All that glitters

When to invest in gold

Welcome to the 550+ investing enthusiasts who have joined us since last Sunday. Join 22,657 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

“Gold is money. Everything else is credit.” - J.P. Morgan

When I was a naive little kid, I thought the best way to get rich was by finding a treasure map and setting off on an expedition to find a chest full of gold coins. That’s how the heroes always did it, striking gold and riding off into the sunset (Obviously, this was years before I heard about the stock market). But it’s not just me. Mankind has been fascinated with the shiny yellow metal for centuries. Even a brilliant scientist like Isaac Newton was no exception - he died of mercury poisoning in the attempt to turn lead into gold.1

Gold is so ubiquitous that it's a part of our language. You can strike gold with a good idea. The hottest trend in the market triggers a “gold rush” and investors with the Midas touch turn everything they touch into gold. Olympians win the gold medal. Black gold, Heart of gold, worth its weight in gold, gold medal, gold digger, golden anniversary, silence is golden... The list is endless.

But for all its fascinating properties, gold is a very polarizing topic in the investment community. There are some who swear by it (I know a friend whose portfolio is 100% gold) and there are others who think it’s just an overhyped story. So let’s look at all the data and try to figure out: Should you invest in gold? And if so, when and how much?

Gold: Money or investment?

Gold had been in use as money for a very long time, with some accounts taking it to the dawn of civilization itself. The metal has some properties that make it very suitable as money. It’s easy to shape, cut, carry, and it’s scarce2. Gold even bypasses the need for a counter-party to approve it, in some sense. But there’s one big problem with the concept of gold as “money” - The idea that the government won’t interfere. And unlike what I wrote in the Bitcoin article, I’m not even hypothesizing! FDR outlawed the personal possession of Gold during the Great Depression, and it was illegal to hold it as money. Bad news for all the gold maximalists out there.

But that’s actually where the story starts. You see, a commodity cannot function both as a currency and an investment - Currencies are liquid while investments are supposed to be stored away for the future. And indeed, it was only after the US went completely off the gold standard in 1971 that the price of gold started shooting up (even adjusting for inflation).

Since the unpegging of Gold in August 1971, its value has risen by 469%, which is a real return of about 3% per year. That doesn’t sound too bad until you compare it with the S&P500 which had a 2,248% return in the same period! (That translates to just 6% a year - compounding ftw).

There’s another problem with gold. Gold is very volatile, and the time in which you had invested would have made a huge difference. Somebody investing in the 1980s would have seen their investment crash and keep dropping for years while an investor in the 2000s would have felt like a financial genius. A lot depends on timing…

The wrong question

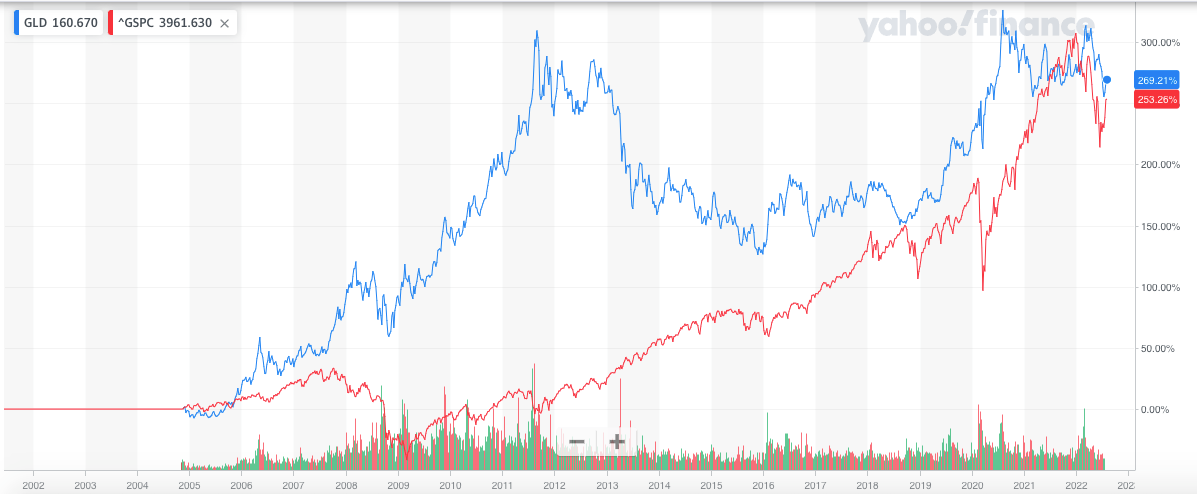

But maybe we’re thinking about this from the wrong angle. Just because someone invests in gold doesn’t mean that they’ll stop investing in stocks or other assets. Maybe what we need to see is how gold fits within a portfolio. Here are the prices of the GLD index fund which tracks gold price vs the S&P500 over the last two decades.

Notice something? Stocks and gold are almost completely uncorrelated. Both stocks and gold are volatile, but because their swings are not dependent, having a little of both in your portfolio might turn out to be a win-win situation. This is what portfolio expert William Bernstein recommends - Diversification among stocks, bonds, gold, emerging nation stocks, etc. leading to a higher return.

But let’s keep it simple.

