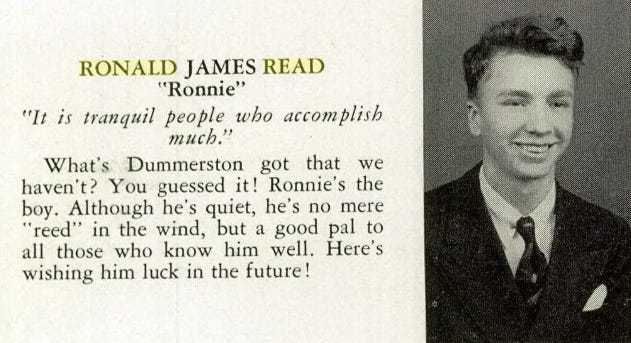

Ronald James Read was an American philanthropist, investor, janitor, and gas station attendant. – Wiki

Ronald Read was born in rural Vermont. After serving in World War 2, Read returned to his hometown and worked as a gas station attendant for about 25 years. He then retired for one year before taking up a part-time job as a janitor at J.C. Penney. His life was unremarkable by all traditional metrics.

Only when he died in 2014 did he make it into international headlines. Unknown to even his closest friends and family, Read had amassed a fortune of $8 million by living frugally and investing in blue chip dividend-producing stocks in industries that he knew intimately. Read focused on companies that paid generous dividends, and avoided technology companies that he did not understand. Read reportedly made his first investment in his 30s and held on to them for the next 60 years allowing compounding to do its magic.

Of the $8 million he amassed, he left $6 million of his fortune to his local library and hospital and the remaining to his family. As Read showed us, investing regularly and sticking to your plan is one of the best possible approaches to creating generational wealth. But, sometimes life can get in the way – maybe you are concerned about the short-term market trends or that the Fed might do something stupid or just forget to invest this month.

So, we wanted to make your life easier and be your accountability partner.

Here is a reminder to you in case you forgot to invest this month.

Tell us about the investments you made so that all of us are exposed to new ideas.

If you have any questions on your portfolio allocation or any new ETFs, we can run some quick backtests and get you the key performance metrics.

Market Sentiment Recap: Mar ’23

While you are here, in case you missed out on any of our previous issues this month, they are:

60/40 Portfolio — Over the past 90 years, stocks and bonds were down together only 3 times. The 60/40 portfolio’s extreme losses in 2022 had a probability of occurring only once every 130 years! Is right now one of the best times to get into the 60/40 portfolio?

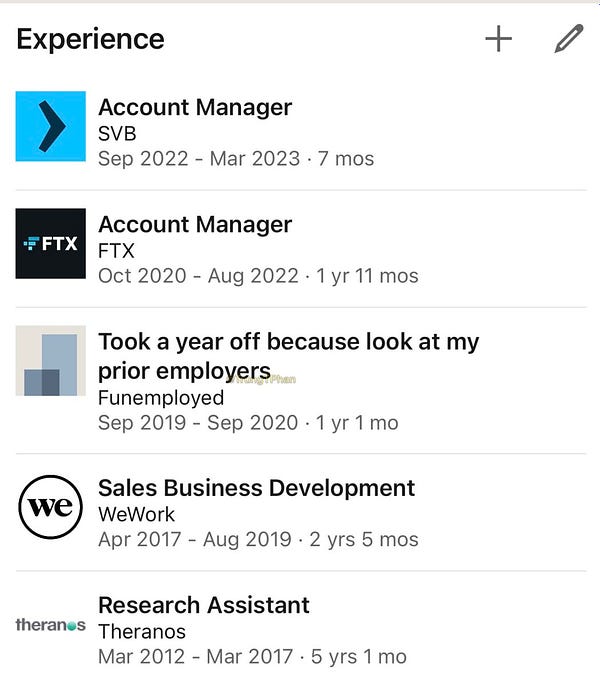

SVB — SVB was the banker for nearly half of all VC-backed startups in the US. They had over $200B in assets and $175B in deposits. Here is the full story of how one of America’s 20 largest commercial banks went down in 48 hours.

3 Fund Portfolio — One of the best portfolios ever created was achieved using just 3 index funds. This simple portfolio was able to outperform 83% of active fund managers and 90% of endowment funds over the last two decades while having an expense ratio of < 0.1%.

The best tools for the job — We have spent 1000s of hours researching ideas, finding data sources, and analyzing data. A lot of you have reached out to us about the tools and data sources we use. We have compiled here all the best tools and resources we have found in one place.

More Interesting Stuff

We spend hundreds of hours researching every month. Here are some of the best articles/videos we enjoyed this month and hopefully, you can discover new and interesting content!

Rob Berger - If you are wondering like us if there are any sane financial YouTubers left who do not rely on clickbait, Rob Berger would fit the bill best. His videos are really in-depth and give a comprehensive view of topics without taking sides.

The makings of a multi-bagger - Even though this was a summer intern project, the output was incredible. The group analyzed the highest-performing stocks over the last five years and identified their common characteristics, trends, and

catalysts so that they can identify strategies to find the next set of high-performing stocks.

Some Fun Stuff

We have a bonus for those who read till the end – you get to decide on one of our next articles :)

Welcome to the 2,100+ investing enthusiasts who have joined us this month. Market Sentiment is now fully reader supported – Please consider upgrading your subscription to support our work and to get access to all of our analyses. We are offering a 20% discount on our annual subscription :)

Rob Berger was new to me. Thanks! 👍