Hello friends! Welcome to Market Sentiment. Join 14,135 other smart investors and traders by subscribing here:

You can check out my best articles here and follow me on Twitter too!

This issue of Market Sentiment is brought to you by… Composer.

80% of new day traders lose money. The reason: human emotions. Smart investors let algorithms invest for them: For example…

Execute paired switching trades between ARK and Bitcoin ETF

Momentum play based on historic returns

But without an engineering degree, quant-trading has been out of reach. Until now…

Composer lets you build algorithmic trading strategies in a snap - no code or spreadsheets required. Drag, drop, edit and swap your own strategies, or choose from their pre-vetted templates in seconds.

Composer makes building algo-trading insanely easy.

In investing, what is comfortable is rarely profitable - Robert Arnott

Not sure if you have ever noticed it, but when it comes to investing, we are extremely reliant on the market in our home country. Think about it: How many times while creating an investment plan have you thought - ‘Hey, would it be a good idea to invest in a country other than where I am situated currently?’

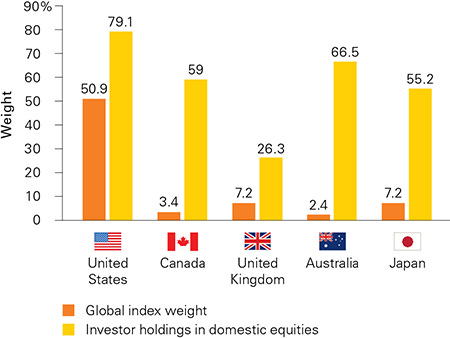

Well, obviously I am not the first one to think about this! This is a well-researched concept known as the Home Country Bias. It’s where investors irrationally expect higher returns in their domestic market compared to other markets. A recent study by Vanguard highlights this issue.

The U.S stock market only constitutes about 50% of the global market but on average U.S investors allocate 80% of their portfolio to U.S companies. The proportion is even more skewed in the case of smaller countries such as Canada and Australia. Canadians allocate ~60% of their portfolio to the Canadian market while it only constitutes 3% of the global market.

So in this issue, let’s deep-dive into why this happens, what its implications are, and how you can get optimal exposure (and possibly better returns) to the Global equity market!

The logical argument for global diversification is very strong. You gain access to economies that are outside your home country. This can be extremely useful over the long run in case your country-specific performance is not great. The classic example is Japan’s stock market. The Nikkei 225 index has still not recovered to the ATH that it reached in 1990. Imagine staying invested for 30 years only to find that you have lesser money than you started with!

But before we go all-in on a globally diversified portfolio, we have to understand the benefits and risks associated with it. There is a multitude of factors that you should consider before investing in a foreign market.

The Pros

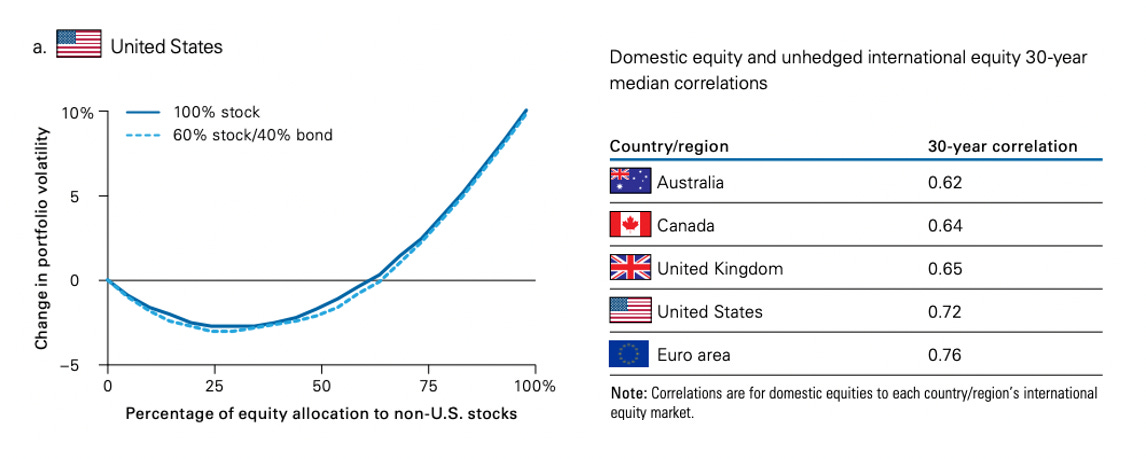

Global Diversification: This is the single biggest benefit of having a global portfolio. Since you are diversified globally, the volatility of your portfolio is significantly reduced when compared to owning stocks from one country. Things that might affect your country uniquely (Tax changes, Political turmoil, new regulations, etc.) would have a lesser impact on your portfolio. Based on a study by Vanguard, you have a better return and reduced volatility as you increase your allocation to Non-U.S stocks (in case you are a U.S investor).

