Welcome to the latest Ideastorm. Market Sentiment curates the best ideas and distills them into actionable insights. Join 39,000+ others who receive curated financial research.

Does a higher market share imply a higher profitability?

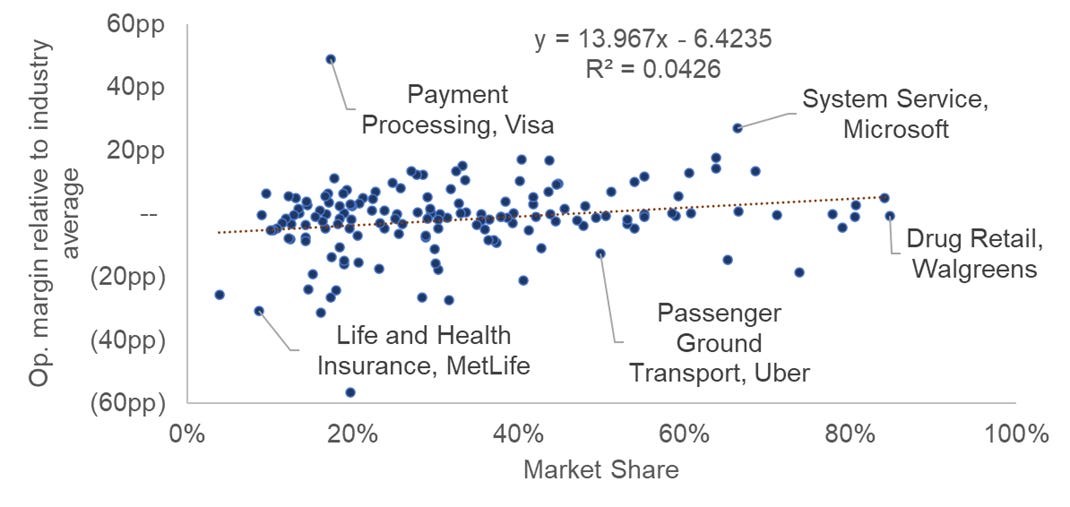

Verdad recently did an interesting analysis where they took all public and private firms in the U.S. and Canada with <$10M in sales and compared their operating margins to the industry average. Conventional wisdom will have us believe that firms with a higher market share can generate a higher profit as they have more pricing power. However, the data shows that market share is not a consistent indicator of firm performance.

Anti-capitalist academics would love to believe that profits derive from companies exploiting their market power, but the reality is companies earn their market share through a better product, better pricing, better service, or a litany of other firm-specific strategic decisions.

It's actually quite rare to see the number-one company in an industry earning far above-market profit margins. In our dataset, 90 companies—or 56% of the industry-leading public firms—have margins below the industry median. — Daniel Rasmussen

While these findings are focused on the financial metrics (and include private companies), our previous analyses have found that monopolies and wide-moat companies that are publicly listed outperform the market.

Investing in Monopolies (Market Sentiment 2022 Analysis)

Monopoly companies on average returned double that of the S&P 500 benchmark during the same period. 65% of the companies in the list beat the benchmark and only in 2 cases would you have lost money on your investments (yes, even adjusting for inflation).

