Coffee Can Investing

Let your winners run

Welcome to the 200+ investing enthusiasts who have joined us since last Sunday. We just crossed 30,000+ subscribers! Thank you so much :)

Check out our - Best Articles | Twitter | Reddit | Discord

“Let your winners run, and cut your losers. It’s easy to make a mistake and do the opposite, pulling out the flowers and watering the weeds.” - Peter Lynch

In 1955, Tino de Angelis started the Allied Crude Vegetable Oil Refining company to take advantage of the U.S. government’s Food for Peace program. The goal of the program was to sell surplus goods in the U.S. to Europe at low prices to help them rebuild the economy after World War 2. By 1962, Tino’s salad oil company was big enough to be involved in the commodities market.

By then Tino had developed a cunning plan. He used his existing large pile of inventories of salad oil as collateral to get loans from Wall Street firms and buy Oil Futures so that he could drive up the price of his inventory. So, ships full of salad oil would dock in the port, inspectors from the banks would certify the quantity of the cargo, and then the banks would issue loans against these assets.

The inspectors just missed out on one simple thing - Oil floats on water.

Tino was fooling everyone by filling his tanks with water and then putting oil on top of it. If the banks had done even basic due diligence, they would have known that the total salad oil inventory reported by Tino was more than the holdings of the entire country. By the time Tino’s gig was up, they were supposed to have $150M in inventories but only had $6M1. The futures market crashed and wiped out the entire value of the loans that de Angelis had taken.

A massive portion of the loans was funded by American Express. When Allied filed for Chapter 11 bankruptcy, AmEx was on the hook for the loans issued. AmEx nearly went under and the stock dropped more than 50% due to the scandal and that’s when Warren Buffett came in. Buffett took a 5% stake in the company for $20M and played an active part in repaying the creditors and building back the trust in the company. His bet paid off with AmEx stock jumping from 94 cents in ‘63 to $5 in ‘68, and Buffett exited his position2.

Even though Buffett’s investment was an incredible success, what’s interesting is that AmEx has increased another 17x since Buffet sold his investments. The company has returned a CAGR of 13% compared to the 10% returned by the market3. Buffett did end up buying back into the company in 1998 and currently owns ~18% of AmEx. Even someone like Buffett, who is famous for holding on to his investments and loathe to sell ended up selling too early.

While there are certainly places where selling makes sense (retirement, portfolio rebalancing, etc.), in most cases holding on to your investments gives the best long-term returns. The problem is that there is too much information available easily and most investors tend to give undue importance to news, earnings reports, and analyst expectations. It's important not to confuse market-moving events with actual intrinsic value-moving events. Most of the time, it pays to ignore the sensationalized headlines.

One way to defend against this folly is to use a concept called the coffee can portfolio.

Coffee Can Portfolio

Coffee can investing was popularized by professional fund manager Robert Kirby in the ‘80s.

The Coffee Can portfolio concept harkens back to the Old West, when people put their valuable possessions in a coffee can and kept it under the mattress. That coffee can involved no transaction costs, administrative costs, or any other costs. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can to begin with. - Robert Kirby

Kirby saw the impact of this process from one of his clients with whom he had been working for more than 10 years. When the client’s husband died suddenly, she asked Kirby to take a look at his portfolio. Kirby was amused to find that the husband had piggybacked on all his recommendations but with one small change - He had neglected all the sell recommendations from Kirby.

The results were stunning. Since he ignored all the sell recommendations, he had an odd-looking portfolio of holdings, some of which had dropped more than 50% and others barely breaking even, but some multi-baggers had pushed the portfolio performance beyond anything that Kirby’s recommended portfolio returned. For e.g, there was one holding that made a 160x return on its initial investment while Kirby had booked profit on that stock after it had rallied.

Kirby’s recommendation was that we should all buy great companies and then just “stick them in a proverbial coffee can and bury them”4.

Problems with Active Management

It’s interesting how an active fund becomes popular - For this, a fund has to achieve “orbital velocity5”. What usually occurs is that you start with a few million dollars, you make some high-risk bets that work out in your favor and suddenly you have a fund that outperforms the market.

The market usually evaluates 3 to 5-year performance and if you made the bets at the right time and with a bit of luck on your side, you are suddenly the hot new fund in the market. With the help of a couple of skilled marketers, you can easily pull in a few billion into the fund.

After this, no matter how badly you perform, the clients would stick around with you for at least 4-5 years in the hope of outperformance. After all, you’ve done it before right? What everyone is missing is that you did it with a much smaller fund making risky bets. The irony is that no matter what happens this time around, the fund will earn its fees.

Don’t believe us? - look at what happened with ARKK 0.00%↑ . The fund barely had a billion under management at the beginning of 2019. The company made some massive bets on tech companies such as Zoom, Tesla, and Coinbase and they paid off incredibly well during the rally just after the pandemic. Investors piled onto the fund and at its top, it had close to $30B under management - a 30x jump in just 3 years. At its current expense ratio of 0.75%, the fund would have earned ~$200M in commissions just in the past two years. Even though the stock is down 60% YTD, investors who got in at the top are still hopeful about a comeback and continue to pay the commission6.

