Do Nothing

The big money is not in the buying and the selling but in the waiting.

Merry Christmas in advance. We are publishing this without a paywall. Please share with a friend.

Before we jump in, we would like to highlight one of our favorite financial writers, Nick Maggiulli.

Nick has been creating content on Of Dollars And Data for the past 7 years and recently came out with his first book, Just Keep Buying: Proven ways to save money and build your wealth. Apart from discussing strategies to start investing on the right foot, the book also gives a solid framework to think about how saving and investing fit into your life and career.

If you like evidence-based arguments about personal finance and investing, then Nick is the person to follow. Sign up for his newsletter here or check out his book on Amazon.

If you stumble on something that really compounds in value for decades, it can make all the difference. The things you were right about become more and more important as time goes by, while the things you were wrong about become less and less important. — Thomas Gayner

The Gayner Family has made an interesting donation to their alma mater, the University of Virginia. Using the donation, students have to create a unique investment fund that focuses on long-term compounding. Per the rules, students are expected to pick 15-20 stocks to build their portfolio.

The catch is that once they build it, they have to lock it in place for the next 25 years! No buy/sell/rebalancing is allowed. Once the 25 years are up, half of the portfolio will be sold and distributed as scholarships, and students will once again reinvest the other half.

While it might look crazy, what Gayner is trying to teach is the principle of Coffee Can Investing, where you let your winners run. The logic behind this is that if you invest in a company, at most, you can lose 100% of your investments. But the upside is unlimited1.

Buffett has famously said that you should make investments using the punch card approach — Invest as if you had only 20 investing possibilities in your lifetime. This forces you to think long and hard before investing, and you give your investments time to compound. Buffett has more or less walked the talk by holding his investments for decades (Coca-Cola: 34 years, Amex: 29 years, P&G: 18 years, and so on…)

The Voya Corporate Leaders Trust was a fund that was set up in the middle of the Great Depression that took this concept to the extreme. The fund aimed to counteract the hazards of excessive trading and speculation that led to the crash of 1929. The fund picked 30 stocks, bought an equal number of shares in each company, and then never sold or bought any other shares till now. When it was set up, the fund managers actively avoided the “hot stocks” of the day like Banking, Automobiles, and Radio.

The fund managers stuck to their plan and held onto the stocks through the World War, Black Monday, the Dot-com bubble, and the Global Financial Crisis without ever selling. Throughout this period, they witnessed the invention of personal computers, the Internet, the iPhone, and even reusable rockets, yet they never bought into a new company.

While no one knows the performance of the fund going back to 1935, when the Wall Street Journal evaluated its performance in 2019, the fund had managed to outperform the S&P 500.

Between the beginning of 1970 and Nov. 30, 2019, the fund gained an average of 11.1% annually, according to Morningstar Inc.; the S&P 500 returned 10.5% annually over the same period.

It ranks 16th among the 62 U.S. stock funds that have been around since 1970. That’s a stellar result for a fund that doesn’t even have a portfolio manager. — The Wall Street Journal

We extended the backtest to 2023, and the fund continues to outperform2.

