How Congress Traded in 2021 - Part 1

A deep-dive into the stock trades and investment returns generated by the U.S Congress in 2021

Welcome to the 43 investing enthusiasts who have joined us since last Sunday! Join 12,597 smart investors and traders by subscribing here:

No more needs to be said about the ability of Congress members to trade individual stocks. With the amount of classified information they have, it’s almost comical that we are still debating on whether it’s against the ‘free market’ to prevent them from trading. There has been controversy after controversy where it’s been alleged that congress members used insider knowledge to gain undue advantage.

I have already covered the 2020 insider trading scandal and also whether it’s possible to beat the market following Congress members’ trades in my previous analyses. Finally, it looks like there is light at the end of the tunnel with both parties introducing similar bills to end the ability to trade stocks for Congress.

While we wait to see if the bill ends up becoming law, let’s see how Congress has traded in the past year (oh, and have they traded a lot!) and if they managed to beat the market while doing so.

Data

All the data used in this analysis was pulled from Capitol Trades. While I had to manually transcribe some of the data from eFDsearch1 last time, this time around, Capitol Trades has made my job much easier by capturing almost all the trades made by Congress in 2021.

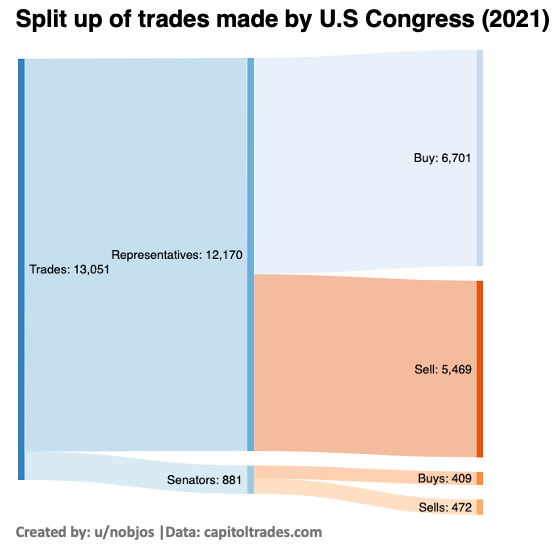

A total of 13,051 transactions were done by Congress Members in 20212. The surprising trend here is the split-up of the number of trades between Senators and Representatives. Even though the number of Representatives is only 4x the number of Senators, they made 14 times more trades than the latter.

Analysis

Given that there are so many trades in the past year, I have split the analysis into two parts. In the first part, we will cover the trades done by Senators and next week’s post will be on Representatives!

I am focusing mainly on the Buy-side because while there are many many reasons why someone would sell a stock3, there is predominantly only one reason to purchase a stock. You expect the stock price to go up!

A total of ~$28 MM was invested by the senators in 20214. Municipal Security seemed to be the most popular with 31% of the invested amount going towards it. A lot of non-public equity investment was done as well by the Senators. Finally, only around 12% of the invested amount went into publicly listed stock. Interestingly, almost the same amount went into hedge funds!

Results

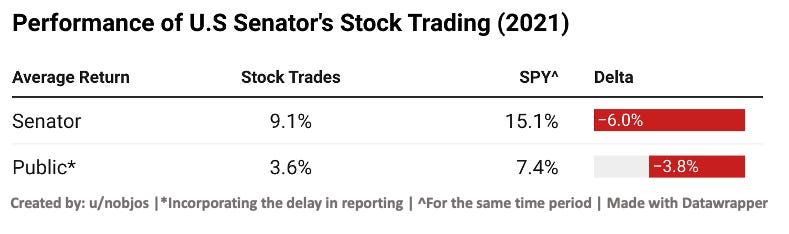

Senators performed decently last year generating an average return of 9%. But this lagged when compared to the market which returned 15% during the same period. If you had tried to follow their trades, your returns would have been a paltry 3.6% compared to the 7.4% you would have generated in the market.5

Even though overall Senators performed worse than the market, 5 senators did manage to beat SPY with their trading skills6.

Mitch McConnell made 4 trades investing around $32K last year, and made a whopping 34% return beating the index by more than 23%! Gary Charles Peters and Ronald Lee Wyden also managed to beat the index by a respectable 7-8%. Thomas Hawley Tuberville made a total investment of more than $2.4MM last year (~14x his annual income) and managed to just beat the market by 0.7%.

