Your Money & Your Vote

The next 4 years for U.S. stocks

Given its importance, we have no paywall on this — Please share

Imagine you were transported back to the 2016 election day. Donald Trump has just been elected president. There is a lot of uncertainty regarding a Trump presidency, and markets are plunging.

You open the New York Times, and this is what you see1 [emphasis added throughout, edited for brevity]:

It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?

Frankly, I find it hard to care much, even though this is my specialty. The disaster for America and the world has so many aspects that the economic ramifications are way down my list of things to fear.

Still, I guess people want an answer: If the question is when markets will recover, a first-pass answer is never.

Under any circumstances, putting an irresponsible, ignorant man who takes his advice from all the wrong people in charge of the nation with the world’s most important economy would be very bad news. What makes it especially bad right now, however, is the fundamentally fragile state much of the world is still in, eight years after the great financial crisis …

So we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened.

Before you dismiss this as the hyperbole of a regular journalist, this was written by Paul Krugman — the same Krugman who was awarded the Nobel Memorial Prize in Economic Sciences (informally considered the Nobel Prize in Economics) in 2008 and is a distinguished professor eminent in his field.

But, we all know how this prediction panned out — There were no global recessions, and even after a global pandemic, by the time Trump left the office, the S&P 500 was up ~70%. Trump did no better or worse than the average president2.

Given that the 2024 election is only 4 days away and it’s a dead heat according to pollsters, there is a lot of speculation and fear-mongering on what this means for investors.

Here’s everything you need to know about how the election will affect the markets:

Does the party in power impact market performance?

Should you move to cash in an election year?

Which companies are supporting which parties in 2024 — and does it matter?

Sectoral effects during and after the election

S&P 500 performance and volatility pre and post-elections

What’s the best strategy for long-term investors?

PLEASE TAKE A MOMENT TO SHARE THIS POST

Does the party in power impact market performance?

No — There is no statistically significant difference in the stock market based on who is in power.

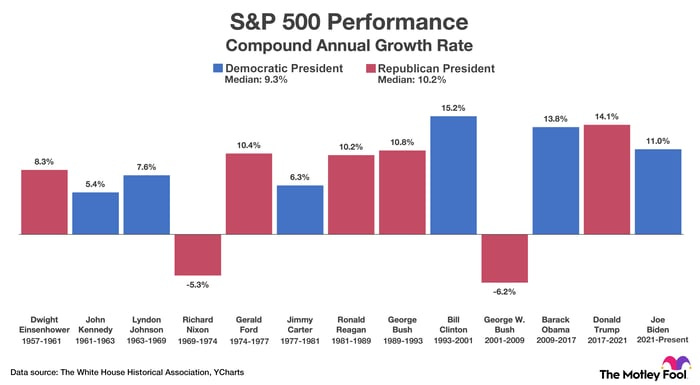

Since its inception in 1957, the S&P 500 has achieved a median compound annual growth rate of 9.3% during Democratic presidencies and 10.2% during Republican presidencies3.

Although pundits will claim that one party is “better” for the market than the other, the reality is that a divided government has correlated with stronger returns. The government gridlock creates fewer policy uncertainties for companies and industries, leading to stronger returns over the long term.

More than the party, the stock market returns are predominantly driven by what’s happening in the economy.

Case in point: Bill Clinton had an exceptional track record because his term ended perfectly at the top of the dot-com bubble, and throughout his term, interest rates fell. Unfortunately for George W. Bush, his term started with the burst of the dot-com bubble (which neither he nor his party had any control over), and his second term ended with the beginning of the Global Financial Crisis. Presidents often receive too much credit and blame for the economic conditions.

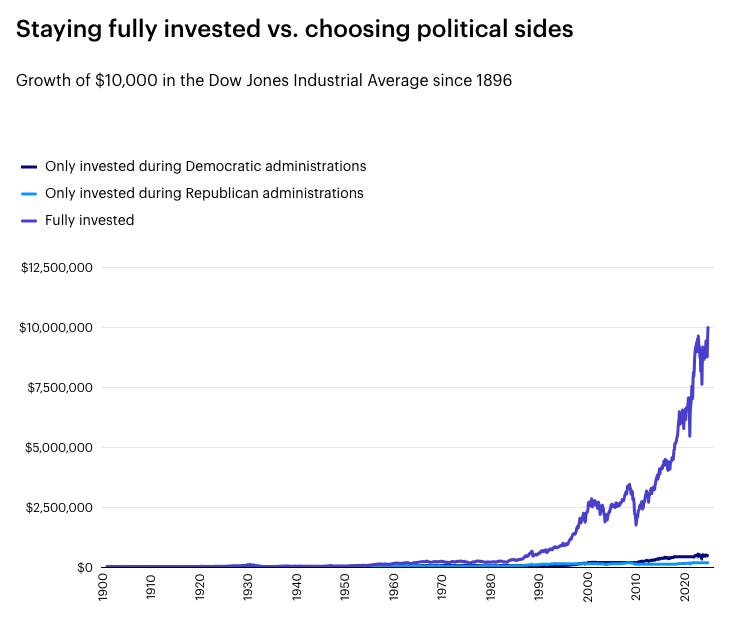

Also, voting with your wallet is a terrible idea as the U.S. markets have consistently risen no matter who was in power.

