Ideastorm #10

Investing in superstar brands, Motley Fool performance, Gold as a safe haven, and more...

Welcome to the latest Ideastorm. Market Sentiment curates the best ideas and distills them into actionable insights. Join 38,000+ others who receive curated financial research.

Actionable Insights

Investing in companies having a large number of trademarks relative to their valuation consistently outperformed the market over the last 50 years.

Political leaning of fund managers significantly affected their investment trends during Presidential elections.

Motley Fool managed to beat both the S&P 500 and the S&P 400 midcap benchmarks from 2015 to 2022 in risk-adjusted returns.

Gold performed as a safe haven asset in 60 of the 68 markets under analysis.

1. Alpha from superstar brands

The U.S. Patent and Trademark Office (USPTO) maintains a record of millions of trademarks registered over the past two centuries. Kai Wu of Sparkline Capital recently used AI to classify this data and backtest the performance of companies with the maximum number of trademarks compared to their market capitalization.

As we can see, small brand-intensive firms like WWE, Brunswick Corporation, and Polaris are the companies that have the maximum # of trademarks related to their valuation. Backtesting these firms with high trademark yields shows that the strategy has outperformed the market consistently over the last 50 years (an average of 3.6% per year!).

Source: Superstar Brands (Sparkline Capital)

2. Political beliefs and Institutional investors

It’s well known that the political party you lean toward has a significant impact on your household beliefs and economic decision-making (especially during election years). But is the same applicable to institutional investors?

To test this, researchers collected information about 2,000+ active mutual fund managers and their self-reported political affiliation. Using the 2020 election results, they found that after Joe Biden (Democrat) won, funds managed by Democratic managers purchased a higher share of equity when compared to other funds. The same effect was observed in the 2012 election when Barack Obama won and was reversed when Trump won in 2016.

The political beliefs of mutual fund managers matter for high stakes investment decisions. Mutual fund teams respond in different ways to the same political event depending on whether the fund team has more Republicans or Democrats.

We show that Republican-led mutual fund teams increased their equity share by nearly 2% in the wake of Donald Trump’s surprise 2016 election to the presidency. This effect is an order-of-magnitude larger the response of households to the same shock.

The wedge between Republican and Democratic portfolios not only persists but also grows over time. — William Cassidy and Blair Vorsatz.

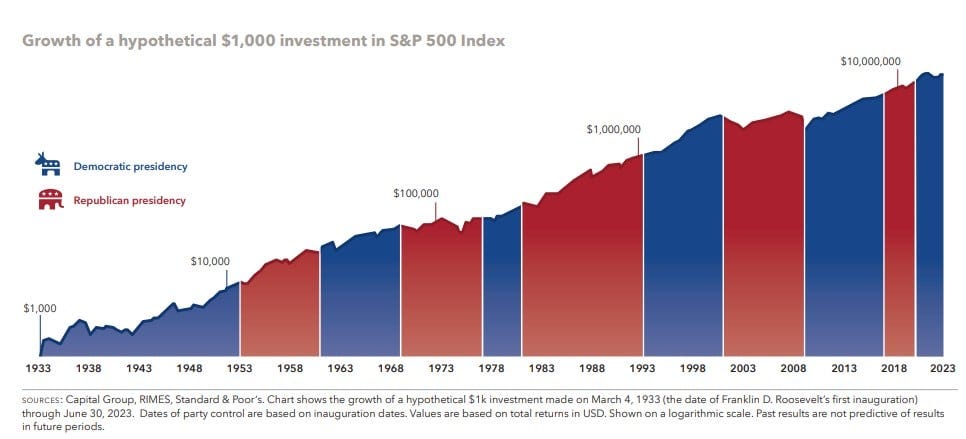

As a side note, if you are a long-term investor, who is in power does not matter for the stock market returns. If you don’t believe us, here is Buffett on why it’s important not to have a political view when investing.

I have lived under 15 presidents and invested under 14 of them. 7 were Republicans, and 7 were Democrats. You do not want to have a political view in investing. If you were a staunch Republican or a staunch Democrat, through these 77 years, you would have missed out on a lot of the party.

Source: Partisanship and Portfolio Choice: Evidence from Mutual Funds

3. Does Motley Fool’s stock picks beat the market?

Motley Fool has more than a million customers paying for their stock picking services. Arguably, their most popular service is the Motley Fool Stock Advisor, where they issue 2 stock picks every month. They heavily push the performance of their overall portfolio, which has substantially outperformed the S&P 500 since its inception.

While this outperformance is certainly correct, the thumb rule when someone tells you about their market-beating portfolio is that you should always ask for risk-adjusted returns. You can always “beat” the market by investing in high-growth or meme-stock companies when the times are good, but the drawdowns and swings will be brutal. This is where the Sharpe ratio comes in.

The Sharpe ratio compares the return of an investment with its risk. It's a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk, rather than investing skill.

Generally, the higher the Sharpe ratio, the better your investment. To test the Motley Fool’s portfolio, we distributed $10K equally to all the active recommendations they had as of 2015. We then compared the returns generated by that portfolio against the S&P 500 and the S&P 400 Mid Cap.