We are publishing this without a paywall. Please share with a friend.

Diversification almost always means having to say you’re sorry. — Brian Portnoy

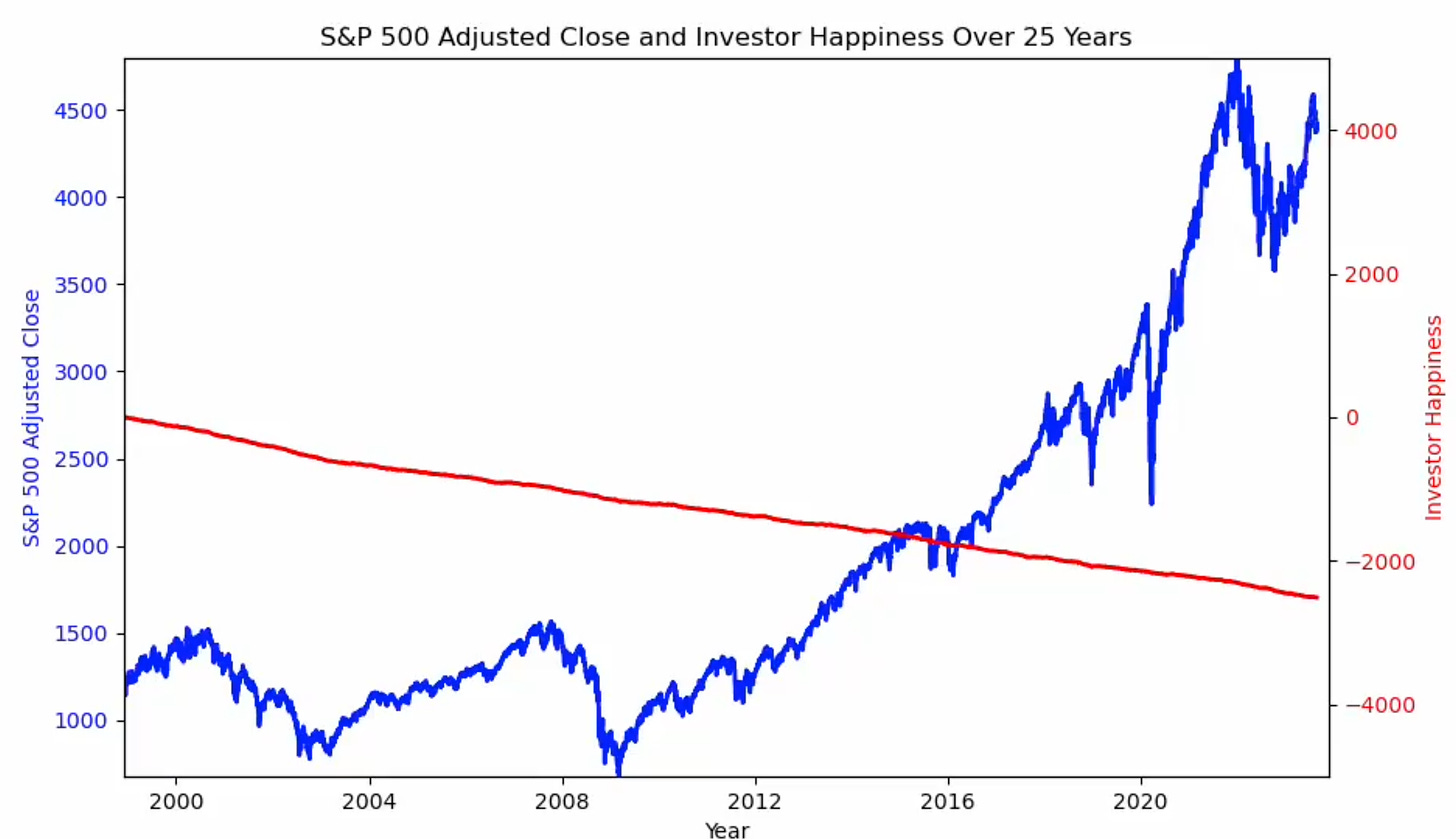

If you follow the stock market daily, you will encounter an interesting behavioral economics phenomenon called loss aversion. It’s where a loss is emotionally more severe than an equivalent gain. For instance, the pain of losing $100 is far greater than the joy gained in finding the same amount.

