Hold

Importance of holding through tough times

Welcome to the 700+ investing enthusiasts who have joined us since last Sunday. Join 23,361 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

This issue is brought to you by… The Entrust Group

Looking for unlimited control over how you invest your retirement money? Want to invest it in crypto, real estate, private equity, or even a racehorse?

With a self-directed IRA (SDIRA), you can. This individual retirement account (IRA) gives you the power to invest in an almost endless list of alternative assets. So if you want a portfolio tailored to your interests, expertise, and appetite for risk, an SDIRA could be the solution.

Want a portfolio fully invested in real estate? With an SDIRA, it’s yours. What about a mix of promissory notes and precious metals? You got it. And of course, if you want to self-direct your retirement funds in traditional markets, you can do that too.

Another bonus? Your growth could be tax-free or tax-deferred, providing certain conditions are met. The Entrust Group pioneered SDIRAs 40+ years ago and has over $4 billion in assets under custody.

They created a guide to walk you through the basics of SDIRAs. It covers how they work, benefits, investment options, and much more*.

*Disclaimer: Entrust does not endorse, recommend or advise on any investment product or service. Rather, Entrust provides the administration, information, and tools to make self-direction straightforward and compliant.

“Our favorite holding period is forever” - Warren Buffet

I have been investing for more than 6 years now and I have only sold my investments a grand total of one time. I thought I was the “buy and forever hold” type of investor but when markets were rallying to dizzying heights and making new ATHs almost every other day in 2021, I thought it made more sense to liquidate some of my investments to pay off my student loans.

I sold somewhere around Jul’21 - Even though it does look like a pretty good move now, I felt pretty stupid at that time since the market went on to rally another 10% over the next 5 months. As someone who does ‘optimizing’ for a living, I know that low-cost debt is great during periods of high inflation1 but I preferred the peace of mind of paying off my loan over a slightly better return.

While selling your investments certainly does make sense in some situations, panic selling during a rally or crash will hurt your long-term wealth creation. We all know that timing the market is an impossible task - let me show you why holding on to your investments as long as possible is the best decision!

Play the Long Game

Let me start with the story of the world’s unluckiest investor ‘Bob’.

Bob made his first investment in the beginning of 1973, right before a 48 percent crash for the S&P 500. Bob then held onto stocks after the drop, saving a total of $46,000, and not getting up the gumption to commit more savings until September 1987—right before a 34 percent crash. Bob then continued to hold tight, making only two more investments before retirement, which came right before the 2000 crash and then the 2007 crash!

Even after all these misfortunes, Bob actually made money. He turned his $184K invested into $1.6M → an annualized return of 9%. The simple secret behind Bob’s success is that he never sold his investments. While undoubtedly this is a hypothetical scenario and it does make sense to sell your investments in certain situations2, it does pay to hold on to your investments.

If you are still not convinced, consider this interesting study that was done by Blackrock which shows that the risk of losing money significantly reduces as you increase your holding period. We all know that the stock market has trended upwards long term - But buying S&P 500 and holding it for 10 years almost guarantees (95% probability) you a positive return and it’s a near certainty after 15 years!

Inflation & Sky-High Valuation?

One of the major reasons why investors are skeptical of investing in the current market even after a drawdown is because of the high P/E ratio. The current value of 32 is more than 2x the median value of 15.9. Add to this the high inflation and the ever-increasing rate hikes that we are facing now - it might seem that stocks might not return enough to justify the risk.

But, if you look at the past 140 years of data, we can see some interesting patterns. This excellent animation created by Nick is one of the best infographics that convey the impact of long-term holding (FYI, it’s a gif and it starts at “over 5 years”).

As you can see, in the beginning, there is a strong negative correlation between real return and PE ratio. This is excepted - If you buy an expensive stock (aka, high PE ratio), your future growth prospects are much lower than buying a value stock3. But as you keep holding, your real returns start increasing. After 15 years, no matter what PE ratio you bought into for the S&P 500, your real returns (returns after adjusting for inflation) turn out positive.

Don’t blindly HODL

One key thing to note here is that the above arguments are valid only for quality income-producing investments. You should not randomly buy a stock (cough.. AMC.. cough) and keep holding it in the hopes that one day it’s going to give you amazing returns. While we are on the topic,

My take on what drives HODL culture is the lottery mentality. People can’t shut up when they happen to own Tesla stock that’s up 400%. This feedback loop forces other investors also to pile into the same stock regardless of its current valuation. These investors are overpaying for the small chance of winning big with their investments. As with the lottery, 99% of the people would end up losing their money.

