The Cockroach Portfolio

The race is not given to the swift or to the strong but to the one who endures to the end

Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1– Warren Buffett

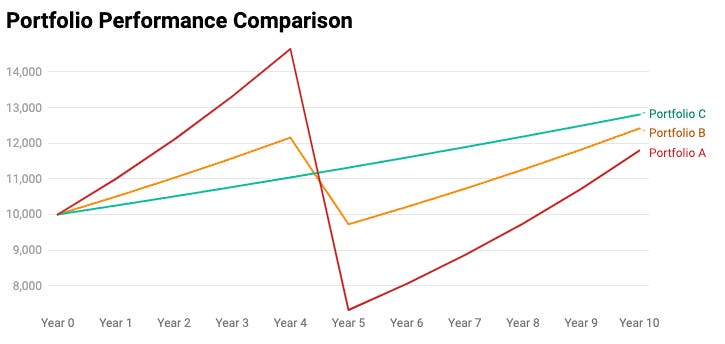

Let’s start with a thought experiment. You are planning to make a long-term investment (10 years) and you have three options.

Portfolio A grows 10% every year consistently but the catch is that once every ten years, it goes through a 50% drawdown. Portfolio B works exactly the same but only returns 5% and has a relatively lower drawdown of 20%. Finally, you have the option of parking your funds in a 10-year term deposit offering 2.5% APY.

The trick here is that most of us tend to allocate more importance to the returns generated by our investments than to their possible downsides. Simple math shows us that a loss of 10 percent necessitates an 11 percent gain to recover. Increase that loss to 25 percent and it takes a 33 percent gain to get back to break even. A 50 percent loss requires a 100 percent gain to get back to where the investment value started. This is why conserving your portfolio is more important than trying for maximum returns.

Coming back to our experiment, portfolio A starts off the strongest generating a yearly 10% return. Portfolio B also outperforms C with a 5% CAGR compared to the pitiful 2.5% return offered by the Term Deposit. But where it gets interesting is once you factor in the drawdown.

After 9 up years and 1 down year, portfolio A would have generated an 18% return (CAGR 1.24%) whereas portfolio B would have generated a 24% return (CAGR 2.18%). But, both of these portfolios would have been beaten by the term deposit offering a CAGR of 2.5% with zero volatility. (In this case, we have assumed the drawdown at year 5. The year in which the drawdown occurs does not matter for the overall return).

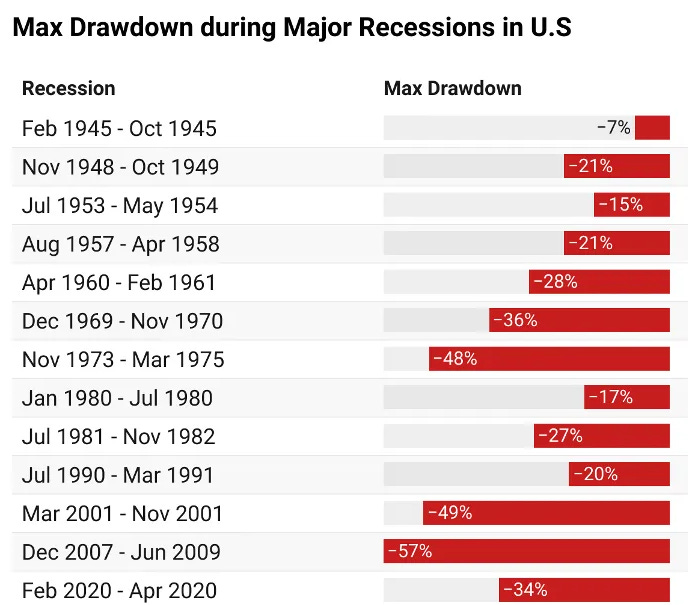

A 50% drop in the stock market is not a once-in-a-century event like the pandemic. The ‘70s bear market, the 2001 tech bubble, and the 2008 Global Financial Crisis all had close to or more than 50% drawdowns for the S&P 500.

While it’s one thing to see these drawdowns on a chart, it is another to have lived through them. More than 15 million people lost their jobs and close to 6 million American households lost their homes during the 2008 crisis. The stock market lost half its value and real estate was down 67% from its top. Imagine losing your job, home, and half of your portfolio in the space of two years.

A portfolio for all seasons?

If you break it down, any period of recorded economic history can be categorized into just 4 types.

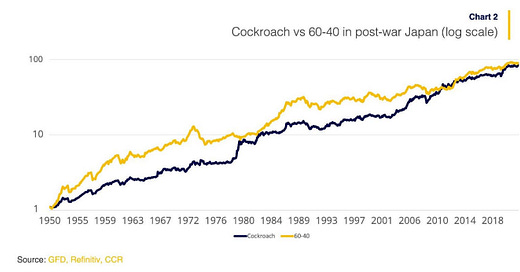

Most of our portfolios are only designed to work well in periods of growth (stocks perform well) or during periods of deflation (bonds perform well). But what if we experience another stagflation like in the 70s when stocks were down ~50% and bonds were down ~10% or in the case of Japan where the stock market took more than 30 years to regain the all-time peak it reached back in 1989?

It’s situations like these where the Cockroach Portfolio shines through. It was Dylan Grace who coined the term Cockroach Portfolio in 2012 to highlight its resilience.

“But what I like best about cockroaches isn’t just their physical hardiness, it’s the simple algorithm they use to survive. According to Richard Bookstaber, that algorithm is singularly simple and seemingly suboptimal: it moves in the opposite direction of gusts of wind that might signal an approaching predator.‛ And that’s it. Simple, suboptimal, but spectacularly robust.” — Dylan Grice

While it all sounds good in theory,

How exactly can you build a Cockroach portfolio?

Can the Cockroach portfolio perform irrespective of the macroeconomic conditions?

How can we maximize long-term compounding while having enough assets in the interim for emergencies?

Can it survive outlier events like the Covid crash, The Great Recession, or 70’s stagflation?

Let’s dig in: