Let’s start with a bit of derivatives magic — With derivatives, it’s possible to create a portfolio that never loses money1 while still having exposure to stocks.

Here’s how it works: say you have $1,000 to invest today. The 1-year treasury bill is now returning ~5%. You buy $950 in treasures and with the remaining $50, you buy an at-the-money call option in the S&P 500 maturing in 1 year2.

Now let’s take a look at the payout structure at the end of 1-year.

If the market goes up 15% over the next year, our overall portfolio will be up 8.6% at the end of 1 year (The call option will be up 72% and the bond will be up 5%). The interesting part is what happens when the market goes down 15%.

If you had a 100% stock portfolio, you would be down 15%. But in our case, only the option call will expire worthless and the investment in the treasury bill will mature to $1,000 effectively shielding our capital loss from the call option.

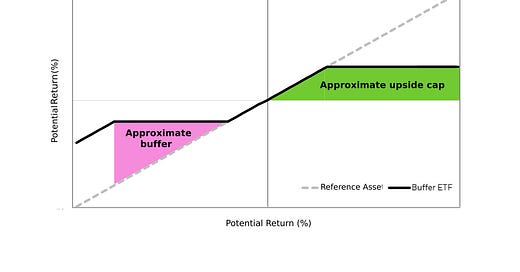

Obviously, we are not the first to come up with this idea and there is an entire market, known as Buffer Funds, that tries to optimize this strategy. One of the recent launches is the Innovator Equity Defined Protection ETF. The fund implements a slightly more nuanced strategy by buying and selling put and call options but the end goal is the same — A fund that can’t lose money.

Ignoring their 0.8% fees, even if the market drops 100%, the fund will not have a negative return. The drawback is that your upside is capped at 16%. If the market goes up 10%, the fund goes up 10% but, if the market goes up 30%, your upside will be limited to 16%.

If you are wondering why you would need to protect your downside at the cost of capping your upside, take a look at how the 2008 crisis derailed the retirement plan by years for thousands of people and how the investors who panicked and withdrew at the depth of the crash never really returned to the market until it was too late. It’s one thing seeing the drawdowns on paper but actually living through a recession that wipes out 50% of your retirement portfolio is a whole different beast.

Historically, buffer strategies like the above ones were only available through advisors implementing custom options strategies for their clients. Managing these were expensive, time intensive, and prone to costly errors.

Now that these strategies are easily available under an ETF wrapper, let’s dig into:

How are buffer strategies created?

What are the different types of buffer funds?

Should you invest in buffer funds?

Pitfalls and downsides of buffer strategies

(Quick note: There is a 20% discount on our annual subscription)