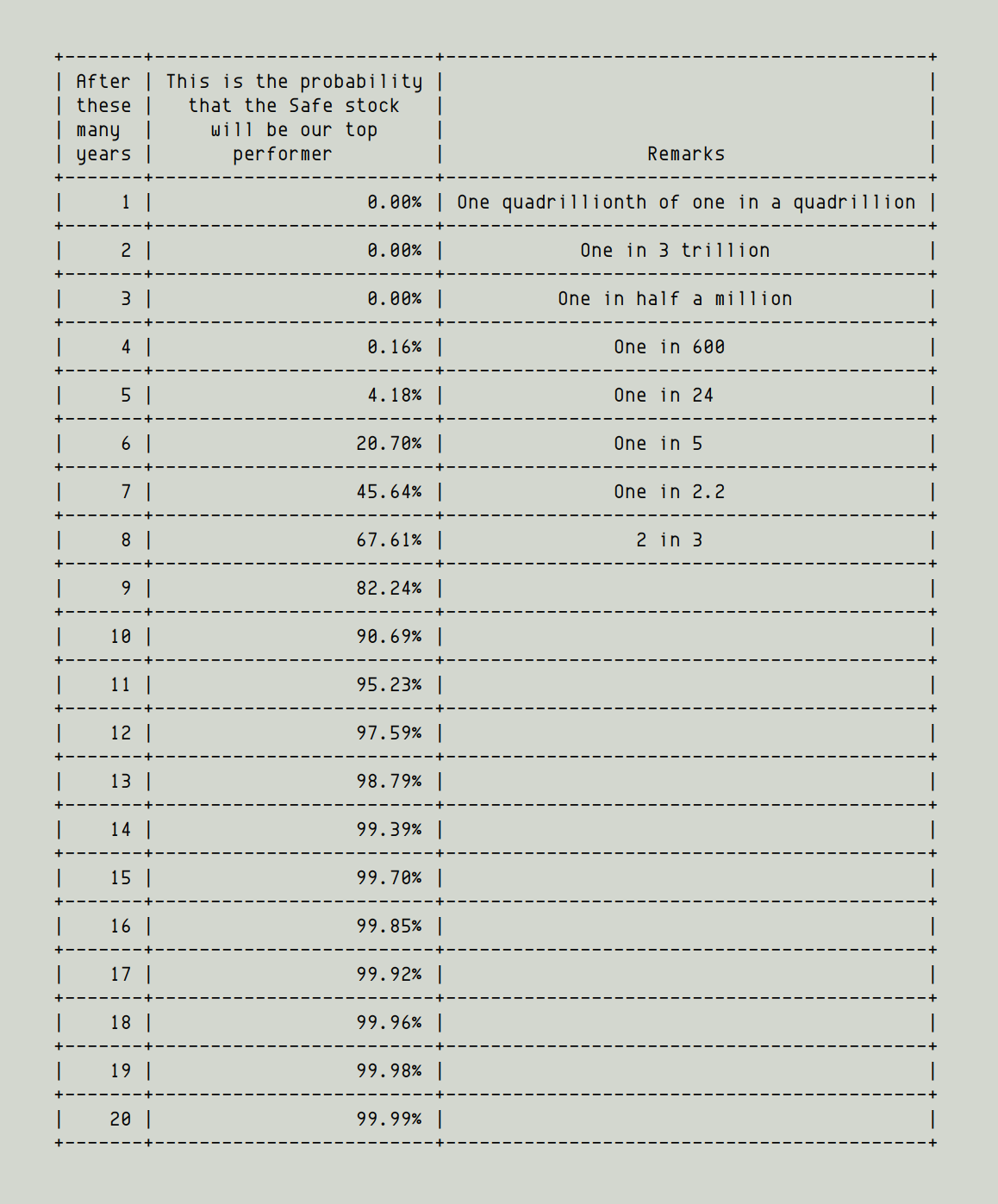

Here is one of my favorite thought experiments which shows that survival over the long term is much more important than higher short-term returns.

Out of these 101 stocks, which one do you think would be the best performing stock in a few years? In the first few years, our safe stock underperforms the risky stock that doubles in value every year. But as time goes by, the risky stocks start dropping off. After 10 years, there is a 90% chance that the safe stock will be the top performer and after 15 years, it’s virtually guaranteed that the safe stock is going to outperform the risky ones.

Some incremental benefits of holding long-term that I haven’t covered here are a lower tax rate on your gains and significantly lesser transaction costs. Staying invested also makes sure that you don’t miss out on the big moves in the market.

As Warren Buffet identifies in our opening quote, the best way to create massive wealth is to hold high-quality investments over a very long period of time. The strategy sounds simple but at the same time is extremely hard to execute when you have doomy news all around. It does pay to be boring.

Sit on your ass. You’re paying less to brokers, you’re listening to less nonsense, and if it works, the tax system gives you an extra one - Charlie Munger

That’s it for this week’s deep dive - Let me know what your take is in the comment section below

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

More Interesting Reads

The Commodity Report: If you are a commodities enthusiast, do check out the Commodity report by Luckas Kuemmerle - an independent commodity researcher specializing in the U.S market. I am a big fan as his research is very practical and is highly data and chart driven. It’s a must-read for every commodity and macro trader.

10-k Diver: The thought experiment in this article was directly taken from his Twitter account. 10-k Diver takes investing and finance concepts and breaks them down into long and interesting threads. There's very little bias - From Charlie Munger to Ed Thorp, Kelly criterion to Retained earnings, he covers it all.

Footnotes

If inflation is 7.5% and your interest rate is 1.6%, you make 5.9% returns by just not paying off your loan!

Rebalancing, buying a house, paying off high-interest loans, retirement, etc. - After all, you are investing to spend it at some point

This is because the company has to ‘grow into its valuation’ and then some to make profits over the long term.

Reading last article about gold investment of %30-70% and this one holding over 10-15 years. It's impossible to not grow your investment :) simple recipe. let's just stay invested, be boring and not greedy :)