Performance of a Do Nothing portfolio

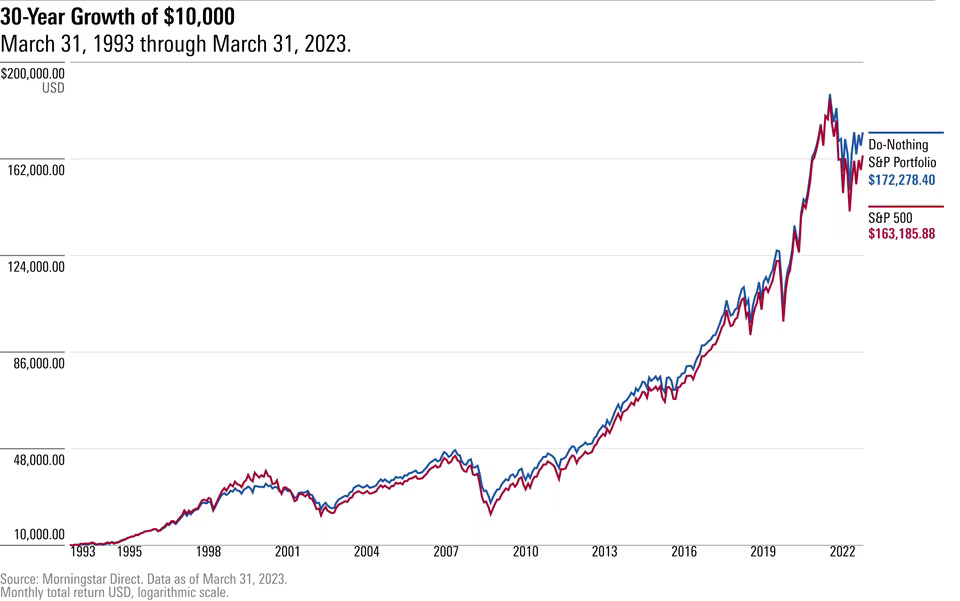

Once in a while, an analyst will put together an analysis we wish we had created. This is exactly what Jeffrey Ptak of Morningstar did. He put together an interesting analysis where he evaluated the performance of the S&P 500 if it stopped rebalancing and adding new stocks. For his test, he picked the S&P 500’s holdings as of 1993, invested in those stocks, and left the portfolio alone for 30 years. The dividends were reinvested, and if any company was acquired/delisted, that proportion was shifted to cash.

Over the 30-year period from ‘93 to ‘23, the Do Nothing portfolio outperformed the S&P 500 with less volatility. This performance is incredible considering that a portfolio frozen in ‘93 would not have added companies like Tesla, Etsy, Domino’s (one of the best-performing stocks of the last two decades), etc.

The outperformance was repeated even if you started the backtest in 2003 or 2013.

The lower volatility of the portfolio was attributed to the cash component (for the portfolio started in 2013, by 2023, it was 5% cash) in the portfolio, which provided downside support during the crash of 2000, 2008, and 2020.

By avoiding high-growth companies that usually join the index with much fanfare (*cough* Tesla *cough*)3, the Do Nothing portfolio tilted more toward Value than Growth.

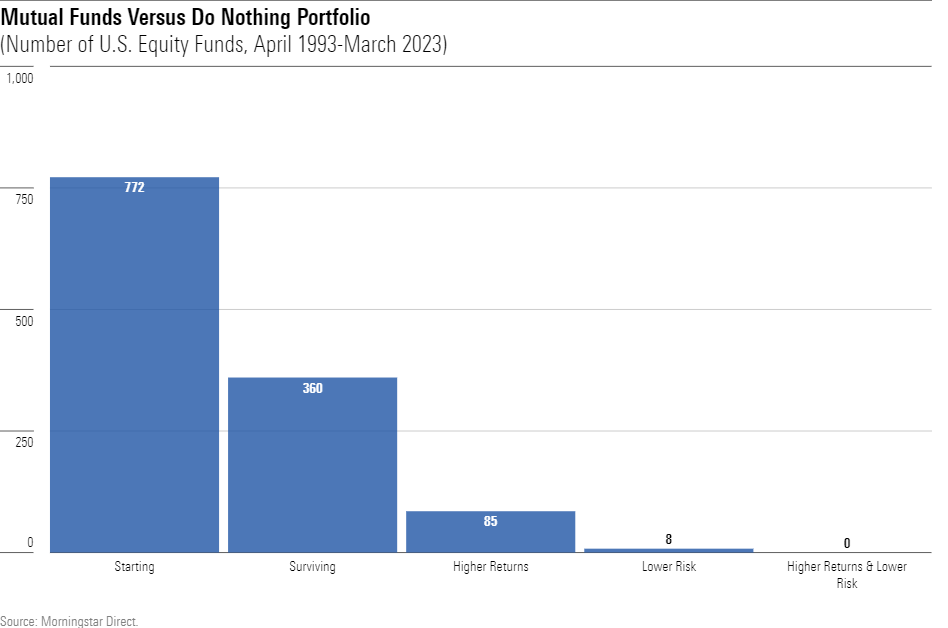

John Rekenthaler went on to expand the analysis and showed that no actively/passively managed fund could beat the Do Nothing portfolio:

