How to hedge against inflation?

A deep dive into various methods with which you can protect your portfolio against inflation!

In my previous analysis one month back, I had given a primer on inflation and how it will affect stock prices. Given that the consumer prices have jumped 5% in May making it the fastest increase since summer of 2008 and the Federal Reserve’s June meeting is expected to conclude on Wednesday (they might tweak their forecasts for interest rates), I figured it was time to dive deep into

What are the best strategies we can use to hedge against inflation?

Data:

Even though slightly higher inflation was expected due to the stimulus checks and the reopening of the economy, the current trends are worrying. As we can see from the chart, even though inflation trends till March were manageable, now it seems to be picking up pace. May’21 CPI is almost 2.8X May’19 CPI. (2020 CPI was down mainly because of the strict lockdowns following the pandemic)

Keeping an inflation-hedged asset class in your portfolio during this transitionary period can work out well in case we go into a steeply rising inflation. This brings us to what are the

Best asset classes that can be used as a hedge against inflation

Stocks

Stocks are a good long-term investment to hedge against inflation. Even though you might have a short-term impact due to the uncertainties surrounding inflation, great companies would be able to pass on the increasing price to the customers. You must look into companies with pricing power (think Apple) to raise prices on their customers without significantly affecting their overall sales. One important type of stock to avoid is high-growth stocks as the valuation of the company is heavily based on future expected cash flows and the increasing inflation rates will reduce the current value of the company thereby detracting a lot of value investors.

Commodities

Commodities are raw materials used for creating the products consumers buy. It provides both inflation protection and diversification to your portfolio. Because commodities are “real assets”, they tend to benefit from rising inflation. As demand for goods and services increases, the price of those goods and services usually rises as well, as do the prices of the commodities used to produce those goods and services. As you can see from the below chart, commodities have a weak correlation to both Equity and Bond markets.

Real Estate and Real Estate Investment Trusts (REITs)

Real estate income rises with inflation. As inflation rises, so do property value and the amount you can charge for rent. Given the normal forms of real estate requires high initial investments, an alternative could be REITs. A REIT consist of a pool of real estate (commercial, residential and industrial properties) that pays out dividends to its investors.

According to this study conducted by the Wharton School of Business

Consumer price inflation (CPI) in the U.S. was 13.5% during 1979, the worst year since 1947. Dividend income from REITs traded through the stock exchange averaged 21.2% that year, and total returns amounted to 24.4%, more than preserving for REIT investors the purchasing power that they had lost to inflation.

Treasury Inflation-Protected Securities (TIPS)

TIPS are a type of treasury security issued by the US govt which is indexed to inflation. As inflation rises, TIPS adjusts in price to maintain it’s real value. To make it simpler, if you invest $100 in TIPS and the coupon rate is 1%, if there is no inflation you will receive $1 for coupon payments that year. If inflation rises by 5%, they will adjust the coupon so that you get $1.05 instead of the $1.

International Diversification

There are several well-developed economies outside the US that do not rise and fall in relation to the US market (Italy, Australia, etc.). Adding stocks/bonds from these or similar countries can help hedge the portfolio against sudden local swings.

Gold

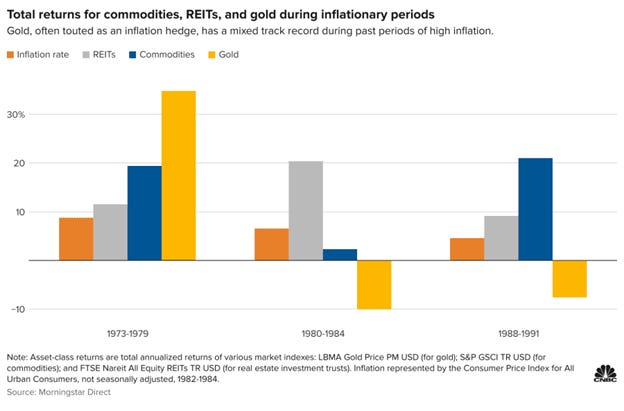

Gold is often touted as one of the best methods to hedge against inflation. I have kept it last as the performance of gold during previous inflationary periods has been spotty.

Gold investors lose 10% on average from 1980-84 when the annual inflation rate was 6.5% and lost 7.6% from 1988-91 when inflation was 4.6%. But the performance of gold was spectacular during the period of 1973-79(when the inflation was 8.8%). The mixed record raises some concerns about using Gold as a hedge against inflation.

Conclusion

Whether we like it or not, inflation is here. The only question right now is whether it’s going to transitionary as the Fed’s explained or whether the rising prices of consumer goods will finally force Fed to increase their interest rates. The Federal Reserve meeting that concludes today will finally give us some insight into how they are going to tackle the current spike in inflation. Whatever their decision may be, it’s a good idea to prepare some hedging strategies for your portfolio!

As always, please note that I am not a financial advisor.

PS: Let me know what you think. I read and reply to every response :)

I know you are not a financial advisor yada yada. But Can you give an example of the stocks for the long term? I can think of Apple, adobe, paypal...