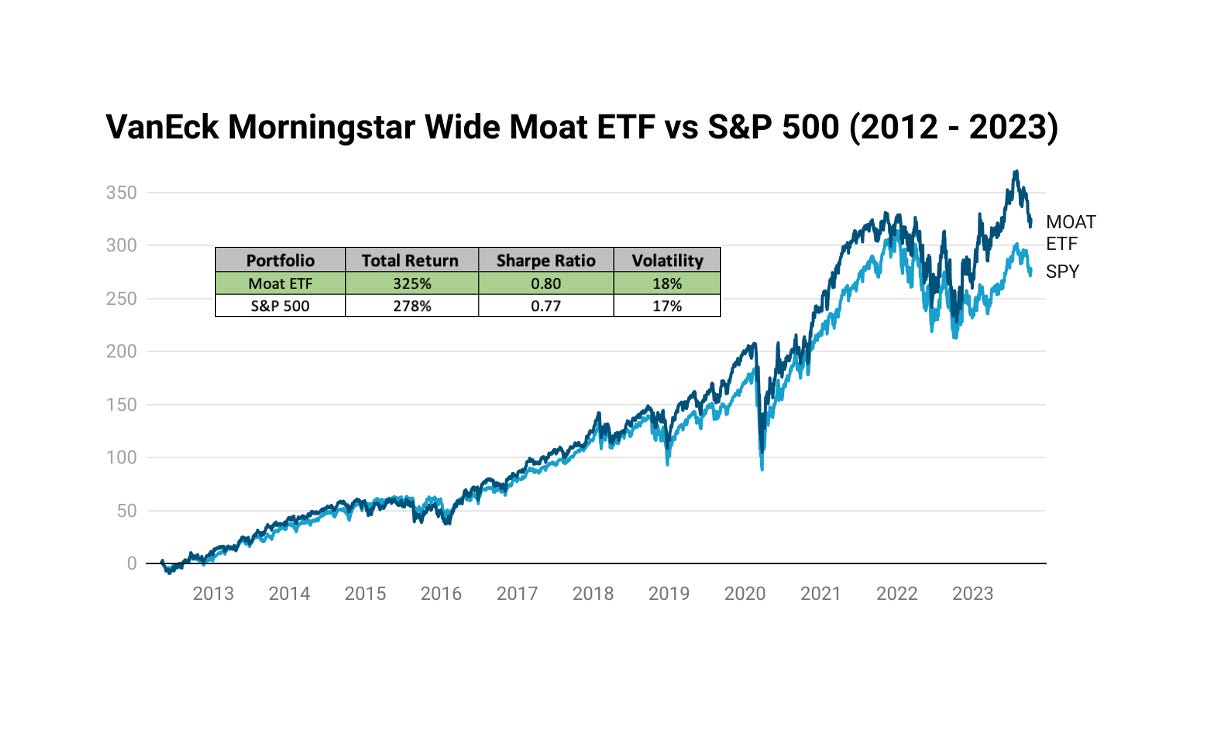

Investing in Moats (Market Sentiment 2023 Analysis)

We benchmarked the performance of the Wide-Moat ETF against the S&P 500, and the ETF managed to give a higher risk-adjusted return against the S&P 500 over the last ten years.

While overall margins might not be proportional to market share, it’s possible to pick companies with high market share and margins. A classic example is Apple, which has one of the highest gross margins among technology companies, often exceeding 40% (For reference, Dell is 25% and HP is 20%).

Source: Market Share & Profitability (Verdad Analysis)$1 is $1

If you have spent time on fintwit, you know how popular the dividend investing community is. This is surprising, considering that it was proven in 1961 that dividends are irrelevant to stock returns.

A big conflict to the dividend irrelevance theory is the S&P 500 Dividend Aristocrats Index. It tracks S&P 500 companies with minimum liquidity requirements with a 25+ year record of growing dividends. Several ETFs track this index, and there is data to show that the index beats the S&P 500 by about 0.74% annually since 1990.

