Be Boring

How the best investments are the most boring ones.

Hello friends! Welcome to Market Sentiment. Join 14,415 other smart investors and traders by subscribing here:

If you are new here, you can check out my best articles here and follow me on Twitter too!

This issue of Market Sentiment is brought to you by… Masterworks

Tired of Dogecoin and Meme Stocks?

Give art a shot. Deloitte reports that the overall value of art is expected to explode by over $900 BILLION by 2026. From 1995 to 2021, contemporary art prices returned 14% per year - crushing S&P 500 returns by 164%, according to public data. It even outpaced assets like gold and real estate by nearly 2x over the same period.

But despite this new boom, few people know how to invest in this "untouchable" asset beloved by billionaires and hedge fund gurus everywhere.

The only issue? Unless you have a crispy $25,000,000 in the bank, you’ve been locked out of this billionaire boys club. Until now...

Thanks to this investing app valued at over $1 billion, you can invest in multimillion-dollar paintings in a few clicks. They’ve fractionalized art investing. In other words, you can diversify with shares of Picassos and Warhols.

The best part? Market Sentiment subscribers get to skip their waitlist

*See important Reg A disclosures

Investing should be dull. It shouldn't be exciting. Investing should be more like watching paint dry or grass grow. If you want excitement, take $800 and go to Las Vegas - Paul Samuelson

Investing can definitely be exciting. Seeing those numbers tick upwards every day or making a play nobody else saw is downright addictive. We all know that we are taking a higher risk with the hopes that the returns would be proportional to the risk. We buy into growth stocks with astronomically high PE ratios thinking that they would ‘grow’ into it or that they would be the next Tesla (*cough* Nikola *cough*). Some of us would even have bought into the ‘next’ bitcoin in the hopes of replicating the Dogecoin millionaires.

But usually, the best long-term investment strategies are the most boring ones. As I highlighted in my last article, the best performing U.S stock in the last 5 decades was not Apple, Intel, Tesla, or Google. It was Altria - A cigarette company. They achieved this by paying a consistent dividend for 50+ years.

So in this issue let’s analyze the long-term performance of high growth vs value companies and see where you should put your money if you are in it for the long haul!

Beta & PE Ratio

First, it’s important to understand these two metrics to evaluate a stock to see how the stock behaves in the market and also what the market thinks about the growth prospects of the stock.

Beta - Beta is simply the measure of the volatility of a stock. It can be considered as the risk of the particular stock when compared to the market as a whole. Beta can be negative, positive, or zero. A beta value of more than 1 means that the stock is more volatile than the market. E.g, Tesla’s Beta is 2.08 - which implies that the stock is more than 2x as volatile as the market

P/E Ratio - Price to Earnings ratio relates a company’s share price to its earnings per share. A high P/E ratio can either mean that the stock is overvalued (stock price being much higher than the earnings the company is generating) or investors are expecting very high growth rates in the future (i.e, the company will grow into the expected valuation very fast) - Taking the same example of Tesla, its PE ratio is 201 compared to the overall PE ratio of 22 for the S&P 500. ()

Generally, stocks having high beta and PE values are considered riskier as they would be much more volatile than the market. A growth stock like Tesla would have a high Beta (2.08) and high P/E (201) ratio whereas a value stock like Johnson & Johnson has a Beta of 0.72 and a PE ratio of 18.

Now the million-dollar question is, if you are investing for the long term, is it better to bet on growth stocks like Tesla or a value stocks like Johnson & Johnson?

Value > Growth

The outperformance of value stocks was first discovered in 1985 in a paper titled ‘persuasive evidence of market inefficiency’ where the authors argued that value stocks had persistently higher risk-adjusted returns than they should have in an efficient market.

In a more recent study by PWL Capital, they show that over a rolling 10-year period in the U.S from 1926 to 2018, value stocks have beaten growth stocks 84% of the time. This is staggering as this proves that value stocks are just as likely to beat growth stocks as the market has been to beat one-month treasury bills.

