Green paper is not evergreen. Gold is.

Dollars, euros, and yen can be printed at will; gold remains scarce.

Gold’s value isn’t just a product of tradition; it’s rooted in its unique physical properties. Unlike paper currency, gold is scarce. While over 200,000 tonnes of gold has been mined throughout history, the very act of acquiring and holding gold has historically been a difficult process — which is why it derives its value from its ‘proof of work’.

As Joe Weisenthal quotes in this speech,

One of the striking things about gold is just how incredibly hard it is to attain (and hold onto once you have it) and the different things you have to master to get gold.

To get gold, you

— Have to be good at warfare

— Be able to marshall an extensive human workforce to mine it

— Mastery of global supply and logistics routes

— Be able to command guards who will watch your gold, and not steal it

— Have the technical know-how to get gold out of the ground, which is expensive and

cumbersome. And so on…Gold, then, is a very specific proof of work. If you can get gold, you’ve proven that you have the ability to run a state or some state-like entity.

Its malleability allows it to be shaped into coins, jewelry, bullion, or stretched into a wire miles long. Most importantly, gold is incredibly durable — it doesn’t rust, corrode, or degrade over time, ensuring that a gold coin from ancient Rome still holds value today.

We have Gold because we cannot trust governments. — President Herbert Hoover

In 2024 alone, central banks scooped up 1,045 metric tons of the precious metal, marking the third straight year of 1,000+ ton purchases.

Investors, spooked by escalating geopolitical tensions from the unabating Russia-Ukraine war to Red Sea shipping disruptions, are piling in, too. With uncertainty running high, gold’s reputation as a “safe-haven asset” has never been stronger.

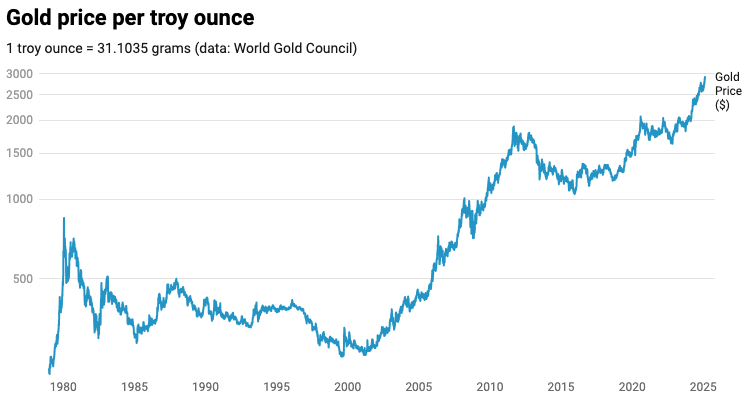

Flirting with the $3,000 per ounce mark, gold is having its moment. Historically, it's been a hedge against currency debasement: When central banks flood the economy with money, whether to stimulate growth or manage debt, currencies lose value.

Enter - gold. The ultimate anti-debasement asset.

While dollars, euros, and yen can be printed at will, gold remains scarce, maintaining its purchasing power over time. As our friends at Doomberg highlighted, an ounce of gold would have bought 690 hot dogs in 1906, and after more than 100 years, it would still have got you 675 hot dogs in 2024.

Gold often soars when inflation runs high. In fact, since the 1970s, when the U.S. abandoned the gold standard, the dollar has lost over 85% of its purchasing power, while gold prices have skyrocketed from $35 to over $2,900 per ounce today — an 84x increase.

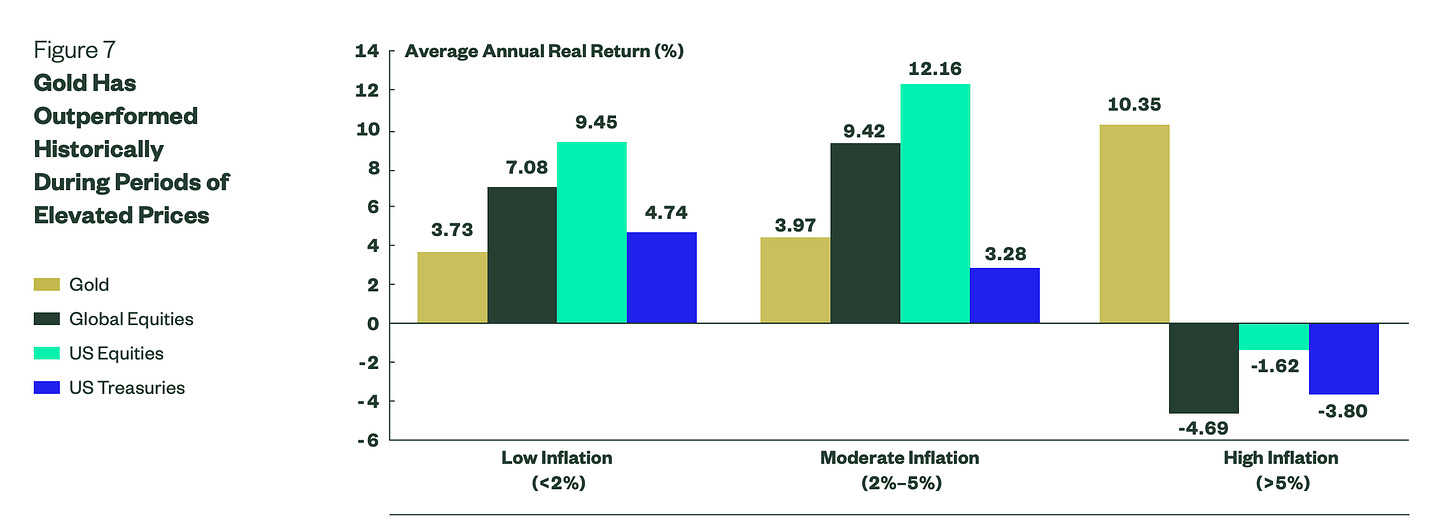

For decades, the stock market has been the go-to wealth builder, consistently outperforming most asset classes. But when inflation runs hot, the tables turn—and gold often takes the lead. Why? Because inflation erodes the real value of corporate earnings and compresses profit margins, making stocks less attractive.

Gold, on the other hand, thrives when traditional currencies lose purchasing power. Over the last 50 years, whenever US CPI has topped 5% year-over-year, gold has provided an average annual real return of 10.35% - over which period both global and US equities, as well as US Treasuries, fetched negative returns on average.

Gold as a portfolio tool

Gold is often a polarizing asset class and is rarely considered in some of the most popular portfolios. But when you look deeper, gold has all the makings for an excellent portfolio tool:

Gold has outperformed U.S. bonds, commodities, and global equities over the past 20 years.

Gold has zero correlation with both equities and bonds.

It’s an excellent crisis tool and has outperformed the equity market during periods of elevated volatility.

It’s highly liquid and lags only the S&P500 in daily trading volume.

Let’s dig in: