Welcome to the latest weekly Ideastorm. Academic research is years ahead of the industry, and Market Sentiment curates the best ideas from thousands of research sources and distills them into weekly actionable insights.

Join 35,000+ others who receive curated financial research.

Actionable Insights

GPT 3.5 model successfully summarized and identified corporate risks from earnings call transcripts. The risk exposure measures were associated with significant alpha unexplained by the five-factor asset pricing model.

Analysis of lifetime returns of 26,000+ stocks listed in the U.S. market from 1926 to 2019 shows that only 4% of stocks outperformed the value-weighted market index, and the top 1,000 companies accounted for all wealth creation.

Building on the above trend, the JP Morgan group analyzed the factors leading to a business failure and found that most business failures were outside the management's control.

Researchers generated abnormal returns by detecting outliers and out-of-pattern trades made by insiders from 1.2M corporate insider transactions.

1. Using Gen-AI to uncover corporate risks

Alex G. Kim, Maximilian Muhn, Valeri V. Nikolaev (University of Chicago) — open access

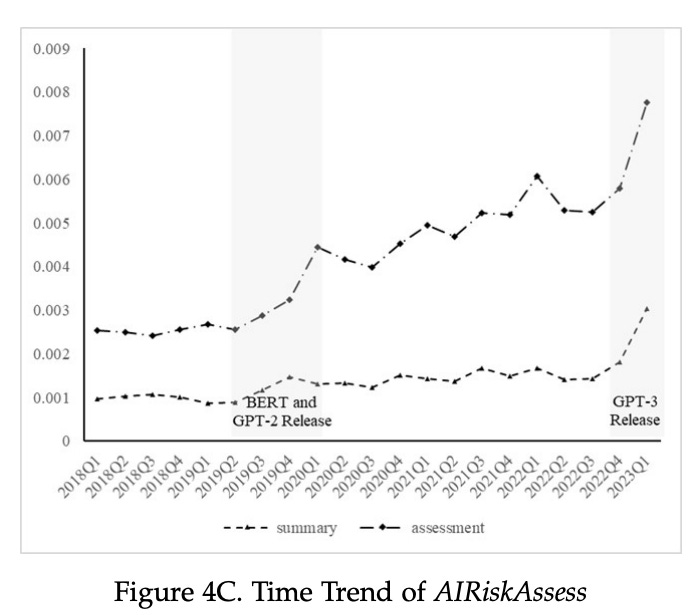

The study leveraged large language models (GPT-3.5) to identify and analyze critical aspects of emerging corporate risks using earnings call transcripts — with respect to Political, Climate-related, and AI risks.

More than 69,000 earnings call transcripts were used in the study, and the GPT model was instructed to make human-readable risk summaries (focusing solely on the transcripts) and risk assessments (incorporating the general knowledge of the AI). The summaries are then converted to a quantitive value.

A higher-risk exposure was directly correlated with a higher market return that was unexplained by the existing five-factor asset pricing model

Political risk — Annualized alpha of 5.28% (not statistically significant)

Climate risk — Annualized alpha of 6.72% (statistically significant)

AI risk — Annualized alpha of 6.36% (statistically significant)

2. Long-run outcomes in the U.S stock market

Hendrik Bessembinder (Journal of Investing) — open access(1), open access (2)

Hendrik evaluated the lifetime returns of every U.S. common stock (26,168 firms!) from 1926 to 2019 and benchmarked it against 1-month treasury bill returns. The results highlight how difficult it is to pick the right stock:

The U.S. stock market increased shareholder wealth by $47.4 trillion — but the majority (57.8%) of companies underperformed the treasury bill during the same time period.

Picking a single stock underperformed the value-weighted index in 96% of simulations and the equal-weighted index in 99% of simulations.

Only 4% of stocks outperformed the value-weighted market index, and 0.3% (86 stocks) collectively accounted for more than half of the entire wealth creation.

Finally, the top 1,000 stocks (~4% of the entire base) accounted for all the wealth creation — i.e., 96% of the stocks just matched or underperformed the treasury returns.

[emphasis by author]

The results presented here reaffirm the importance of portfolio diversification, particularly for those investors who view performance in terms of the mean and variance of portfolio returns.

The results here focus attention on the possibility that poorly diversified portfolios will underperform because they omit the relatively few stocks that generate large positive returns.

Actively managed portfolios tend to be concentrated. The results, therefore, help to explain why active portfolio strategies most often underperform benchmarks (such as the S&P 500 return) that are constructed as average returns across securities available for investment.

3. Problems with concentration

JP Morgan Asset Management — open access (2021 report, 2014 report)

In their 2021 report, JP Morgan examined the critical reasons businesses fail. They found that more than 40% of the companies in Russell 3000 experienced a catastrophic stock price loss (70%+ decline in stock price) and that the median return for an individual stock in Russell 3000 was negative. Only ~10% of the companies generated more than 500% return over the 40-year period. (1980-2020)

The interesting finding was that most business failures were outside the management's control.

[emphasis by author]

Great fortunes have been created by visionaries who seized a unique opportunity and work singlemindedly to realize their ambition. Concentration is an effective engine of wealth creation: In the US, the top 10 of the “Forbes 400” also made their fortunes through concentration.

As difficult as it is to build a company and amass wealth, it is just as difficult to keep fortunes aloft. Our analysis (and others before it) demonstrates the hard reality that, all too often, continued concentration may ultimately destroy wealth.

4. Is there alpha in corporate insider trading?

Fevzi Esen, Emrah Bilgic, Ulkem Basdas — not open access

The Random Walk theory states that stock prices are random and implies efficient markets. One exception to this can be company insiders — due to the nature of their work, they possess information unavailable to the public.

Researchers investigated more than 1.2M transactions from 2010 to 2018 and used outlier detection to identify out-of-pattern trades made by insiders. The findings indicated that all insider transactions generated significant abnormal returns, with outlier transactions having higher returns.

In general, studies suggest that corporate insiders were willing to exploit their preferential and superior access to non-public information in order to get an unfair informational advantage over the market.

Besides, the profits generated by insiders (i.e., the returns of these trades) were found to be statistically significant

How to detect illegal corporate insider trading? - Fevzi Esen et al.

If you found this recently, the poll is closed. Here is the deep-dive:

Corporate Insider Trading

Jeff Skilling was the CEO of the Enron Corporation during the infamous Enron scandal. The company was considered one of the fastest-growing and most innovative companies in the U.S. However, in reality, they had artificially inflated revenues and hidden losses using massive accounting and corporate fraud.

Just a reminder that Market Sentiment is now fully reader-supported. A lot of work goes into these articles, and if you enjoyed this piece, please hit the like button and consider upgrading your subscription to access all issues.