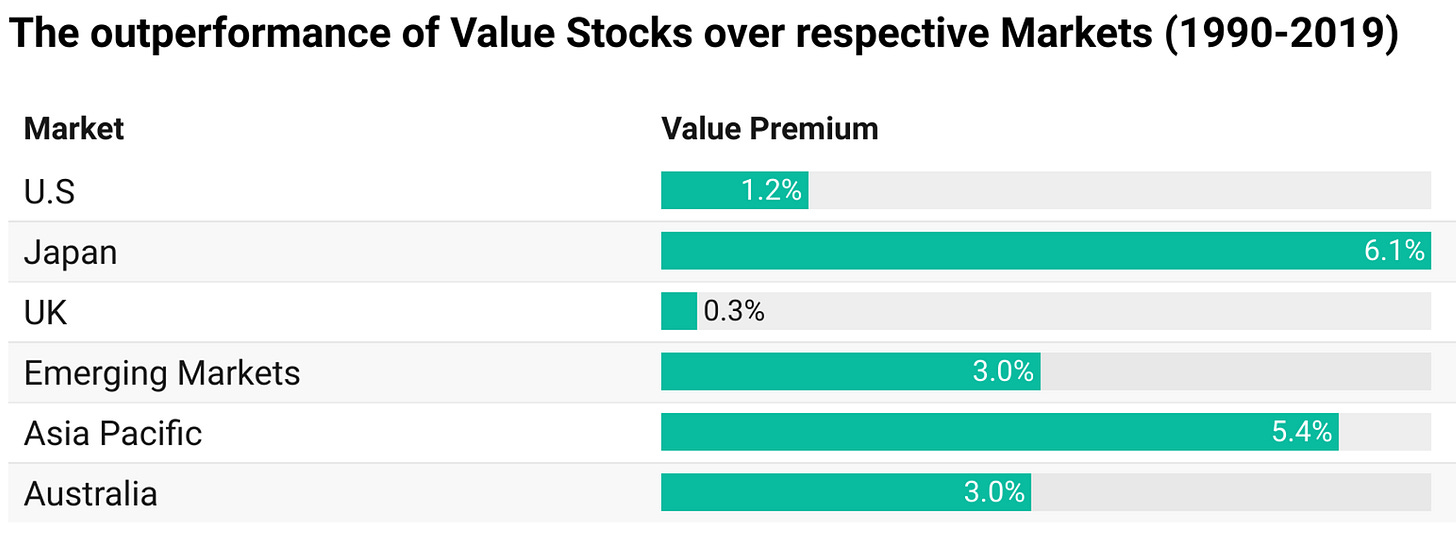

Also, it’s not just the U.S market that is exhibiting this phenomenon. A study covering 33 different markets during the time period from 1990 - 2011 also showcases that Low-Risk stocks tend to outperform the market.

Remember the Beta we talked about in the beginning? Generally, high beta stocks are associated with growth and high future expected returns, but research conducted by Harvard has shown that low beta stocks have consistently outperformed riskier stocks and the overall market.

Why boring wins

There are both fundamental and behavioral reasons why value stocks tend to outperform their growth counterparts.

Overvaluation - Investors tend to overvalue more exciting stocks that tend to dominate the headlines. Investors who are looking to find the next Google or Amazon are willing to overpay for companies with similar characteristics in the hope of hitting it big. (Check out this excellent article by Kris Abdelmessih where he argues that companies can have insane valuations only while their claims are still far from reality).

Nobody wants to be boring - Avoidance of boring companies by retail investors tends to have an effect on suppressing their stock price. Even in the case of active management funds, managers have to show their investors that they are in on the most trending stocks. People tend to accept below-market performance after making a risky play but that might not be the case if your fund is underperforming the market even after only investing in safe stocks.

High-volatility stocks are attractive to professional money managers who are under pressure to dress up their portfolios with market-leading headline stocks to please their shareholders - Nardin L. Baker and Robert A. Haugen

Lottery mentality - People can’t shut up when they happen to own Tesla stock that’s up 400%. This feedback loop forces other investors also to pile into the same stock regardless of its current valuation. These investors are overpaying for the small chance of winning big with their investments. As with the lottery, 99% of the people would end up losing their money.

It does look like value stocks can beat growth stocks as well as the market over the long run. But, at the same time, you should be aware that anomalies like this in the financial markets tend to disappear or decline once they have been published. For the U.S market, we have been observing an increasing decline in value stock outperformance but even as per the latest reports, value stocks are outperforming the market by 1.2% each year. The difference is much more pronounced in the Asia Pacific and emerging markets!

So if you can resist the allure of hot and trending stocks and the ‘next big thing’ you can end up coming on top over the long run. Who knew, it does pay to be boring!

Until next week…

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

I've been a financial advisor for over 14 years, and completely agree with you; boring makes for good investing. Most people don't react well to "exciting" investments, because as soon as the excitement goes the wrong way, they freak out! Give me boring old banks, insurance companies, railroads and oil companies any day...

Good article.

this article was so boring, loved it