Welcome to the 2,000+ investing enthusiasts who have joined us this month. Join 34,300+ smart investors by subscribing here.

Check out our - Best Articles | Twitter | Reddit | Discord

What motivates us most in investing is the continuous pursuit of self-improvement. Anyone who has played sports at a competitive level will instantly notice the similarity between investing and competitive sports. Take running for example – If you are preparing for a race or trying to improve your time, you start off at a base level of fitness.

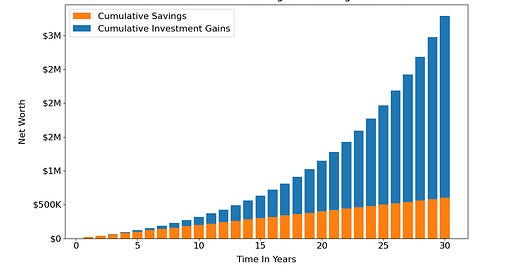

Then you put in hours and hours of training. The funny thing is that no matter how good you feel after a workout, your fitness level isn’t very different from just the day before. But, over the course of a few months, you can identify a massive improvement from where you started. It’s an even longer feedback loop in investing where the results of your effort can only be seen after years or even decades. It requires enormous focused effort and patience to become a successful investor.

By now you should be aware that trying to time the market is a fool’s errand and a continual purchase of a diverse set of income-producing assets is one of the time-tested ways of becoming wealthy. But, sometimes life can get in the way – maybe you are concerned about the short-term market trends or that the Fed might do something stupid or just plain forget to invest this month.

So, we wanted to make your life easier and be your accountability partner. Starting today, at the end of every month we will run this thread so that

It will be a reminder to you in case you forgot to invest that month

Tell us about the investments you made so that all of us are exposed to new ideas

If you have any questions on your portfolio allocation or any new ETFs, we can run some quick backtests and get you the key performance metrics

Suggest new analysis ideas/portfolio backtests/interesting books or blogs

Market Sentiment Recap: Jan’23

While you are here, in case you missed out on any of our previous issues this month, here they are:

Inverse Cramer (Free): We evaluated 20,000+ stock picks made by Jim Cramer over the past 6 years and the results are surprising.

Motley Fool (Paid): Motley Fool Stock Advisor has claimed ~3x the returns of the S&P 500 since its inception in 2002. It’s time we put their stock picks to the test.

Interview: Nick Maggiulli (Paid): We interviewed Nick Maggiulli, author of Just Keep Buying and Chief Operating Officer at Ritholtz Wealth Management to unpack his approach toward money and how to maximize fulfillment over portfolio returns.

Moats (Paid): Warren Buffett was one of the first to popularize the concept of economic moats. We decided to see if durable competitive advantages convert to extraordinary shareholder value.

The Cockroach Portfolio (Paid): Creating a portfolio that can survive everything from the Great Depression to the Great Recession.

More Interesting Stuff

We spend hundreds of hours researching every month. Here are some of the best articles we enjoyed this month and hopefully, you can discover new and interesting content!

Compounding Quality: Written by an equity fund manager, it’s a great place that teaches you the fundamental principles of identifying quality companies and also lessons from the best fund managers.

Infinite Play: Nate Eliason quickly turned out to be one of our best finds of 2022. His When the Money's Just Too Damn Good is an amazing look into how we should be careful about how we are making money. After all, incentive drive actions.

30 Lessons for Living: Who should you turn to for advice – Why not listen to the people who have been there and done that? The author spent five years asking more than a thousand Americans over the age of sixty-five to share their advice for living with the younger generation.

Some fun stuff!

Yes I did. In yhe internet retail sector in Europe

Hi, I just lost my job and I got a lump sum payout of my pension. So now I have $150K and I don't know what to do with it. I have to invest in something, as this is a big part of my pension. I'm 44 years old. What would you do in a similar situation?