more is not a sustainable strategy.

Finally, if you invest long enough, you will encounter one of the stock market's most pervasive phenomena: Mean Reversion. No outperformance lasts forever, and markets tend to revert to their long-term averages over time. Going back two decades, we can see that international markets outperformed the U.S. market from 2003 to 2011. If history is any guide, it’s only a matter of time before international stocks have their day in the sun.

In the words of Howard Marks from his book “The Most Important Thing”: [emphasis ours]

I think it’s essential to remember that just about everything is cyclical.

There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.

Emerging Market Advantages

Given the recent underperformance, the expected premium for emerging markets is now at an all-time high6. In addition, while emerging markets have been riskier in the past, the volatility has come in line with developed markets.

One key benefit of having a global portfolio is reduced volatility. Things that might affect your country uniquely7 would have a lesser impact on your portfolio. Based on a study by Vanguard, you would have reduced volatility as you increase your allocation to non-U.S. stocks.

Buying low and selling high?

In addition to a high probability of mean reversion for the U.S. stocks, companies outside the U.S. are well-positioned to take advantage of their strong domestic economic growth. According to the IMF, 12 countries are estimated to have a higher growth rate than the U.S.

Over the long term, most markets improve your purchasing power.

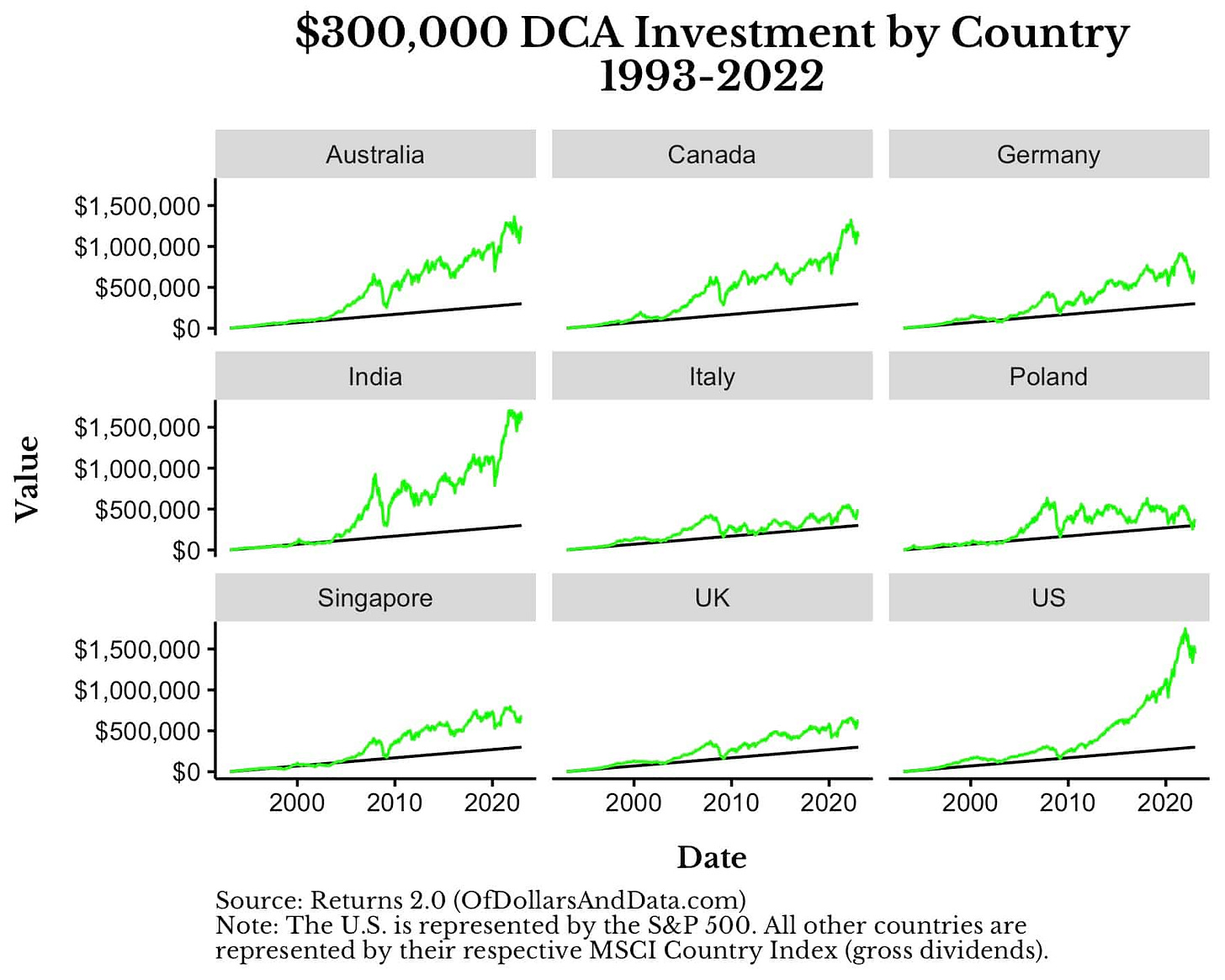

Our friend Nick had done this excellent analysis where he calculated how one would have performed if they had invested $10K per year over a 30-year period from 1993 to 2022 for nine different markets. Every single market outperformed sitting in cash, and all countries except Poland were able to grow their purchasing power after adjusting for inflation.

A hedge for the bad times

As we highlighted last month, the expected future returns of the U.S. market are overly optimistic with respect to loss probabilities as we only backtest the U.S. market data — an easy data and survivorship bias.

If you do the 30-year analysis just using the U.S. data, you will come to the conclusion that there is just a 0.5% chance that the U.S. will experience something similar to what occurred in Japan. But, if you consider other developed markets throughout history, the probability jumps to 9%!

Diversifying internationally is the best way to avoid country risk.

The only free lunch in finance

Nobel Prize-winning economist Harry Markowitz, the father of Modern Portfolio Theory, famously called diversification “the only ‘free lunch’ in finance.” For someone who has invested only in the U.S. market, it has worked for a very long time (~30 years running now). This is longer than most investors’ time horizon; most now believe this is simply how the world works. It’s easy to just recommend the U.S. market.

But, in investing, doing the right thing is usually hard. You don’t tend to win long-term by doing the same thing as everyone else — You will have years or even decades where the domestic market outperforms the international one. But putting all your eggs in one basket has rarely worked out for anyone in investing.

Thank you for reading and being a continued supporter of Market Sentiment.

Data, references, and footnotes

We are not sure if anyone else thought of this idea before, but Munger said that only Berkshire, with their excellent credit, could get the loan at such a low rate.

We could do that…Nobody else could. It looked attractive at half a percent, but you couldn’t get it. Berkshire with its credit could. — Munger on Acquired podcast

On a 5-year monthly rolling return (source — Hartford Funds)

Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla

Re-Emerging Equities — AQR research

Tax changes, Political turmoil, new regulations, etc.