Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works. — Morgan Housel

Let’s start with a thought experiment. Consider you started a job and got into investing at the beginning of the 80s. Think about all the crises you would have lived through:

The U.S. was coming off stagflation and the Fed rate was an eye-popping 18%.

Black Monday in ‘87 during which the markets crashed 30%.

Russian debt default in ‘98 followed by the Dot-com crash of 2000. And 9/11.

Global Financial crisis in 2007 when the S&P 500 lost half its value in 18 months.

Finally, the Covid crisis whose aftereffects we are still reeling from.

All the above ones were the certified big ones. There were so many others that could have turned out equally worse, but we don’t think or talk about them since the risks never materialized - the Evergrande crisis (‘21), the European debt crisis (‘12), and the Asian crisis (‘98) just to name a few.

Now think about how many times you were worried about one of these and tweaked your portfolio to fit the ongoing crisis. Deep down, we all know that sticking to your strategy is one of the best methods to make great returns long term. But would you have given what was going on in the market?

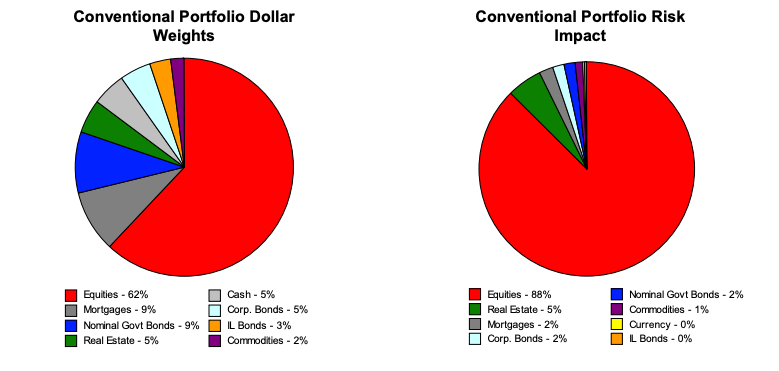

The index fund & chill crowd loves to highlight this chart and state that the markets only go up long-term (we are also somewhat guilty of this). But, what this chart lacks is an emphasis on all the drawdowns during which you had to hold on to your investments while they were cut in half and the uncertainty that comes with a stock-heavy portfolio. There were 4 multi-decade periods just in the last century (1901-20, 1929-47, 1964-81 & 2001-13) where stocks had zero return (These periods are known as the lost decades). Most of us significantly underestimate the portfolio risk that we are taking by overweighting toward equities.

There is also this big assumption that the market only goes up over the long term — while it has held for the U.S. market, consider the case of Japan. If you had started investing in the Japanese market in the 80s, you would’ve had an incredible run up till 1990 after which you would’ve been averaging down for the next 20-odd years – and you still wouldn’t have crossed the peak that you touched in the 90s! Greece is another example where the market has not recovered ever since the 2008 crash.

The truth is that one lifetime is too narrow a perspective to trust your own experience to accurately predict and escape all crises. American billionaire investor and hedge fund manager Ray Dalio had his humbling moment quite early in his life. Fresh out of college, Ray was working as a clerk on the New York Stock Exchange when President Richard Nixon announced that the U.S. was breaking out of the Bretton Woods system of fixed exchange rates that had tied the dollar’s value to gold.

Ray was confident that the markets would drop the next morning. Instead, the DJI rose by 4% and gold shot higher in what was later called the “Nixon Rally”. Reflecting back on the event, Ray said

That was a lesson for me. I developed a modus operandi to expect surprises. I learned not to let my experiences dominate my thinking; I could go beyond my experiences to see how the machine works.

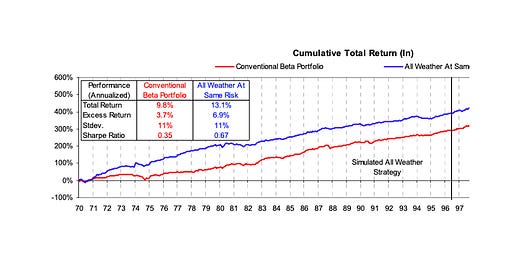

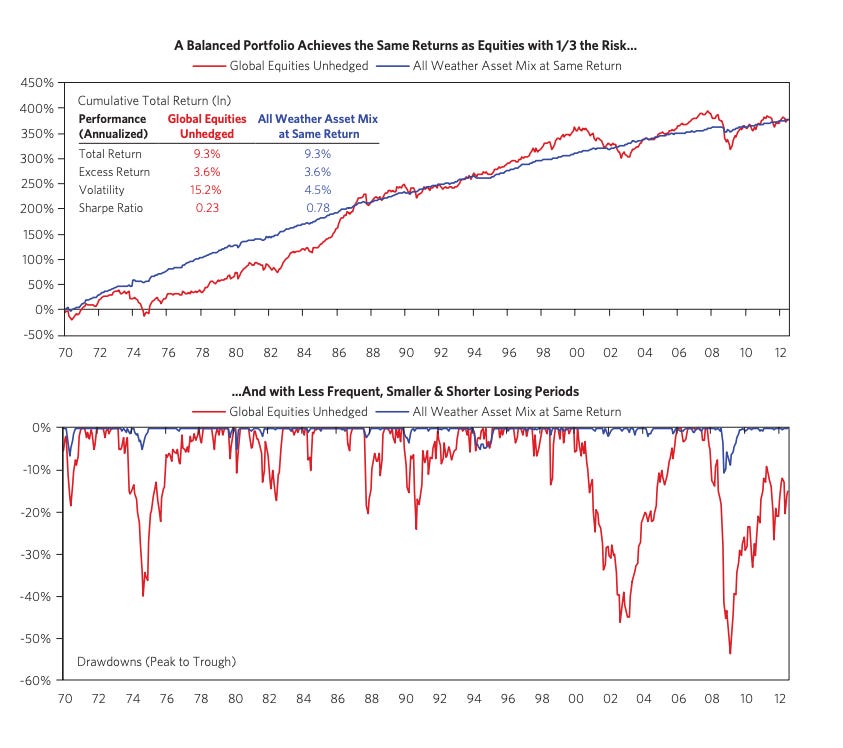

Ray started working on creating a passive portfolio with a simple goal — It should do reasonably well 20 years from now without attempting to predict anything about the future. It would take Ray and his team 25 years of learning to perfect the all-weather strategy. But the portfolio they created was able to achieve the same return as the global stock market while having 1/3rd the risk.

Ray Dalio’s All Weather Portfolio

If we break it down, any period of recorded economic history can be categorized into just 4 types — Inflation, Deflation, Growth (Bull market), and Decline (Bear market). If we want to build a portfolio that requires no further input, then you need to create one that can perform in all of these economic conditions. That’s exactly what Ray Dalio did:

(Annual subscriptions are now at a 20% discount. E-mail us if you are interested in a group/corporate subscription)