Diving deeper into the data, you realize why on average they did not manage to beat the index. There were some truly awful investors in the mix. In a year when SPY return +29%, 3 senators ended up losing more than 50% of their invested capital. (Fun Fact: Patrick Joseph Toomey got into GME when it was trading at $347)

Finally, let’s come to the best individual stock investments made by the Senators last year. It’s a good mix of manufacturing, semiconductors, and financial services firms. Thomas Hawley Tuberville topped the list by making an investment in Alcoa corp which has returned 144% to date. Wells Fargo seemed to be another popular choice with both Mitch McConnell and Shelly Wellons Capito generating more than 50% returns in 8 months.

Limitations

There are certain limitations that you should be aware of before trying to replicate the strategy.

a. Data Quality - I took the data for this analysis from Capitoltrades.com. While I cross verified a sample of their data for accuracy, I cannot be completely sure that they have captured 100% of the trades reported by Congress since it’s a highly manual process. (See Footnote 1)

b. Time Delay in Reporting - Congress members are expected to report their trades within 30 days. During my last analysis, I noticed that the median delay in reporting was 28 days and the average delay was 52 days. So not all trades that happened in 2021 would be captured in this analysis.

c. Other Investments - As you could see from the first chart, only 12% of the investments made by Senators went into publicly listed companies. We do not know how the other investments such as private equity, hedge funds, and municipal bonds performed. So the performance of their overall portfolio might be drastically different than the one we are observing here.

d. Overall Portfolio - This brings me to one of the biggest limitations of the analysis. We don’t know how the overall portfolio of the senator looks like. This prevents us from analyzing their trading patterns. For eg., if a Senator reports that he sold apple stock, we don’t have a way to identify whether it was a short-term play or whether he sold it from his existing long-term portfolio for some liquidity.

Conclusion

I truly hope this is the last year in which I have to do this analysis! While it does look like the Senators did underperform the market, we have to keep in mind that they only make up ~7% of the overall trades that members of Congress did in 2021.

Since this analysis was already getting too long, I have pushed the Representatives’ trading results to next week. Do comment below any suggestions/improvements that you would like to see for next week's analysis on Representatives!

Data used in the analysis: Here (It’s a live tracker where I will be updating the trades as frequently as I can. Also FYI, you can duplicate this sheet to your own workspace and play around with the trades. Do comment in case you can find a better strategy that I missed out on :))

More Interesting Reads

Of Dollars And Data: Nick Maggiuli is one of the most insightful and interesting writers in the personal finance space today. He has the unique ability to present the data in a clear manner, while not making it sensational or clickbaity. He usually writes about investing, risk, and long-term wealth creation. My favorite articles of his are: What Risk isn’t and Even God couldn’t beat Dollar Cost Averaging.

Sahil Bloom: If you think Twitter has run out of meaningful binge-worthy content, you haven’t seen Sahil’s feed yet. His threads break down complex concepts in finance, investing, mental models, decision-making, and more in easy-to-consume bytes. This thread on the most powerful ideas in life is a great place to start.

Footnotes and Disclaimers

I have no idea why even in 2022, someone would fill a sheet with a pen and then scan and upload instead of directly listing it in the portal. Example of this monstrosity.

I have considered the transaction date and not the reporting date. Any transaction done in 2021 was considered for the analysis even if it was reported to the public in 2022.

If you think about it, you can sell stocks for any number of reasons - down payment for a house, a medical emergency, or just plain profit booking.

Fun fact → This is 160% of the total salary that all the senators were paid in 2021.

The drastic difference is due to the delay in reporting and our short period of analysis (1 year) → Taking an average delay of 30 days, your returns are highly impacted as you would not have been in the market for those 30 days.

If you’re wondering why the benchmark keeps changing for different Senators, it’s due to the time difference between their investments. Someone who invested in Feb’21 would have a vastly different index benchmark compared to someone who invested in Sep’21

*Excluding N.Y. state residents.

** Titan Crypto holdings as of 1/13/22

If you enjoyed this piece, please do us the HUGE favor of simply clicking the LIKE button!

Thank you for another great article.

This makes me wonder which public companies and sectors received most investments overall from both senators and representatives.

Looking forward to see the next week articles.

what about Pelosi? Will she be in part 2?