Factor Investing

What drives asset returns

Hey everyone, we had a surprising amount of controversy for our last article where we showed how momentum strategy has successfully beaten the market over the long term. Given this, we thought it would be a great time to remind our new readers that we don’t have any specific funds that we are running or investment firms we work with. All our work is driven by curiosity and is supported just by you — our readers.

One of our favorite reader comments captures well what we strive for:

"This is easily the most evidence-backed, not click-bait, not "#1 Stock Now!" investing information I've found. I value supporting that. Thanks. Good work"

If this is something you believe in, please consider upgrading your subscription to support us.

Buffett introduced this fascinating thought experiment back in 1984:

Let’s assume that every single person in the U.S. participates in a national coin-flipping contest. So, every morning, 300 million Americans wake up and make a coin toss and all of them start with a wager of $1. If they call correctly they win the dollar from those who called it wrong and those who called it wrong will drop out.

After 10 continuous days of this experiment, there would be ~300,000 people who would have correctly called ten flips in a row and they would now have more than $1,000 each in winnings. Things get crazy after 20 days — Now there are close to 300 people who would have turned $1 to $1 million by just tossing a coin every morning. They would inevitably write best sellers on “How I turned $1 to $ 1 million in 20 days” and be considered experts in coin flipping. But in reality, these were just extremely lucky people who got randomly picked from 300 million players.

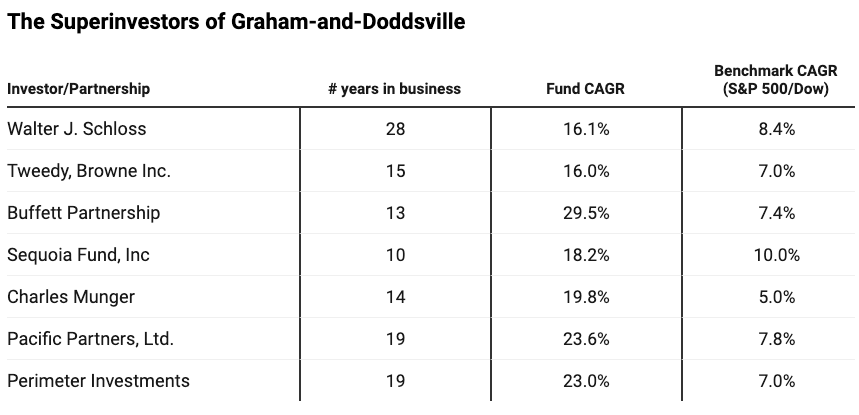

Buffett’s point in his letter was to highlight that we should always dig deep into why certain investors and strategies outperform and make sure that the outperformance was driven by skill more than luck. Buffett then goes on to showcase a group of investors who were able to beat the market for decades running – but unlike the coin tossers in the experiment, all the investors in this group had one thing in common. They followed the value investing principles of Ben Graham.

What Buffett and the followers of Graham intuitively realized about the benefit of investing in value stocks was later proven by the scientific community. In their paper, Persuasive Evidence of Market Inefficiency (1985, just a year after Buffett published his memo), Rosenberg, et al found that stocks with a high book value relative to their market prices (aka value stocks) had higher average returns that were not explained by market risk.

By then, Rolf Banz also published a report showing that small stocks had consistently higher average risk-adjusted returns, which the efficient market hypothesis could not explain.

The pricing anomalies were addressed in 1992 by the Fama French 3-factor model in which they incorporated both the size of the stock and the relative price of the stock as factors beyond market risk which significantly improved the model performance. Over time, experts have identified two more factors (profitability and investment) that showcase persistent pricing anomalies which leads us to

The Fama French 5-Factor Model

The current Fama French model is the combined effort of 40 years of research. While the model and how it’s built is beyond the scope of this article, as an investor, it’s important to understand its implications.

The past 6 decades of data show us that there are 5 factors that were able to explain 95% of the differences in returns between diversified portfolios (all figures are annualized).

Market Risk (MKT-RF): The market beat one-month treasury bills by 5.37%.

Size (SMB — small minus big): Small stocks beat large stocks by 2.04%

Value (HML — high minus low): Value stocks beat growth stocks by 2.68%

Profitability (RMW — robust minus weak): Highly profitable companies outperformed weakly profitable companies by 2.8%.

Investment (CMA — conservative minus aggressive): Companies that were conservative in asset growth beat aggressive growers by 2.93%.

What this shows us in simple terms is that even if we believe in Efficient Market Hypothesis, there are certain factors that would get us better results through long-term exposure rather than if we just stuck to market-cap-weighted index funds.

Let’s dig in: