Since my last article on Robinhood IPO, a lot of you have reached out to me regarding an explanation for Payments for Order Flow and what it means for the average investor. Given that it’s a complicated topic that is not easily understood and with the pending Robinhood IPO, I felt that this would be the right time to dive deep into what is PFOF and how it has changed retail trading.

What is PFOF?

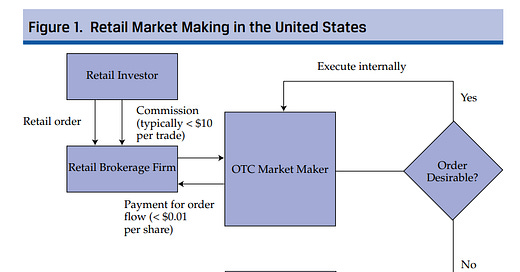

Before we try to explain what is PFOF, we first need to understand how a trade happens in the US stock market [1]. Let’s say you have 500 shares of AMD that is you want to sell. The probability of someone else who wants to buy exactly 500 shares of AMD at the same exact moment is low. Here is where the market makers come into play.

They would buy the 500 shares from you at $99 and then sell those 500 shares to a different set of people at $100. So, the spread for this sale is $1 (in reality this would be in pennies, but this would give a round number for easier understanding). In theory, the market maker made a $500 profit for executing this trade.

If you are wondering why the market maker gets paid for doing a simple supply/demand match transaction, it’s because they are taking a risk by holding the security for that short period of time. For Eg. In this case, if the market maker was not able to sell it to another buyer at $100 in that short period of time and the stock tanked, they would have to take that loss. Hence you can consider the market maker as someone who takes the risk of holding the security from one seller to the time another buyer comes for the same stock.

Now coming back to PFOF, Payment for Order Flow means exactly that. The brokerages get paid a percentage of the spread for routing the transaction to particular market makers. In our example above, the $500 dollar profit that was made by the market maker would be split between the market maker and the brokerage that gave them that order flow.

In theory, this should be a win-win for everyone involved (Trader, broker, and the market maker) as the trader get to execute his trades for zero commissions, the broker gets paid from the market maker and the market maker will get his profit from the spread between the buy and sell prices. Almost all the major players (except Fidelity) have some amount of revenue coming in from PFOF and this is not necessarily a bad thing. It’s estimated that market makers provided in total $3.6 billion of price improvement for trades in 2020. (i.e., they made the trades at a better price than what was present in the public exchange)

So why is this controversial?

PFOF is controversial due to the inherent conflict of interest it raises. A broker is expected to obtain “best execution” for their clients. ie, the broker is expected to look across all the market markers and give the trade to the one offering the best price for its client (in this case the trader who is selling 500 shares of AMD).

But if your main source of revenue is coming from PFOF (as in the case of Robinhood), the company might try to maximize its profit by giving the order to flow to the market maker which would pay them the most instead of getting the best deal for its customer who pays them next to nothing.

In December, Robinhood paid $65 million to settle an SEC enforcement action for not disclosing how much money it was receiving for routing its orders to firms like Citadel and for failing to seek the best price for its customers' orders. (They have neither admitted nor denied the allegations)

SEC said in the announcing settlement that

Due in large part to its unusually high payment for order flow rates, Robinhood customers' orders were executed at prices that were inferior to other brokers' prices and it caused its clients $34.1MM

It’s not like the situation at Citadel is any better. They have been accused of more than 59 market violations over the past 15 years with them paying $22M in 2017 to settle charges against misleading clients about pricing trades. At the moment, it looks like these companies consider these fines as part of the cost of doing business!

Are there any alternatives?

There are multiple well-developed markets where PFOF is banned. This paper by CFA Institute analyses the impact of the UK Financial Services Authority banning PFOF in 2012.

FSA argued that the conflict of interest between the broker and its client under PFOF arrangements was unlikely to be compatible with the FSA’s inducement rules and risked compromising compliance with best execution rules.

They have stated in their paper that,

We observed an increase in the proportion of retail-sized trades executing at best quoted prices from 65% to more than 90% between 2010 and 2014. It is possible that markets that do have trade-through protection, such as the US market, may not need this explicit quote protection to maintain best execution as long as PFOF is banned as well

This shows empirical evidence that you can have efficient markets without having PFOF.

Conclusion

PFOF was pioneered by Bernie Madoff and although it was not a factor in the Madoff investment scandal, it’s still rife with some massive conflict of interests.

While I don’t think that the SEC is going to ban PFOF in the recent future, the growing retail trading, increased scrutiny into companies accepting PFOF, and successful shift of the UK market to a more efficient one after banning PFOF is all bound to put more pressure on the SEC to bring in new regulations.

Footnotes

[1] This paper by CFAInstitute gives an excellent overview of how trades occur in the US market vs the UK market.

As always, please note that I am not a financial advisor. Hope you enjoyed this week’s analysis.

If you found this insightful, please share it with your friends :)

How would you rate this week’s newsletter?

PS: Some of you have reached out to me stating that this newsletter is going to the promotions tab instead of the primary inbox in Gmail after I have shifted to Substack. This is mainly due to the usage of $ symbols for Stock tickers and using the terms Buy and Sell for analyst recommendations. Google AI mainly classifies emails containing these words as promotional e-mails.

It would be awesome if you could mark this e-mail as important or move it to primary or just reply to this email with a “hi” or any questions you have so that it always comes to your primary inbox and you won’t miss out on the weekly posts. Thank you :)

Excellent analysis! One callout, Fidelity accepts PFOF too. Not for equities, but for options.