The next chart shows, from left to right, the number of U.S. diversified equity funds that:

1) existed in April 1993;

2) remained in existence for the next 30 years;

3) outgained the Do Nothing Portfolio,

4) were less risky than the Do Nothing Portfolio, and

5) accomplished both the third and fourth tasks.

That final bar represents the null set. From April 1993 through March 2023, no U.S. equity fund of any flavor—I included funds that invest in small and midsized companies, as well as those that buy growth or value stocks—managed to make more money than the Do Nothing Portfolio, while also being less volatile.

Explaining the outperformance

While there are no conclusive explanations for the outperformance of these buy-and-hold portfolios, there are a few fundamental aspects that can give us a clue:

Avoiding the high-growth companies — By sticking to your portfolio, we ignore the allure of the next big thing. As we highlighted in the strategies that beat the market, when you buy into companies due to an amazing story and an expectation of future growth (aka high PE ratio), you are most likely bound to be disappointed in the end. Veteran investor Jim O'Shaughnessy’s analysis proves the same - (emphasis added throughout, edited for clarity):

Both All Stocks (comparable to Total Stock Market) and Large Stocks (comparable to S&P500) with high PE ratios perform substantially worse than the market. Companies with low PE ratios from both the All Stocks and Large Stocks universes do much better than the universe. In both groups, stocks with low PE ratios do much better than stocks with high PE ratios. Moreover, there’s not much difference in risk. All the low PE groups provided higher returns over the periods, with lower risk than that of the universe. - Excerpt from What Works on Wall Street.

Lower transaction cost and portfolio turnover — By not touching the portfolio, we save on transaction costs. Also, a University of California study of 66,000 investors (aptly named trading is hazardous to your wealth) found that the higher a portfolio's turnover, the lower the average return. Those who traded the most lagged the overall market's performance by 6.5%.

Taxes — While not applicable to the above backtests, investors tend to avoid the impact of taxes on their portfolios. At a 20% tax rate, if you sell a winner and reinvest the profits into another stock, it has to go up 25% for you to just break even.

While buy and hold is a great strategy, by no means is it a silver bullet.

If you had bought the top 10 stocks from 1986 and held them till 2022, you would have underperformed the market by a large margin. If that’s not convincing enough, consider this: Across the 25,967 stocks listed in the U.S. from 1926 to 2016, the most common one-decade buy-and-hold return was -100%.

But what these portfolios show us is that it’s possible to create market-beating returns without actively managing your portfolio or buying into upcoming industries. So if you can resist the allure of hot and trending stocks and the ‘next big thing’ you can end up coming on top over the long run.

Who knew, it does pay to do nothing!

Market Sentiment is now fully reader-supported. A lot of work goes into these articles, and if you enjoyed this piece, please hit the like button and consider upgrading your subscription to access all issues.

If you enjoyed this, you will find this interesting:

During the dotcom crash, the S&P 500 was down 45% and 60|40 was down ~20%, but the Cockroach portfolio was only down 5%.No, this is not a justification for holding on to meme stocks and shitcoins.

As we explained in ideastorm #8, even though the fund has outperformed the market, it’s hard to recommend paying an expense ratio of 0.49% for a frozen portfolio of ~18 stocks. You can just as easily create the portfolio yourself and set it on autopilot.

Not so fun fact — Tesla stock has underperformed the market after joining the S&P 500.

Great essay! And my favourite form of zeitgeist farming (https://www.strangeloopcanon.com/p/zeitgeist-farming)