I backtested the returns from a portfolio that had a mix of the S&P500 and GLD from Jan 2006 to now, rebalanced annually. We can change increase the proportion of stocks to gold and see the difference in returns. Along with that, we have the drawdown which shows the maximum amount that a portfolio can drop by, and the Sharpe ratio which measures risk-adjusted return. Ideally, we would want a lower drawdown and a higher Sharpe ratio.3

There’s a clear advantage to mixing gold and stocks - They achieve results that neither can achieve on their own. The sweet spot seems to be 10 to 30% gold.

10% gold has the best cumulative returns of 345.2% while having a lower drawdown than if you just held stocks.

On the other hand, 30% gold reduces the max drawdown from 55% to 38% and boosts the Sharpe ratio from 0.55 to 0.68 compared to a pure stock portfolio. The cumulative return is only 7% lesser!

Depending on whether you want to maximize returns or minimize risk, you can decide the proportion of gold to include in your portfolio.4 Now let’s look at another way that gold can make a difference to your finances.

Hedge for bad times

It’s true that gold does not generate any cash flows or dividends and that its value is heavily driven by perception. But in times of war, economic uncertainty, and turmoil, perception is a very powerful force as history has demonstrated, most recently during the pandemic.

Even if you don’t want to hold gold in your portfolio forever, it acts as an excellent hedge during - you guessed it - bear markets and recessions. In my bear market strategy article, I observed how gold is the only asset that has an increase in value when the market hits a bear market bottom.

Gold has an average return of 12.4% in a bear market.

Since 1971, gold has had an average inflation-adjusted return of 12% during recessions when inflation might be a major concern.

Even if gold is not the best way to appreciate value, it might be one of the best ways to preserve it.5

How to invest in gold

If you are convinced by now that owning some amount of gold is a good thing, there are a few ways to go about it. How you own gold also makes a huge difference to your returns. You can physically own gold, for sure, but the overhead of storage, security, insurance, and the stress that comes with it nullifies a lot of the benefits that gold provides. You can own gold through plain old financial instruments in three ways:

Gold Bullion Funds like SPDR Gold Shares (GLD) and IAU (iShares Gold Trust). These are ETFs that are physically backed by gold bullion and track the price of gold very closely.

Synthetic Gold Funds like Invesco DB Gold Fund (DGL) are ETFs that are long on gold futures. They aim to replicate the performance of gold and reduce the tracking error.

Precious Metal Equity Funds like Vaneck Gold Miners ETF (GDX) and iShares MSCI Global Gold Miners ETF (RING). These hold stocks in gold mining companies.

Though they are all in some way correlated with the price of gold, the performance and correlation with the S&P500 can be vastly different. Let’s compare the returns from 2006 (some funds are relatively new).

The bullion fund GLD has the best performance followed closely by the synthetic fund DGL. GDX which tracks the NYSE Arca Gold Miners’ Index, has performed terribly, generating negative returns after nearly two decades. Even in terms of risk, bullion ETFs and synthetic funds perform the best - they have a lesser drawdown and they have very little correlation with the S&P500 making them ideal candidates to hedge against market crashes.

Bullion funds also have another advantage - A lesser expense ratio. It’s a no-brainer to pick them and stay away from precious metal equity if you decide to invest in gold.

Whenever the longevity of a product or a concept is discussed, the “Lindy effect” is frequently brought up - If something has been around for a long time, then the probability that it will stick around for a longer time is higher. This partially explains why people still read Shakespeare and Socrates, but forget the bestsellers of the last decade. Considering it that way, modern monetary systems are relatively new, stocks are just a few centuries old, and cryptocurrencies are a mere speck on the timeline. But gold has been around forever and it’s not going away anytime soon.

I side with Warren Buffett when it comes to viewing gold as an investment - It has limited scope for growing in value and it’s not something you should count on for building wealth. But when it comes to storing value and protecting against hard times, gold has a solid history of acting as a hedge, and it’s a good idea to have at least a small portion of your portfolio in it in the form of bullion ETFs.

Until next time…

Disclaimer: I am not a financial advisor. Please do your own research before investing.

This was after he lost a fat sum of money in the stock market. Newton was human, after all.

The scarcity of gold is brought up often to draw parallels to Bitcoin, even giving Bitcoin the name “digital gold.” While it makes for a good theory, it’s up for debate whether a deflationary currency is a solution to all our problems.

In general, the greater a portfolio's Sharpe ratio, the better its risk-adjusted performance.

The backtests were run with Composer. You can play around and experiment with different proportions and rebalancing frequencies here.

Real estate is also a very good option - But the entry barrier is high, markets can be uncertain, and that’s a topic for another day.

Life Hack: If you introduce something valuable to someone, they associate that value with you. So, if you found this analysis insightful, do share it with another investor :)

Thanks for this great article. As we already discussed in the Discord channel, Gold had a lot controversial thought. I think this clarifies the whole point.

I personally use the gold as a liquid saving. We all say that we should have some funds or 6 months of financial securities saved on side in case of emergency. Considering today's high inflation environment, we can save gold ETS, or physical gold instead of keeping those emergency funds as printed money.

Noob here. I thought gold had been underperforming as a hedge against inflation these past few months. Is that not true?