A “partisan” portfolio, only invested during administrations of one party or the other in that 123-year span, underperformed by millions of dollars.

The same $10,000 only invested during Democratic administrations grew to approximately $528,000. Invested only during Republican administrations, the initial $10,000 rose to just shy of $181,000.4

PLEASE TAKE A MOMENT TO SHARE THIS POST

Should you move to cash in an election year?

You are not alone if you are nervous about markets this year. Every election year, the news cycle and the candidates focus on highlighting the critical issues plaguing the country. Nobody is going to campaign with a rosy picture — hearing this day in and day out for a year can sway the mind of even a staunch optimist.

Data proves this — Historically, investors moved away from equity funds and invested in low-risk money market funds during the presidential election year5.

But this is rarely a winning strategy. If you had $10K to invest, based on the data from the last 23 election cycles,

If you invested $10K on Jan 1st of an election year, you had the best outcome 60% of the time.

If you split the $10K into $1K each month of an election year, you had the best outcome 26% of the time.

Finally, if you waited on the sidelines to invest after the election, you only had a 13% chance of coming out on top

The investor who stayed on the sidelines had the worst outcome 17 times and only had the best outcome three times. Meanwhile, investors who were fully invested or made monthly contributions to a 401(k), for example, during election years came out on top.

Which companies are supporting which parties in 2024?

If you are interested in tracking a particular company’s, the best place to go is Open Secrets. They do a fantastic job of tracking the total donations each candidate and party receives. Here are the top 5 donors for the 2024 election [Now tell me, how many in this list have you heard of?]:

While the top donors’ list skews towards Republicans, the story is completely flipped when you check in on the Magnificent 7. All companies in the Mag-7 except Tesla (due to Elon Musk) are leaning towards Democrats6.

Kai Wu, CIO of Sparkline Capital, did an excellent analysis on the impact of political donations and stock returns. First, he classified stocks based on their political contributions. Partisan stocks are the ones that have a high share of donations to either Democrats or Republican candidates. Nonpartisan stocks tend to hedge their bets and are more balanced in their support to both parties.

What type of companies do you think beats the market?

Surprisingly, both! Based on the last 27 years of data, companies that donate for political influence tend to outperform the broader markets. But interestingly, it’s the companies that take a hedged approach [Defense contractors, airlines, banks, etc.] that tend to outperform companies that go all-in on one party.

Political influence is an undervalued intangible asset leading to subsequent excess returns. — Kai Wu

PLEASE TAKE A MOMENT TO SHARE THIS POST

What about betting on an industry?

Repeat after me: Macro > Politics

Investors who bet on a certain industry expecting one party to favor them are in for an unpleasant surprise. While it’s intuitive to think that oil companies must do better under Republicans and green energy under Democrats, we just have to go back a few years to find that this does not hold.

With Trump favoring traditional energy sources such as oil, natural gas and coal, and Biden supporting a transition to renewable energy to address climate change, the instinctive choice would have been to overweight the traditional energy sector after the 2016 election and renewables after the 2020 election.

However, that strategy would have yielded poor results: During the Trump presidency, clean energy outperformed traditional energy by 43% per year. During the Biden presidency, traditional energy outperformed clean energy by 53% per year7.

If you are still not convinced, here is what Naveen Malwal, investment manager for Fidelity has to say about the futility of betting on industries during elections8

There are dramatic differences between the proposals expressed on the campaign trail and the actual policy changes that take place once the candidate is in office.

It's exceedingly rare that a candidate will be able to deliver on exactly what they've proposed once they take office. If you're making investment decisions based on such proposals, that could be a risky way of managing one's money.

What about short-term election volatility?