Based on the loss aversion theory, if we assign a +1 happiness score if the markets end in green and a -2 if the markets end in red (The 1:2 ratio is often considered the thumb rule), we see that someone who checks the market daily will be deeply unhappy — irrespective of their overall gains.

Given how unhappy you can be with a winning asset like the S&P 500, you can imagine how much regret you will have while holding a loser.

The “problem” with diversification

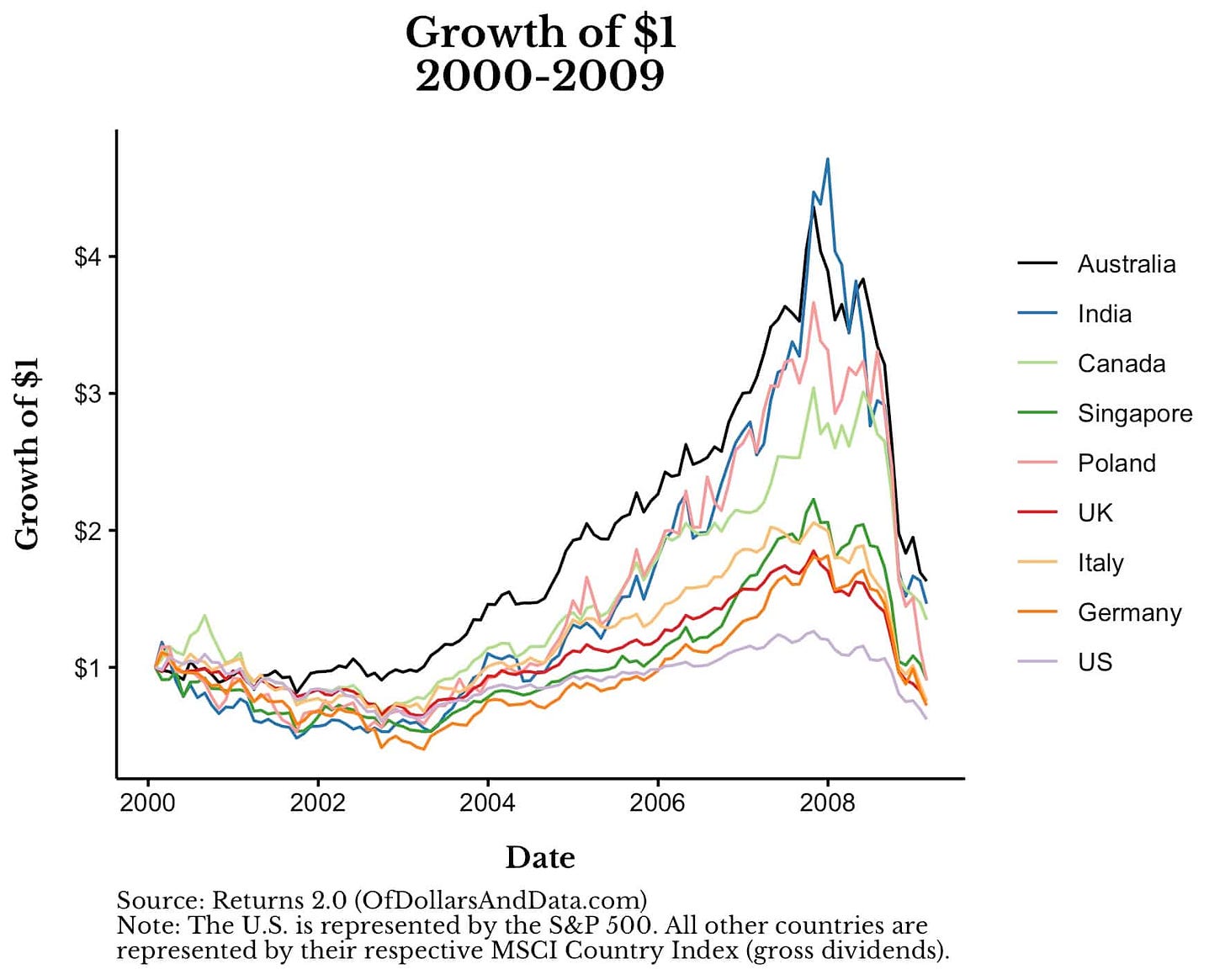

For someone who has been investing since the Global Financial Crisis of 2008, any sort of diversification away from the U.S. market has implied that you will have underperformed the S&P 5001. Over the last ten years, everything from small-caps, bonds, international stocks, gold, etc., have all underperformed the S&P 500 — by a considerable margin.

