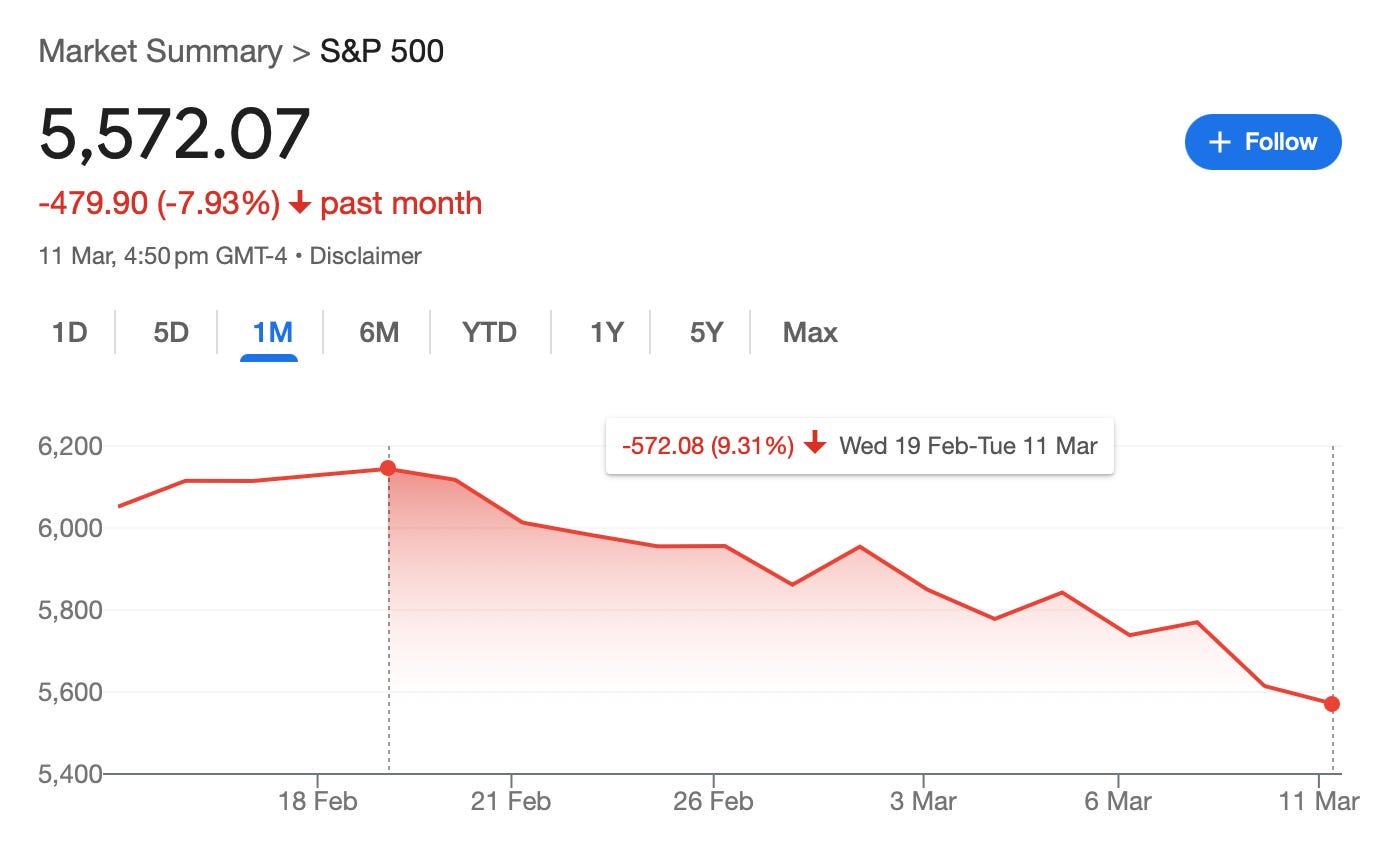

Well, there is no easy way to put this, but Trump’s second term is off to a rocky start. Barring the global financial crisis, this is the worst start to a presidency in the last 50 years.

Yesterday, the S&P 500 dropped another 1% as Trump started yet another trade war. We have officially entered correction territory, with the S&P 500 down more than 10% from its all-time high.

The last time we wrote about buying the dip was in May 2022, when rising inflation and interest rates caused the S&P 500 to drop 18% and the Nasdaq to drop 25%. While the S&P 500 dropped another 8%, if you had invested then, you would have been up 42% by now (even after considering the drawdown).

What to do during a market correction?

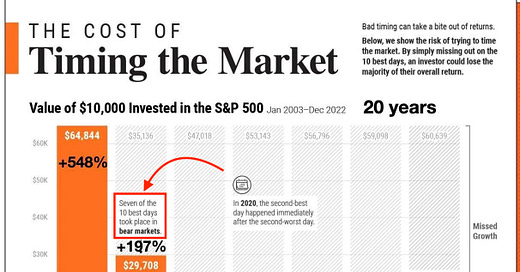

The key question in a market correction is whether to wait out the storm before investing again or double down and buy more?

To find out, let’s consider three investors: Cautious Charlie, Average Andy, and Daring Dave.

Each invests $100 in the S&P 500 at the beginning of every month. When the market falls below 10% of its previous all-time high (correction territory), each investor reacts differently to the dip.

Cautious Charlie “holds” - He stops investing, holds the cash, and waits till the market crosses the threshold again to deploy the capital.

Average Andy “stays” - He continues investing as usual.

Daring Dave “doubles” - He invests double the usual amount till the market crosses the threshold again.

Who did better?