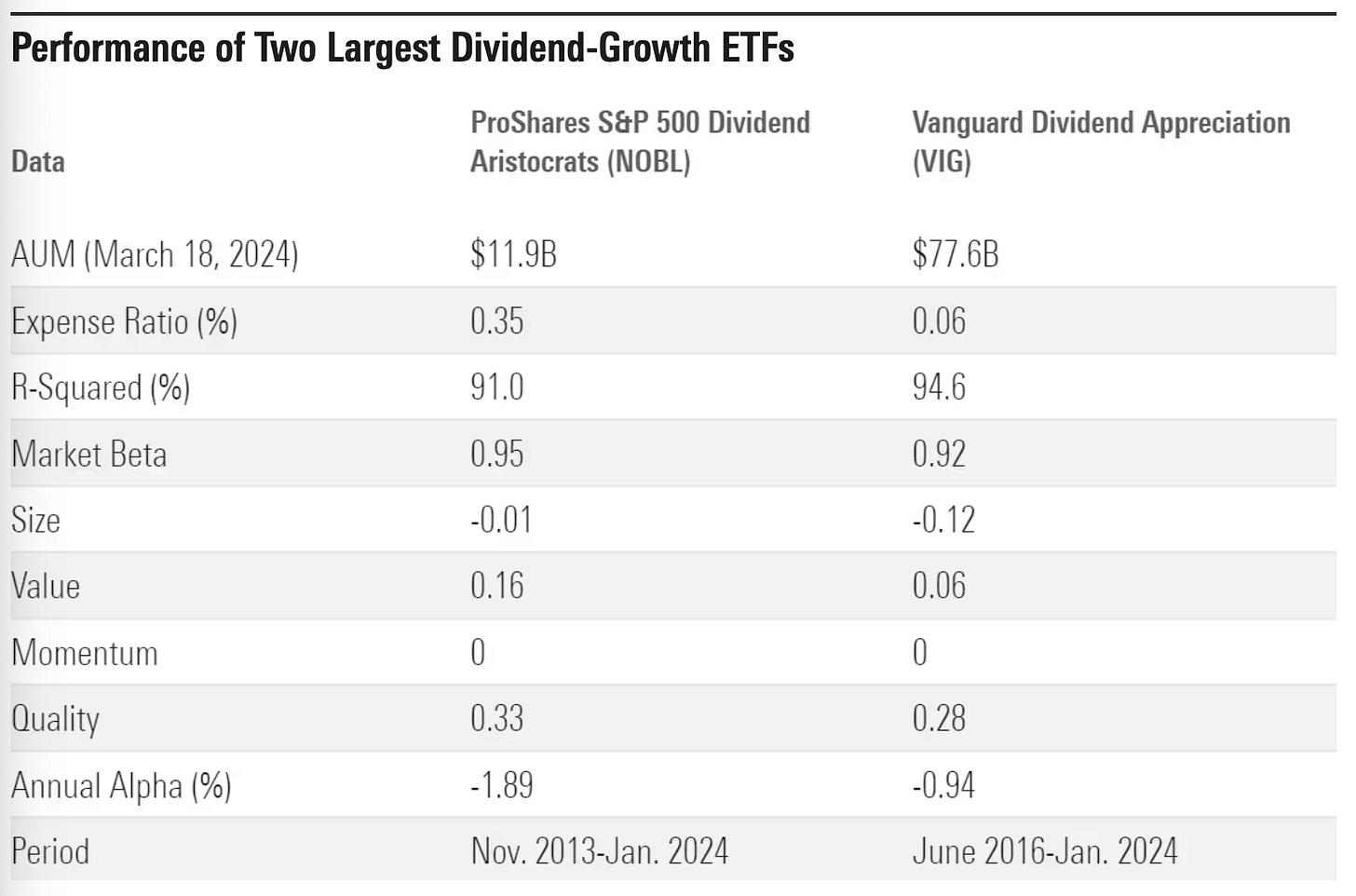

To dispel this argument, Larry Swedroe recently analyzed the performance of the two largest dividend growth ETFs: ProShares S&P 500 Dividend Aristocrats ($NOBL) and Vanguard Dividend Appreciation ETF ($VIG).

He found that

Both funds had large and statistically significant exposure to the quality factor

Both had economically significant negative alphas — meaning the funds were subtracting value for the investors.

The evidence is consistent with economic theory: There is nothing special about dividends, with the returns of dividend-paying stocks well explained by exposure to common factors. Dividends are neither positive nor negative, at least from a pretax perspective.

And if you consider taxes, it’s all downhill from there:

The tax consequences for all taxpaying shareholders are inferior – usually far inferior – to those under the sell-off program. Under the dividend program, all of the cash received by shareholders each year is taxed whereas the sell-off program results in tax on only the gain portion of the cash receipts.

- Warren Buffett on dividends, Berkshire Hathaway annual report 2012

Dividends are objectively more tax-inefficient as they are taxed at Federal income tax rates, which are almost always higher than capital gains taxes.

Source: There Is Nothing Special About Dividends (Morningstar)All that glitters

Gold has been on a tear this year, with spot prices rising more than 13% in 2024 (compared to 9% for the S&P 500). The demand is so high that Costco sells $200 million in gold bars monthly. As if that’s not enough, Meb Faber recently posted an incredible stat that’s hard to believe.

The universal investment benchmark is the 60/40 portfolio of stocks and bonds. What if you replaced the bonds entirely with gold....crazy right?

Turns out it makes no real difference.

This begs the question, is there an investment case for gold?