Effective diversification of your portfolio means that there will always be a part of your portfolio that’s underperforming. Diversification doesn’t feel very good when one part of your portfolio is outperforming — especially when it is something like the S&P 500, which you know you should have been overweight on.

But this is a classic hindsight bias. By the end of the crisis in 2009, the U.S. market had experienced one of its worst decades ever and underperformed almost all other markets. After experiencing this, it’s irrational to assume that one would have gone with a 100% S&P 500 for their portfolio.

Take a look at the asset return map for the last ten years. Commodities went down 23% in 2015, only to go up 10% in 2016. China's market was up 54% in 2017 (top-performing asset class) and then went down 19% the next year to be the worst-performing asset class.

If you have a diversified portfolio, it’s guaranteed to have outright losers in it every year. Even U.S. large caps are not immune to this.

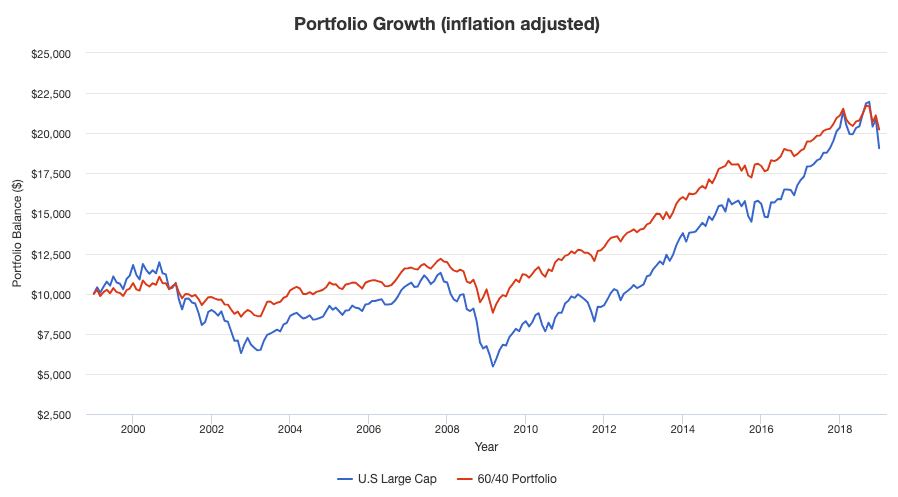

Consider if you went 100% equities in 1999. You would have underperformed the 60/40 portfolio for the next 20 years while having a much higher volatility.

Granted, very few investors stop with a lump sum investment, but you have to ask yourself if you have the patience to see an investment through a multi-decade period of underperformance.

No Pain, No Premium

For someone who only has invested in U.S. stocks, it has worked for a very long time (~15 years now). This is longer than most investors’ time horizon, and most now believe this is simply how the world works. It’s easy just to recommend the S&P 500.

But, in investing, doing the right things is usually hard. Diversification is hard because there will always be something in your portfolio that underperforms. This is a feature, not a bug.

NASA calculates the number of single-point failures for every mission. It’s the part or process of a system that, if it fails, will stop the entire system from working. The idea is to minimize the number of single-point failures and to keep redundancies where the risk is the highest. Similarly, we should always evaluate our portfolios for weaknesses.

After all, putting all the eggs in one basket has rarely worked out for anyone in investing.

Further Reading

Diversification Means Always Having To Say You're Sorry — Brian Portnoy

The Downsides of Diversification — Nick Maggiulli

The Diversification Drag — Ben Carlson

Unless you diversified into Bitcoin, which is a story for another day.

Diversification in the past 10 to 15 years, has evolved / morph driven by globalization, has led multinational corporations to adopt increasingly sophisticated financial strategies to expand their presence across diverse geographies. These strategies include not only tax deferral and foreign exchange management but also complex mechanisms such as bond issuance and transfer pricing. By leveraging these tactics, companies enhance their financial performance, thereby offering investors diversified exposure across various geographies and financial instruments within the market.

In my opinion there is no need to open positions in several locations to get exposure to different markets and instruments.

when there is no data to assess your prompt payments thats what you get. 😏