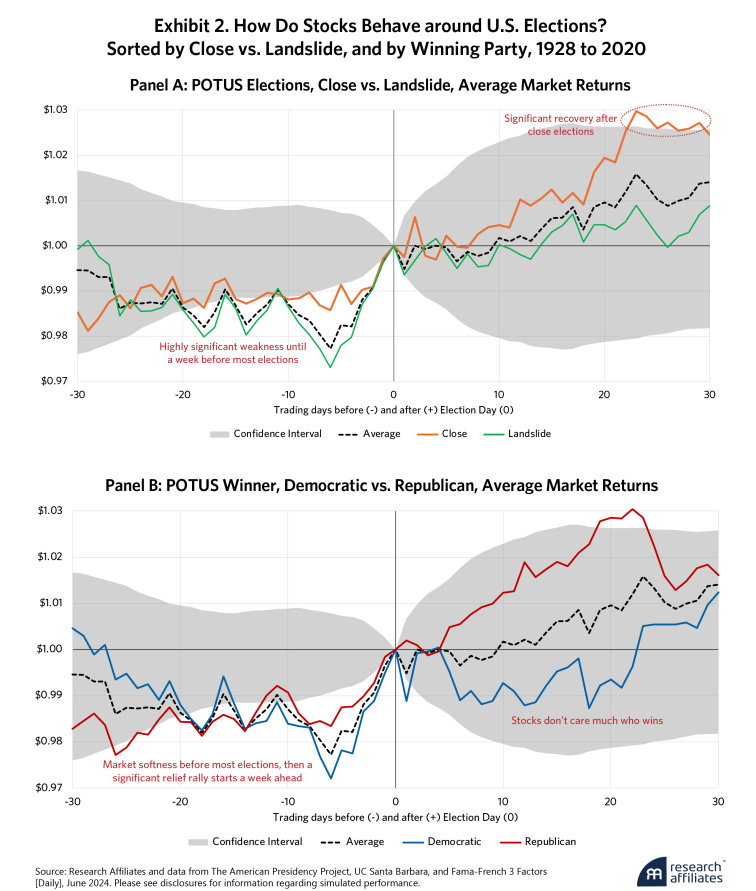

Rob Arnott at Research Affiliates analyzed the market performance 30 trading days before and after the U.S. presidential elections over the past ~100 years. They found that both Republican and Democratic victories lead to near-identical outcomes in the 30 days after an election.

The average outcome, displayed as the black dashed line, shows that the stock market tends to fall in the weeks heading into the vote but spikes in the campaign’s final week.

Then, the post-election period is usually pretty dull, except after close elections, when the stock market rallies about 2.5% over the next 30 trading days9

If you are still adamant about making an “election play”, Rob has given some guidelines:

If we want to play a market-timing game, we might go risk-on in late October, with a tilt towards small-cap stocks after the election.

Then, if our crystal ball gives us confidence that Kamala Harris will waltz into the White House, we should hang on to those Magnificent Seven stocks at least until Christmas.

If, on the other hand, we expect Trump to roll back into the White House next year, we might want to pivot towards RAFI (Value instead of Growth) sooner rather than later.

The best strategy for long-term investors:

It’s tempting to put your money where your vote is. But historically, the stock market has largely been unperturbed by presidential elections.

The number of unknowns are extremely high to make an informed decision:

The polls are showing a dead heat implying you can’t predict who is going to win

Even if you guess correctly, you don’t know which policies they are going to implement or whether anything major will get implemented (hello, filibuster)

How investors and other countries are going to react to the new policies

And on and on…

As we saw at the start, when Trump was elected, pundits were claiming pandemonium for the markets. When Obama was elected, they were predicting that his radical ideas would kill the Dow. In the end, there were 130+ new all-time highs during his presidency.

So, no matter who gets elected, there are going to be experts claiming that “this time is different” and that we are going into a recession. Rather than play along to their tune, it’s infinitely better to do nothing.

PLEASE TAKE A MOMENT TO LIKE & SHARE THIS POST

If you are new here, please consider upgrading your subscription to support Market Sentiment. We are 100% reader supported — Here’s Ian on why he subscribed to our lifetime membership!

The Alpha Letter series, but more specifically the Alpha letter #4: Factor investing. I frequently read the article again and use it in my Investing philosophy. I have been flirting with the idea of becoming a lifetime member for some while now and I really wanted to read the full article of some of the recent articles posted.

After being on the free subscription for a while, I could see that the articles posted would be worth the 399$.

Footnotes / Suggested Readings

Since 1929, only three presidents have experienced negative returns for the S&P 500 on an annualized basis over the course of their term(s). The average annualized return for a president’s term is over 9.5%. — Darrow Wealth Management

Before you say, huh Republicans perform better (its all about the measurement period — as they say, If you torture the data long enough, it will confess to anything) :

“Lubos Pastor and Pietro Veronesi (2017) show that between 1925 and 2015, stocks rose 10.7% per year on average when Democrats held the White House and fell 0.2% per year under Republicans.

But as we pointed out in 2017, the Pastor and Veronesi results are skewed by the Great Depression, from 1929 to 1932, and the Global Financial Crisis (GFC) in 2008. Exclude those periods and there is little difference between markets under Republican and Democratic presidents.

But what about Australia, Canada, France, Germany, and the UK? Did their stock markets perform better under left- or right-of-center governments? Our out-of-sample test did not indicate any relationship between which party won an election and how the stock market fared during its time in power.” — Research Affiliates

Guide to Investing in an Election Year — Capital Group (UBS)

Partisan Investing — Sparkline Capital

Elections and the markets: 4 lessons from the past — Edward Jones

Elections and the Stock Market: Polarization Trumps Politics — Research Affiliates

Great information. thank you for share.

America is about to shine like a #($*%&^ diamond. I had typed a whole paragraph but this is shorter.