Another classic example is the Canadian market where the Energy and Finance sectors contribute to more than 45% of the market (compared to only 13% in the case of the U.S market). So in case these two sectors perform poorly, the overall returns of the Canadian market would significantly be affected.

Higher returns and expanded opportunities: Emerging markets have a smaller economy when compared to developed markets but they would provide a higher growth rate. For example, the Indian market has been growing at the rate of 6% on average last decade when compared to the 2% growth rate of the U.S. Also, global markets would give you access to sectors and industries that your country might be lacking (Canada/Russia for Energy, China for Lithium/rare metals, Taiwan for Semiconductors, etc.).

Better Value: Finally, emerging markets tend to be less saturated than developed markets. The theory here is that stocks in developed markets tend to be more overvalued since there are more players in the market who are actively investing. Even if it’s not overvalued, finding an undervalued stock in a well-developed economy is exponentially more difficult than doing the same in an emerging market.

The Cons

Well, no investment strategy is complete without knowing the downside.

Reduced information and lax reporting standards: One of the biggest concerns with investing in a foreign country is information asymmetry. The country that you might be investing in might follow a different/lax reporting standard which means that you cannot do the same form of due diligence that you are used to. Even if the reporting standards are comparable, in countries like China and Russia, most of the media is controlled by the government - the information you might be receiving could be a carefully controlled narrative by the government and not the ground reality.

Higher Volatility: Emerging/smaller markets tend to be much more volatile than developed markets, and that’s the price you pay for higher growth. Adding to this, inter-country relationships can also have a significant impact on stock prices. The China-US trade war was a classic example of country relationships affecting the stock market.

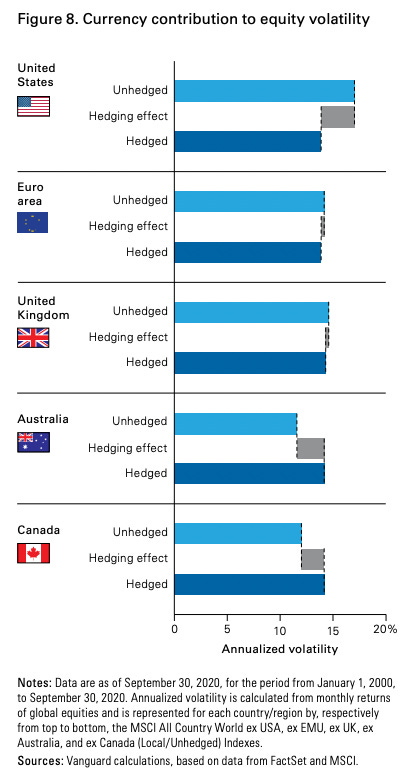

Taxes, Expense ratios, and Currency rate fluctuations: I have bucketed these three into one since all of these can affect your final returns. It’s vital to understand the tax rules of your country thoroughly before making foreign investments. In the worst case, you might end up paying the dividend and capital gains tax on both your country and the country where you invested. Also, in case you are investing via an ETF, be mindful of the expense ratio. Generally, global ETFs tend to charge slightly higher than domestic ETFs. I have kept currency rate fluctuations for the last because according to the study by Vanguard, currency contribution to equity volatility is negligible over the long run.

What about the S&P 500?

One question I had while researching this is wouldn’t the S&P 500 give enough global exposure on its own? After all, most of the companies in the S&P 500 are well-established multi-national companies with a presence in hundreds of countries. So shouldn’t this mean that we can get away with investing in just the S&P500?

Sadly, the answer is no. The main issues here are that most of the S&P 500 companies are well-established, well-researched, and are probably over-saturated/valued considering the current level of investments flowing in from the index funds. So you might not end up getting the actual growth that the emerging economies are going through just by investing in these large multi-national companies.

Also, just focusing on the S&P 500 companies would imply that you have no exposure to leading global companies that are domiciled outside your home market.

So what are our options?

The easiest and safest method for getting global exposure is to use well-diversified global ETFs. I am listing down some of the most popular ones below.

Fidelity ZERO International Index Fund (FZILX) - Invests in foreign developed and emerging stock markets. USP is that it has an expense ratio of 0%!

Vanguard FTSE Developed Markets ETF (VEA) - Invests in a diversified group of stocks of large, mid, and small-cap companies located in Canada and the major markets of Europe and the Pacific region.

Vanguard Total International Stock ETF (VXUS) - Has broad exposure across developed and emerging non-U.S. equity markets.

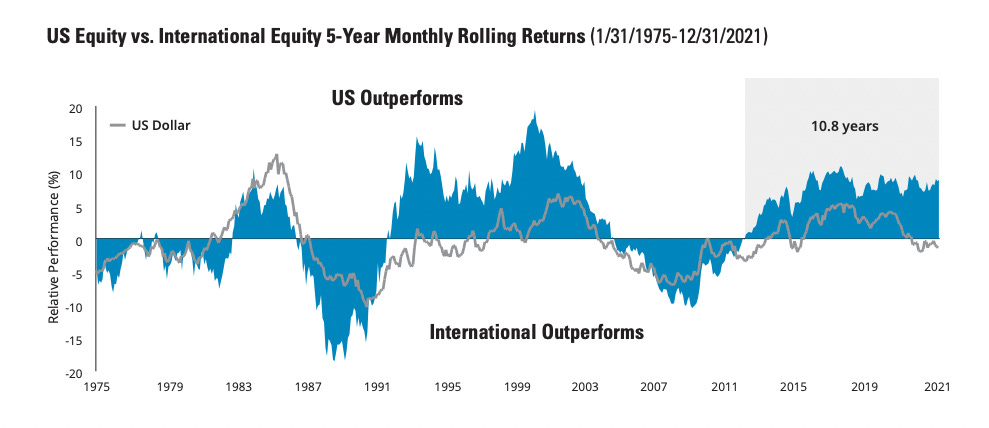

But something you should be aware of is that over the past decade, the U.S market has outperformed foreign markets. As you can see above, the S&P 500 has given 5x the return of Vanguard Total International Stock ETF over the last 10 years.

So you might be wondering why you should invest in a foreign market (especially if you are based in the U.S) since the S&P 500 is giving you the best return after all. The answer lies in the time horizon. Since 1975, the outperformance cycle for the US versus international stocks has lasted an average of 7.8 years. Currently, we are in a place where the local stocks are outperforming the international ones. The tide can turn anytime!

Conclusion

One final thing to consider before going global with your portfolio is the significant behavioral challenge that you have to overcome! If you are in the U.S, news and articles about the U.S stock market would be in your face every day.

If, say, the Brazilian stock market goes on a bull run, we probably wouldn’t even notice that in the U.S. But, if the same happens in the U.S, we will be bombarded with the news without a breather and it will be extremely hard to ignore it. You might even have an urge to increase the portfolio allocation in your home country - in what would end up as a classic case of a buying high!

It seems like going global with stock portfolios is definitely not for the faint-hearted. You will have years and even decades where the domestic market outperforms the international one. But as we saw from the analysis, over the long run, having an international portfolio would give you much lesser volatility while simultaneously having a broader exposure to the equity market!

Until next week…

More interesting reads

Asian Century Stocks: Given that you have now understood the importance of diversifying your portfolio to have equity exposure across different countries, you should definitely check out Asian Century Stocks. Michael provides excellent information on Asian Equities with key news reports and links so that you can stay up-to-date with the Asian equity markets.

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

If you look at the updated data, 1970-2021. Due to the run in 2021, US alone has slightly outperformed vs any combination of US and international, with negligible standard deviation increase.

Maybe I missed this, but while broader exposure with less volatility sounds great, if my intent is to maximize my return over a 40-60 year horizon through an index (not concerned about drops over time), would the S&P outperform a global index overall? Or at least historically?