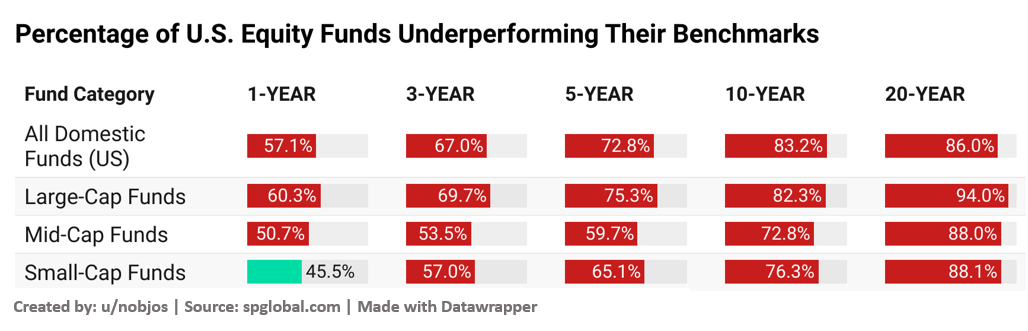

This trend is more pronounced when you look at the number of funds that outperform the market benchmarks. Except for the lone one-year period for small-cap funds, most actively managed funds underperformed their corresponding index in all the other time frames across the different funds.

The difference only becomes pronounced as you increase the time period. Over a 10-year period, less than 20% of the actively managed funds managed to beat the market. This is unsurprising considering that most fund managers “made it” by taking risky bets, and that does not work in their favor in the long term. Add to this the fact that fund managers are expected to be on top of the market and also pick the “hot stocks”, and it’s routine to see the turnover ratio of funds crossing 50%. The added transaction fees only bring down your portfolio returns.

Patience as an edge

One question that I always get is how retail investors can beat the money managers and hedge funds who have access to million-dollar data streams, teams of analysts, and algo trading setups that can make instantaneous traders - The answer is patience!

More information is not always useful information. All of us have a tendency to place undue importance on stock price changes and the headlines. Ignoring the short-term noise and focusing on the long-term value is one place where retail investors can beat the professionals. Money managers have to justify to the board/press/investors why they are still holding on to a stock when it’s taking a beating. The pressure to cut their losses or sell at the top is too much.

For retail investors, generating market-beating returns would be as simple as purchasing stocks that have

A large moat (Google, Visa, etc.)

High Return on Invested Capital ROIC7 (Apple, AMD, etc.)

Stellar management (Microsoft, Pepsi, etc.)

Great industry tailwinds (Tech/AI, Renewable energy, Electric mobility, etc.)

and holding them for a very long time.

As always, Charlie Munger puts its best.

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result."

Using a coffee can approach focuses you to think about the long-term durability and growth of the business. If most of the market is thinking about how the stock price would look like next month or quarter, thinking differently is going to give you the edge we are all looking for.

What would be your stock pick for a coffee can investment? Let me know in the comments. (You can find my pick in the comment section!)

More Interesting Stuff

NFT Collapse - I had highlighted the ongoing NFT collapse back in June. Now the situation has become even direr with a 97% collapse in volume. NFTs that were sold for multi-million dollars have no takers. As Buffet famously said, Price is what you pay. Value is what you get.

Collab Fund - One of the best financial blogs I have come across. Morgan Housel regularly writes there - The freakishly strong base is an all-time classic that you should read.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Footnotes

Everything is reminding us of FTX these days…

He had his reasons and in addition, he ended up compounding his portfolio at a much higher rate

“Last year I referred to one investment which substantially outperformed the general market in 1964, 1965 and 1966 and because of its size (the largest proportion we have ever had in anything – we hit our 40% limit) had a very material impact on our overall results and, even more so, this category. This excellent performance continued throughout 1967 and a large portion of total gain was again accounted for by this single security. Our holdings of this security have been very substantially reduced and we have nothing in this group remotely approaching the size or potential which formerly existed in this investment” - Buffett on his ‘68 letter to shareholders

A 3% difference every year over 50 years makes a massive difference. If you had put $100 in Amex in 1968, it would be worth ~$73K vs only ~$17K invested in the market (not adjusted for inflation)

Recent research also highlights this - 58% of companies listed after 1926 failed to beat the returns of treasury bills and just 4% of the companies accounted for all the additional wealth creation by investing in equities.

Again, as defined by Kirby.

The sad part is that Cathie is now trading stocks like a day trader.

My Coffee can pick would be Microsoft. Extremely good margins, high ROIC, great management and sticky b2b customers.

What a bet from Buffet on Amex back in the days, I had no idea, crazy!